The USDA’s latest monthly WASDE report was constructive for wheat as adverse weather in Australia, Canada and the EU is expected to tighten global supply. However, the release was more bearish for corn on the back of revisions higher to US acreage and ending stocks

Higher Acreage Pushes US Corn Supply Up

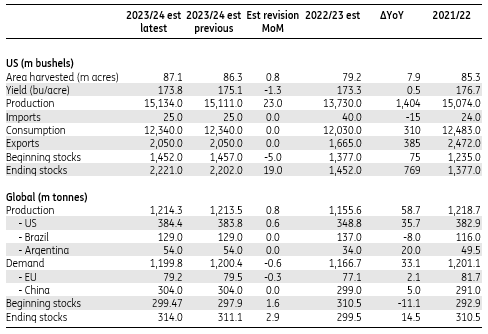

The USDA revised up its 2023/24 US corn production estimates by 23 million bushels to 15.13 billion bushels, with an increase in acreage offsetting lower yields. This is higher than the roughly 15 billion bushels the market was expecting. Planted acreage estimates were increased by 0.8 million acres to 94.9 million acres, whilst yield estimates were lowered by 1.3bu/acre to 173.8bu/acre. With no changes to demand estimates, 2023/24 ending stocks were increased by 19 million bushels to 2.2 billion bushels. This is higher than the roughly 2.13 billion bushels the market was expecting. Therefore, it was not surprising to see CBOT corn coming under pressure following the release.

For the global balance, 2023/24 ending stock estimates were revised up from 311.1mt to 314mt primarily due to higher beginning stocks and expectations for larger US output. The market was expecting a number below 310mt, so again, the USDA’s estimate is a lot more bearish than what the market was expecting. It will also provide some comfort to those who have been concerned over lower export availability from Ukraine since the suspension of the Black Sea (NYSE:SE) Grain deal.

Corn Supply/Demand Balance

Source: USDA, ING Research

Lower Yields Tighten US Soybean Market

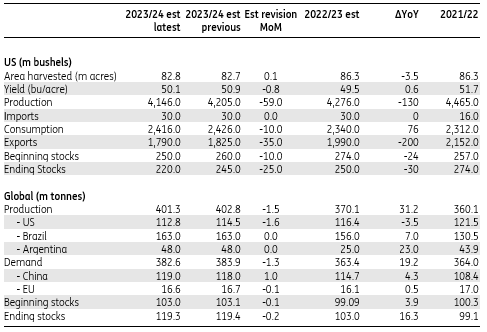

For the US, the USDA slashed its 2023/24 soybean production estimates from 4,205 million bushels to 4,146 million bushels on the back of revisions lower in yields, whilst acreage was largely flat. This lower supply was partly offset by downward revisions in demand with export estimates cut by 35 million bushels, whilst domestic demand estimates were lowered by 10m bushels. As a result, 2023/24 US ending stock estimates were reduced from 245 million bushels to 220 million bushels. However, it was still higher than the roughly 213 million bushels the market was expecting.

For the global soybean balance, the USDA revised down 2023/24 global ending stocks marginally from 119.4mt to 119.3mt. The market was expecting a number of a little over 118mt.

Soybean Supply/Demand Balance

Source: USDA, ING Research

Unfavourable Weather Weighs on Wheat Supply

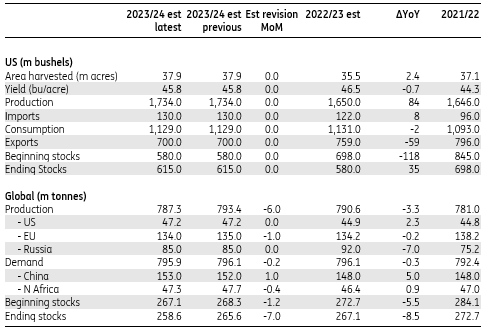

The global wheat balance continues to tighten, with 2023/24 ending stocks lowered by 7mt to 258.6mt, which is quite some distance below just over 264mt as expected by the market. This tightening was driven by revisions lower in supply with 2023/24 global output cut by 6mt. Lower output is largely driven by Australia (-3mt), Canada (-2mt), Argentina (-1mt) and the EU (-1mt), primarily due to unfavourable weather conditions. These reductions were partly offset by expectations for higher Ukrainian output. The main concern for Ukrainian supply is whether it will all be able to make it onto global markets.

For the US market, the agency made no changes to the wheat balance.

Wheat Supply/Demand Balance

Source: USDA, ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more