Almost every investor knows the story of the Detroit auto industry collapse in the late 2000s.

The Great Recession couldn’t have come at a worse time for General Motors (NYSE: NYSE:GM), Ford Motor Company (NYSE:F) or Chrysler (NYSE: FCAU). As the wars in Iraq and Afghanistan raged, oil and gas prices rushed upward. That decimated sales of Detroit’s flagship products: giant trucks and SUVs.

Given that the auto industry suffered in a time of high oil prices, you’d think that it would be doing great with today’s rock-bottom prices.

You’d be wrong.

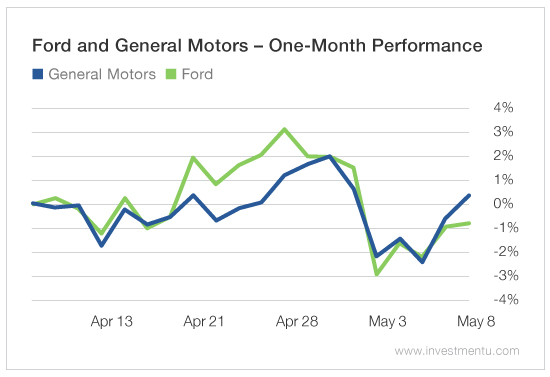

Ford and GM shares plunged Tuesday after both automakers reported extremely disappointing April sales. Revenue growth has been slowing in the industry for three consecutive months now. And auto inventories are at their highest levels since the Great Recession.

What caused this new auto industry crisis, and how bad could it get? As we’ll see below, the problems that led automakers to this point are very different from the ones that led to the 2009 bailout.

The Industry’s Own Little Subprime Loan Bubble

In the late 2000s, Detroit nearly destroyed itself by focusing on gas guzzlers in a climate of rising oil prices. But the problems with today’s auto industry aren’t really related to vehicle design, nor gas prices.

In fact, the recent collapse in auto sales bears much more of a resemblance to the late 2000s housing crash.

Don’t panic - it’s not going to destroy the global economy. The auto industry is considerably smaller than the real estate sector. And the market for auto loans is a fraction of the size of the mortgage market. But size aside, the causes of these two downturns are remarkably similar.

In recent years, aggressive sales incentives and predatory subprime lending practices have created unsustainable sales expectations in the auto industry. Manufacturers, dealers and financiers have all played a part in flooding the market with cars... And now they can’t find enough buyers. Just replace “cars” with “houses,” and you’ve got 2007 through 2008 in a nutshell.

Part of this overselling phenomenon involves dealerships offering insane bargains to credit-worthy buyers. In this time of near-zero interest rates, car sellers can’t make much money from loans to buyers with good credit scores.

Instead, they’ve been trying to make up that money with sales volume. And they’ve been offering consumers zero-interest loans and deep discounts in an overzealous bid to move units.

The low interest rates have also incentivized dealers and financiers to double down on subprime loans, which can carry APRs north of 20%. The popular HBO show Last Week Tonight with John Oliver ran a segment about the subprime auto loan boom last summer.

As Oliver explained, these subprime loans rarely end well for the borrower or the lender. Borrowers have been defaulting on their loans at an increasing rate. And when that happens, their cars get repossessed and end up back on a used car lot, thus raising inventories.

Between the predatory lending practices and the unsustainable sales incentives, it’s no wonder that the industry can’t find enough new car buyers to sustain its pace.

The Road to Recovery

It might take a long time for conventional automakers to overcome this downturn. For things to get better, cars will have to become somewhat scarce again. And that will take a long time to happen.

The auto industry is clearly bracing for a persistent downturn. Fiat Chrysler is temporarily shutting factories across the U.S., idling thousands of workers in the process. GM is following suit. The latter even agreed to write off its massive factory in Venezuela - a $100 million value - after local authorities seized the plant last month.

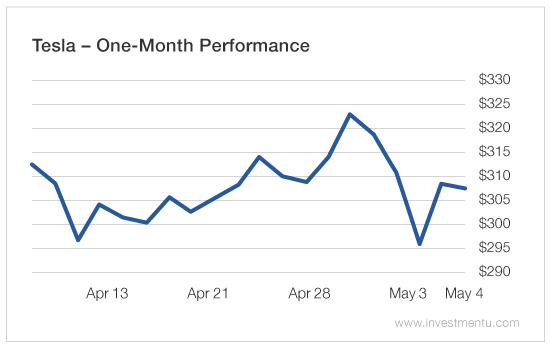

But there’s still one type of vehicle for which demand outstrips supply: electric cars. While GM and Ford shares slid last week on sales misses, Tesla (Nasdaq: NASDAQ:TSLA) hit record highs.

As The Oxford Club’s Energy and Infrastructure Strategist David Fessler recently wrote, Tesla (and other EV makers) represents the kind of disruptive and transformative technology that investors should bet on.

Even though Tesla isn’t profitable yet, it’s pretty obvious that the EV maker is in a better position to weather this industry slump than the legacy players.

In contrast to Ford and GM, which can’t find enough buyers, Tesla has almost half a million preorders for the unreleased Model 3 sedan. While institutional investors have fled from Ford and GM stock in droves over the last decade, internet giant Tencent Holdings recently bought a 5% stake in Tesla.

You don’t have to be a financial math whiz or a car buff to understand this incipient auto downturn. Companies that sell products for which demand exceeds supply make good investments. Companies that oversaturate the market with their products make bad investments.

Hopefully, Detroit carmakers will learn this lesson soon. They barely made it through the last auto industry crisis... and who knows if they’ll survive a second one.