The Gold (CBT:ZGM14) price range has compressed significantly in recent weeks, which suggests expansion ahead. Watch 1300 closely.

Range Compression

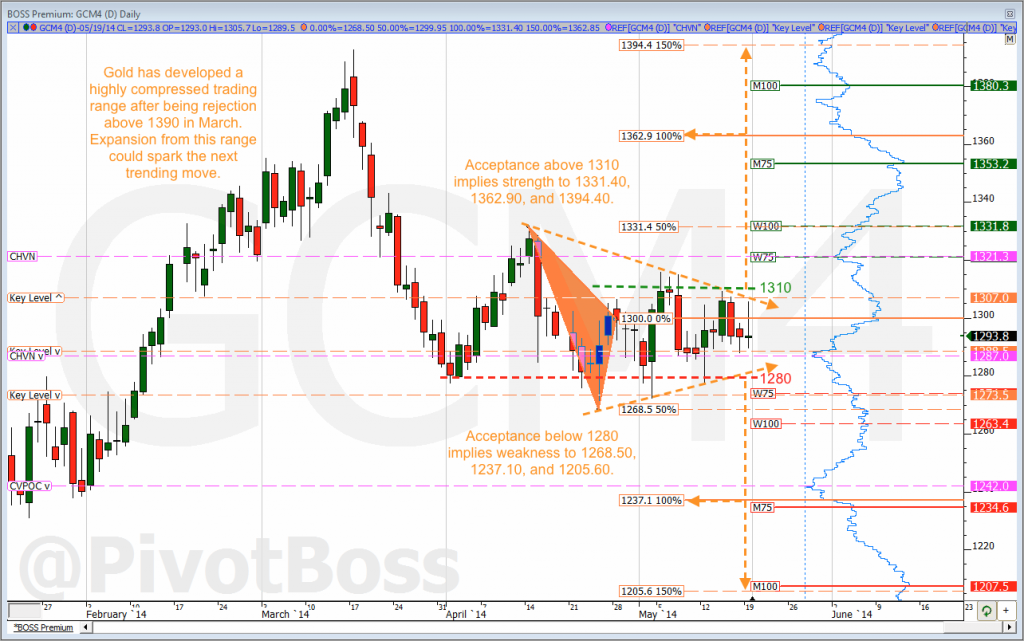

After Gold saw rejection above 1390 in March, price dropped into the 1270s before establishing a trading range between 1268.50 and 1331.40. Gold has since traded within this range for seven weeks and appears poised for expansion soon.

Gold has averaged 108.30 points of range per month on a 10-month basis, but only has a range of 43.80 points in May thus far. While there are eight sessions left in the month, it is already shaping up to be a narrow-range month, which is another sign of compression and future expansion.

At the moment, however, Gold is just chopping around the center of the range at 1300, which is our pivot to watch for early signs of directional bias.

1300 is the Pivot

Gold has established a balanced trading range around the 1300 key level, which is the center of the current trading range. Since price has traded around this level for two months, expect it to offer the earliest clue for directional bias ahead of expansion.

At present, the price of gold has been offered above 1300 up to 1307, but it has also been bid between 1273.50 and 1288.50, which means the range is building energy as stops are created on either side of the range. The fact that price was rejected sternly above 1390 lends a bearish bias looking forward. But keep in mind, a significant trending move could be seen in either direction once the stops are let out.

Key Levels and Targets

The safest bet is to avoid the chop within the range and wait for expansion to kick in. While an early breakout could be seen through either 1307 or 1287, a confirmed breakout would occur above 1331.5 and below 1268.50.

Above 133.50 has expansion targets at 1362.90 and 1394.40. Below 1268.50 has downside expansion targets at 1237.10 and 1205.60.

Bears will look to fade a retest between 1305 and 1307, and will want to press sell stops below 1287. The bears have yet to get price to gain acceptance below 1280, so this is the real level to watch for a definitive breakdown ahead.

Bulls will look to defend 1280 and will want to press buy stops above 1307. The bulls have yet to get price to gain acceptance above 1310, so this will be the level to watch for a confirmed upside break and a momentum play.