Everyone loves turnaround Tuesday.

But was this really the day to buy?

Taking one example, Nvidia (NASDAQ:NVDA), the darling of the MAG7, let’s examine every time I heard an analyst tell us the valuations are cheap, this stock cannot go down much, earnings will continue to grow, and, basically, ignore the macro backdrop.  All this might be true. Nvidia no doubt, is the best AI innovator of chips around.

All this might be true. Nvidia no doubt, is the best AI innovator of chips around.

After all, Nvidia’s financials remain strong, reporting a record $130.5 billion in revenue for Fiscal 2025, a 114% year-over-year jump.

So why should we consider reasons to doubt the number crunchers given

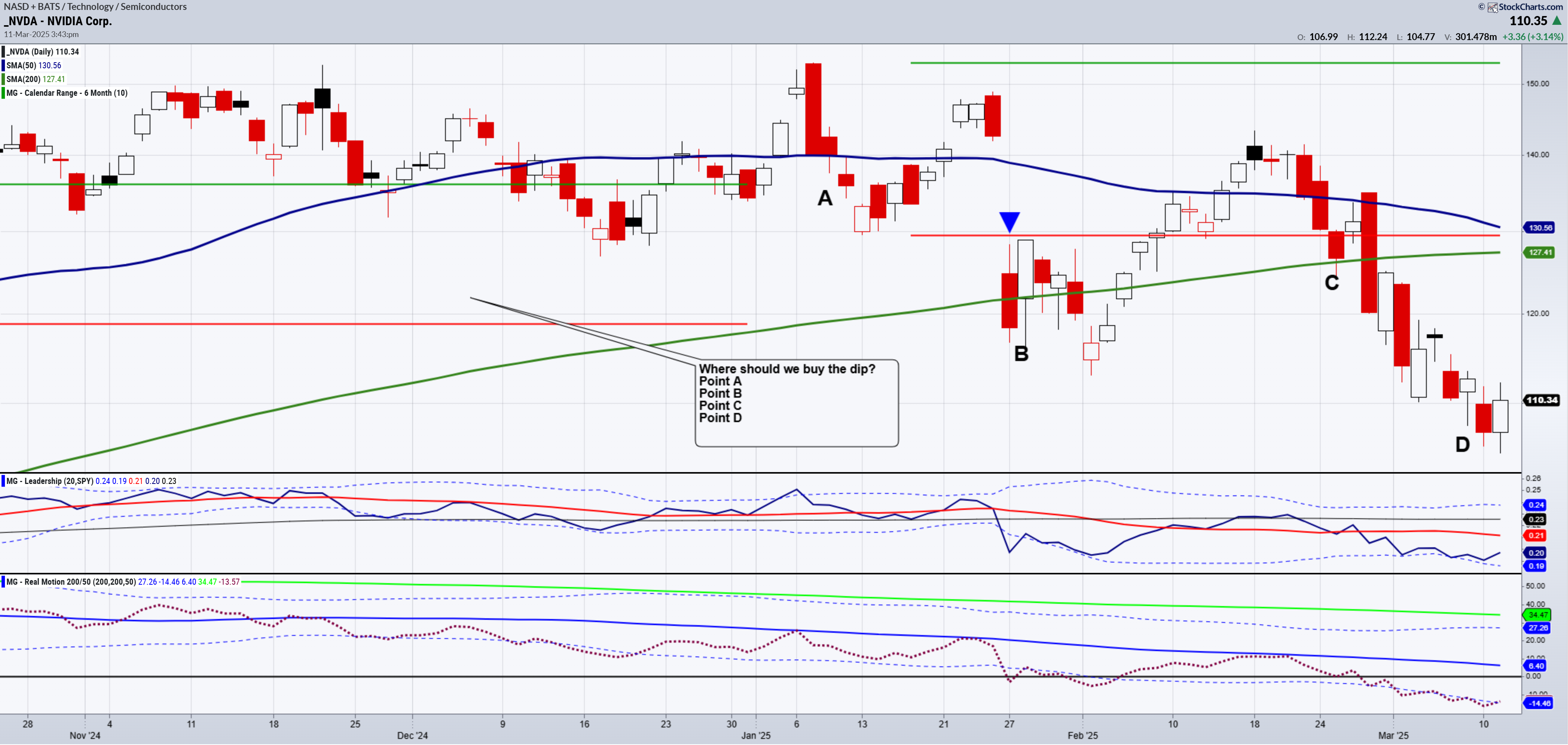

Tariffs, geopolitical stress, contraction of consumer spending, recession and rising costs are all part of the current macro landscape.  Let’s look at a chart with 4 examples of times when I heard analysts say we should buy the dip.

Let’s look at a chart with 4 examples of times when I heard analysts say we should buy the dip.

Can you afford this?

A. At the beginning of 2025, ahead of earnings and the inauguration of President Trump, analysts said this is the dip to buy.

In fact, Nvidia was upgraded with a price target of $185-200. Buying at $140, said analysts, is cheap.

B. Then, after earnings in late January, the day after NVDA tried to clear $150 and could not, the price gapped lower. If you bought it at 140, then again at 120, the average price was 130. And, until February 21st, you looked good. Nvidia ran back up to $140, so you had a $10 profit. But did you get out?

C. Most likely not, because analysts got happy and perhaps a bit smug. This was just at the time when tariffs began to dominate headlines. But, no worries, because analysts said buy the dip when NVDA dropped back to $130. Ok, not too bad, the buyer is breaking even. However, the buyer may have doubled up the position at $130 thinking, this is a snap.

D. At least from February 21st until March 11th, analysts were relatively quiet. So, I did not see much about anything other than tariffs and the risks. But yesterday, the analysts were out in full force again. Nvidia is cheap right now. Buy the dip. Now, top heavy long at $130, maybe the buyer accumulates more at $108. Assuming the buyer bought the same amount they were holding at $130; the average price is now $120.

The buyer is underwater.

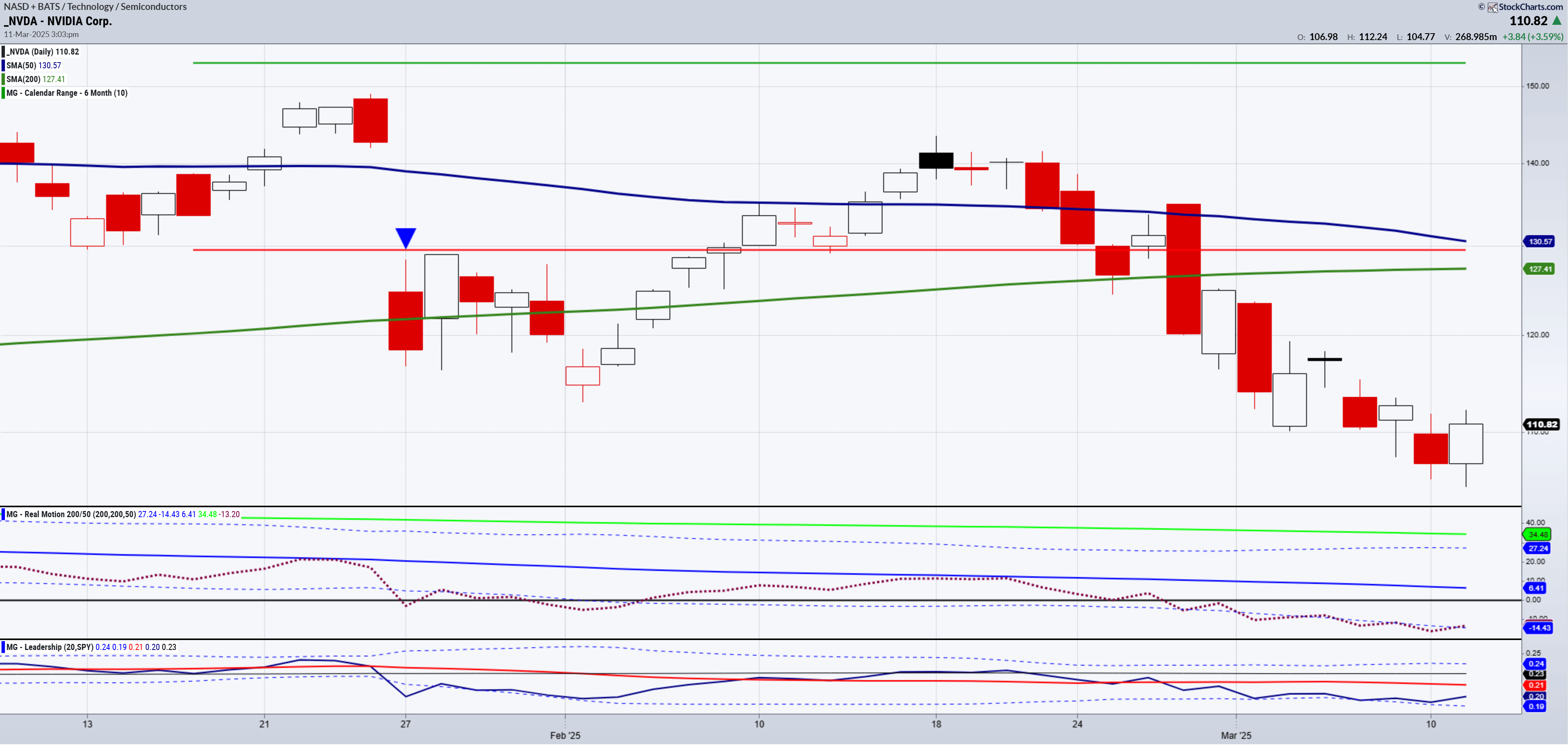

Momentum on Nvidia is in a bearish divergence with the 200-DMA (green) well above the 50-DMA (blue.) The opposite is true in the price.

NVDA underperforms the benchmark.

There is no clear reversal pattern yesterday.

Let’s say the stock drops to major support around $90. The buyer has lost $30.

Whether that level holds, or the stock continues to decline further, the point is this:

Can you afford to add to a losing position?

Will the long-term story help you in the short term?

The bottom line is PRICE DICTATES THE NARRATIVE!

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) 540 next major support

Russell 2000 (IWM) Can 200 area hold?

Dow (DIA) 415 support

Nasdaq (QQQ) 440 support

Regional banks (KRE) 54 support

Semiconductors (SMH) 205 support

Transportation (IYT) 65.00 pivotal

Biotechnology (IBB) 135 pivotal

Retail (XRT) 70 now resistance to clear