Waste Connections Inc. (NYSE:WCN) reported better-than-expected results in second-quarter 2017.

GAAP earnings came in at 47 cents per share, compared with 13 cents per share in the year-ago period. The company reported net income of $123.7 million compared with $27.5 million in the year-ago quarter. The year-over-year improvement in earnings was primarily due to solid top-line growth.

Quarterly adjusted earnings came in at 55 cents per share, beating the Zacks Consensus Estimate of 53 cents. The bottom line also came in 25% higher than the year-ago tally. The upside was primarily driven by strength in solid waste volumes, E&P waste activity and recycled commodity prices.

Revenues for the reported quarter improved to $1,176.6 million from $727.6 million in the year-ago quarter. The year-over-year rise in revenues was driven by the accretive Progressive Waste acquisition. Revenues exceeded the Zacks Consensus Estimate of around $1,150 million.

Operating income for the reported quarter was $206.9 million compared with $63.5 million in year ago period. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased to $373.6 million from $233.6 million in the year-ago quarter.

Segmental Performance

Solid Waste Collection segment was the highest contributor to total revenue in the quarter at 67.6%. The segment’s revenues increased significantly from $501.2 million in the year-earlier quarter to $794.7 million.

Solid Waste Disposal and Transfer contributed 21.9% to the overall revenues. Quarterly revenues increased to $257.2 million from $160 million in the prior-year quarter. Solid Waste Recycling revenues increased to $41.3 million (3.5% of total revenue) from $16.7 million a year ago.

E&P Waste Treatment, Recovery and Disposal segment recorded revenues of $47.2 million (4%) compared with $27.5 million in the year-ago quarter. Finally, Intermodal and Other contributed 3% to total revenue and increased to $35.1 million from $22.2 million in the prior-year quarter.

Balance Sheet and Cash Flow

Waste Connections had cash and cash equivalents of $399.7 million as of Jun 30, 2017. Cash from operating activities was $551.9 million for the first half of 2017 compared with $259.6 million recorded in the year-ago period. Capital expenditures for property and equipment for the reported quarter totaled $111.4 million compared with $55.5 million in the year-ago period.

The strong free cash flow profile following the Progressive Waste acquisition has enabled Waste Connections to maintain a healthy dividend payout for shareholders. This financial strength and flexibility, together with expanded footprint following the acquisition, will likely facilitate the company to better execute its long-term growth strategy, while increasing shareholder returns.

2017 Guidance

Waste Connections expects revenues of approximately $4.57 billion compared with its previous guidance of approximately $4.450 billion. The company expects adjusted EBITDA of about $1.45 billion, while adjusted free cash flow is expected to be approximately $750 million.

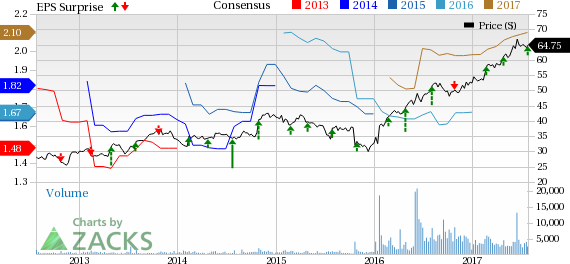

Waste Connections, Inc. Price, Consensus and EPS Surprise

Waste Connections currently has a Zacks Rank #3 (Hold). It pulled off an average positive earnings surprise of 7.84% in the last four quarters. A few better-ranked stocks in the same space are listed below:

Exponent, Inc. (NASDAQ:EXPO) , carries a Zacks Rank #1 (Strong Buy) and delivered an average positive earnings surprise of 10.14% in the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Fiserv, Inc. (NASDAQ:FISV) carries a Zacks Rank #2 (Buy) at present and delivered an average positive earnings surprise of 1.70% in the last four quarters.

Waste Management, Inc. (NYSE:WM) carries a Zacks Rank #2 (Buy) at present and came up with an average positive earnings surprise of 1.66% in the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Exponent, Inc. (EXPO): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Waste Management, Inc. (WM): Free Stock Analysis Report

Waste Connections, Inc. (WCN): Free Stock Analysis Report

Original post

Zacks Investment Research