Market movers today

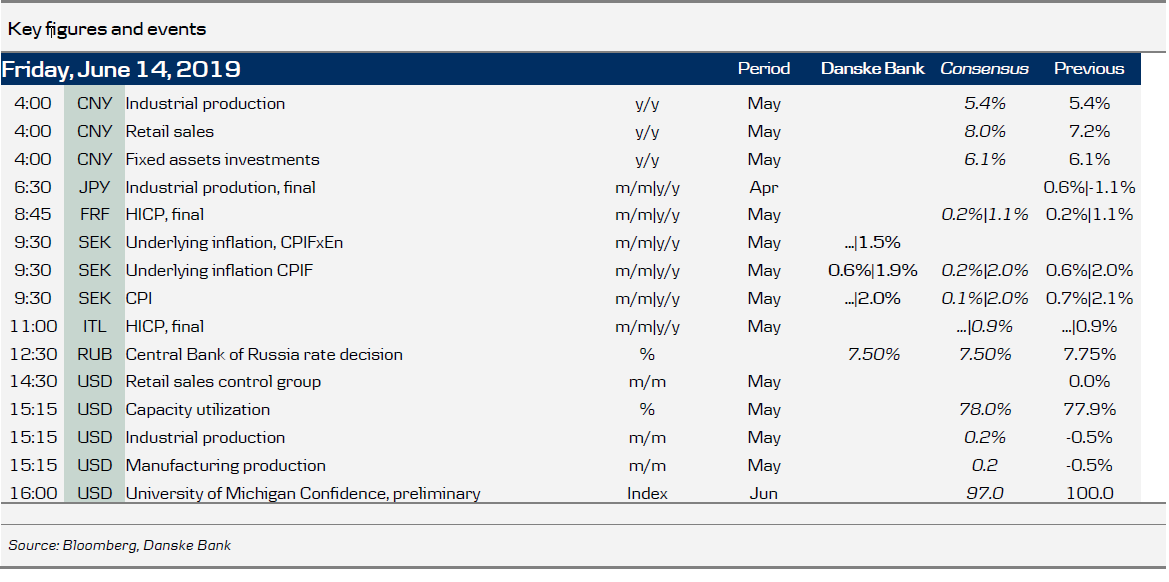

In the US , we get a range of data releases to keep an eye on today in light of the increased uncertainty over the macro outlook, notably industrial production and retail sales for May . In addition, the first estimate of consumer confidence from the University of Michigan for June is due out.

In Europe, it is quiet on the data front and markets will stay tuned to the political headlines ahead of next week's EU summit and the ECB's Sintra Forum.

In the Scandi markets, today's big event will be the Swedish May inflation figures (see next page).

The Bank of Russia (CBR) will announce its decision on the key rate and the central bank governor will hold a press conference. Together with Bloomberg and Reuters consensus, we expect a 25bp cut to 7.50% as the central bank has stated its confidence about decelerating inflation, and external conditions (lack of new anti-Russian sanctions by the US) are not shaking up the RUB .

Selected market news

Stocks in the Asian session traded miscellaneously on Friday morning, while the bond rally intensified on trade war concerns putting the brakes on global economic growth and new geopolitical tensions in the Persian Gulf region after the tanker incident. The Trump administration accused Iran of the attacks on the tankers while Iranian officials denied they were behind the incident.

US Secretary of State Michael Pompeo said on Thursday in Washington that Iran had threatened earlier to restrain oil transport in the Strait of Hormuz. While Pompeo gave no evidence and did not take any questions from reporters, Trump administration officials said that at least one of the ships was attacked by mines. They showed a picture of a tanker with a hole caused by a mine that had exploded and an undetonated mine inside.

The US has sent a guided missile destroyer to the Gulf of Oman to join another US destroyer stationed near a damaged tanker. While the Pentagon stated that Iranian small boats were identified in the area, the US Central Command said "a war with Iran is not in our strategic interest, nor in the best interest of the international community".

Brent soared by almost one US dollar per barrel after Pompeo's statement, but quickly deflated, trading around 61.5 USD/bbl on Friday morning, which means a 3.7% surge from yesterday's lows.

In the UK, Boris Johnson led the race to become the country's next prime minister in a secret ballot of Tory MPs. Foreign Secretary Jeremy Hunt came second, gaining less than half of votes versus those for Johnson. The next round of voting is next Tuesday.

Scandi markets

In Sweden, inflation figures for May are set to be released at 9.30 CEST. We expect CPIF to be 0.1% m/m and 1.9% y/y, which is 0.1-0.2pp below the Riksbank’s forecast. As falling electricity prices should cancel out rising car fuel prices and as mortgage rates are essentially unchanged, focus will be on the behaviour of CPIF Ex Energy (we expect 0.1%/1.5%). There are seldom big price swings in May, with the exception of international airline tickets and charter packages. These tend to move in opposite directions and hence balance each other out, which is also our base case. However, we do see downside risks as charter prices may surprise on the downside and actually decline instead of going up. This could potentially pull inflation down by 0.2pp and hence inflation may end up 0.3-0.4pp below the Riksbank’s forecast. The risk is skewed to the downside, so if inflation surprises to the downside, we would expect the yield spread between the EU and Sweden to tighten.

Fixed income markets

In Europe, it is more of the same – spread tightening between the periphery and the core EU markets. 10Y Italy rallied some 7bp versus Bunds despite the EU adding pressure on Italy to rein in the deficit in order to avoid disciplinary measures, given comments yesterday from the Portuguese finance minister and head of the Eurogroup, Mario Centeno, and EU Commissioner Dombrovskis. However, given a foreign investor participation of 64% in the new 20Y syndicated deal on Wednesday and solid demand at yesterday’s BTPS auction, the market is ‘ignoring’ the problems between the EU and Italy.

There are no key figures out of Europe today, so we expect modest movements in rates/yields while we await the Federal Reserve meeting next week. France is up for review by Fitch tonight. We do not expect any changes to the rating or the outlook.

FX markets

Today, all eyes will be on the Swedish inflation figures for May, where recent developments point to a downward risk to our initial forecast (see Scandi section). In light of this, we conducted an exercise where we examined inflation surprises (vs consensus as well as the Riksbank) from 2016 onwards, and found that negative surprises more than 0.15 p.p. below consensus estimates were associated with EUR/SEK rising 5.5 figures on average during the first 30 minutes post-release, and almost 9 figures until the close of business (17:00 CEST). Thus, should the aforementioned downside risk materialise, we could see EUR/SEK again testing 10.80. For more details, please see FX Strategy – EUR/SEK response to Swedish CPIF data.

EUR/USD has been more responsive to US data releases of late. This is likely due to the high uncertainty about Fed policy heading into next week’s FOMC meeting. The release of retail sales and industrial production today could therefore be market movers. We think the risk is tilted towards slightly stronger readings, which would be EUR/USD-negative. Regardless, we are confident the Fed will cut rates in July, which should pave the way for a move in EUR/USD towards 1.17 in 6M.

USD/JPY is consolidating around 108 but we believe the trend continues to be down in the coming months towards around 107. US inflation expectations remain on a downtrend but yields are more stable for now. We view it as unlikely that the Fed would invite in a tightening via real rates and the upcoming FOMC meeting could very well be the next catalyst for a stronger JPY as the BoJ remains firmly side-lined.

We see a real risk that the market will test the SNB’s willingness to pursue its inflation target given its constrained toolbox and let EUR/CHF test 1.11 again. The ECB has proven its creativity when it comes to unconventional policies, while the SNB revealed its distaste for balance sheet expansion in 2015. This suggests asymmetric (downside) risks to our 1- 3M (NYSE:MMM) target of 1.12. Broadly, SNB could prove an interesting lab for what happens in the FX sphere when a central bank risks its credibility by inaction. Please, read more in our FX Strategy note EUR/CHF – a lab for effects of central bank inaction, 13 June.