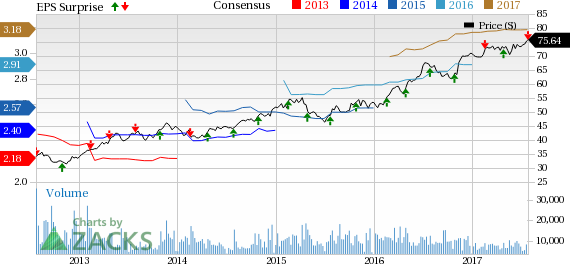

Waste Management, Inc. (NYSE:WM) reported mixed second−quarter 2017 results with GAAP net income of $362 million or 81 cents per share compared with $287million or 64 cents per share in the year-ago quarter. The year-over-year increase in earnings was primarily driven by higher revenues. However, earnings missed the Zacks Consensus Estimate by a penny.

Quarter Details

Revenues for the reported quarter improved to $3,677 million from $3,425 million in the year-ago quarter. The year-over-year rise in revenues was driven by an increase in volume and yield in its collection and disposal business as well as recycling business. Revenues exceeded the Zacks Consensus Estimate of $3,643 million.

Internal revenue growth from yield (for collection and disposal operations) was 1.9% in the reported quarter. Traditional solid waste internal revenue growth from volume was 3.2%. Core price (including price increases and fees, other than the company’s fuel surcharge, net of rollbacks) was 4.7% in the reported quarter.

Revenues from the company’s Collection business increased to $2,326 million in the reported quarter from $2,211 million in the year-ago quarter. Landfill revenues improved to $864 million from $792 million in the prior-year quarter. Recycling revenues increased to $375 million from $290 million while Transfer revenues increased $23 million to $414 million.

Balance Sheet & Cash Flow

Cash and cash equivalents at the quarter end were $32 million while long-term debt (including current portion) was $9,057 million. Net cash from operating activities for the quarter was $813 million compared with $762 million in the prior-year period. Capital expenditures were $299 million, up from $312 million in the year-ago period.

Free cash flow was $520 million in the second quarter compared with $461 million in the year-earlier quarter. During the quarter, the company returned $437 million to its shareholders through dividend payments.

2017 Guidance Affirmed

With strong yield, volume and cost performance, the company reiterated its 2017 guidance and continues to expect adjusted earnings in the range of $3.14 to $3.18 per share. Free cash flow is expected between $1.5 billion and $1.6 billion. For third quarter, the company expects to repurchase $500 million shares.

Zacks Rank & Other Stocks to Consider

Waste Management currently carries a Zacks Rank #2 (Buy). Some other stocks worth considering in the same sector include Omnicom Group Inc. (NYSE:OMC) , Publicis Groupe S.A. (OTC:PUBGY) and WPP (LON:WPP) plc (NASDAQ:WPPGY) . All three stocks carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicom has a long-term earnings growth expectation of 7.5% and is currently trading at a forward P/E of 16.18x.

Publicis Groupe has a long-term earnings growth expectation of 12.9% and is currently trading at a forward P/E of 13.83x.

WPP plc has a long-term earnings growth expectation of 9.8% and is currently trading at a forward P/E of 12.69x.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Omnicom Group Inc. (OMC): Free Stock Analysis Report

WPP PLC (WPPGY): Free Stock Analysis Report

Publicis Groupe SA (PA:PUBP) (PUBGY): Free Stock Analysis Report

Waste Management, Inc. (WM): Free Stock Analysis Report

Original post

Zacks Investment Research