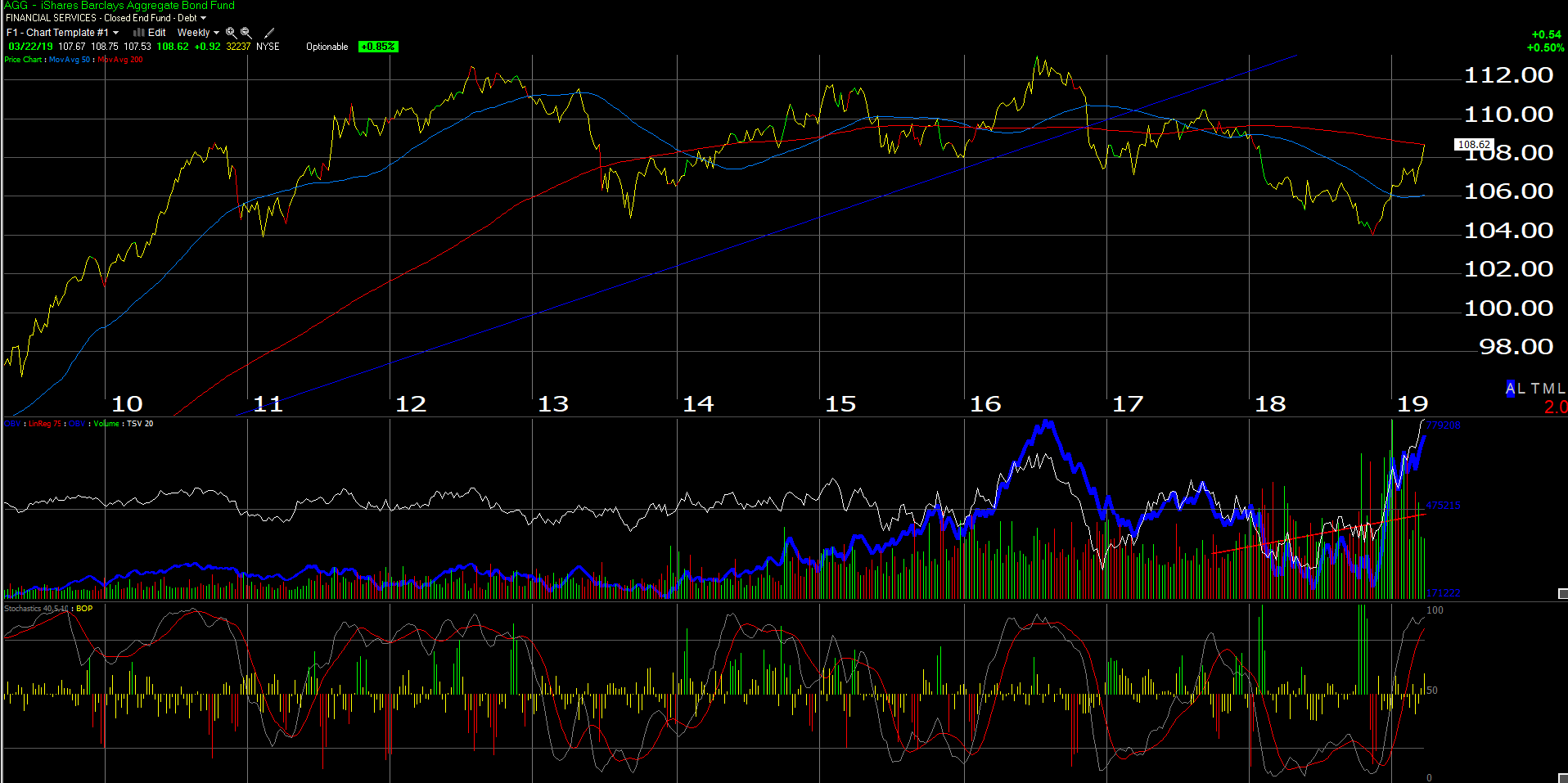

This weekly chart of the Bloomberg Barclays Aggregate (AGG) ETF, shows it bumping into formidable resistance at the 200-week moving average.

For readers, 44% of the AGG is “Government” with 39% of the 44% being Treasuries, 25% of the AGG is corporate credit risk and 26% is “securitized” with the remainder being a small municipal bond position and cash.

Any time we get a day like Friday, March 22nd, 2019 in the major indices, I immediately look to the high-yield credit market (in this case, the HYG) to see how it is reacting to the equity weakness, and the HYG finished both higher on the day Friday, and finished the week above the critical 200-week moving average, although not by enough to breathe easier yet.

Analysis / conclusion: There is an old saying or question in the equity market about, “Which is the tougher trade?” and you’d have to think the bullish case is the harder case to make today as much because the equity and “risk” markets have run up so much in the first 90 days in 2019, as well as the fact that sentiment seems to turn sharply negative on a dime, after 2008.

Gary Morrow, (@garysmorrow) who writes for the blog, “This Week on Wall Street”, posted this chart on the 10-year yield late last week:

Gary also posted this tweet on Friday, March 22nd:

Being long the TBT is a “contrarian” trade right now. Have to admire Gary’s chops.

Of the 11 SP 500 sectors, Financials are the most oversold after last week, and Treasuries and interest-rate sensitive sectors are overbought, but watch how “credit risk” and credit spreads react this week following Friday’s pummeling in the major indices.

If there is more downside ahead for the SP 500, credit spreads will likely start to reflect that, as they did in late 2015, and 2016, and then again in Q4 ’18.

Personally, I think we are inching closer to China trade and Brexit resolutions and SP 500 earnings growth should be higher for the rest of 2019.

Take all this as one opinion, and with substantial skepticism.