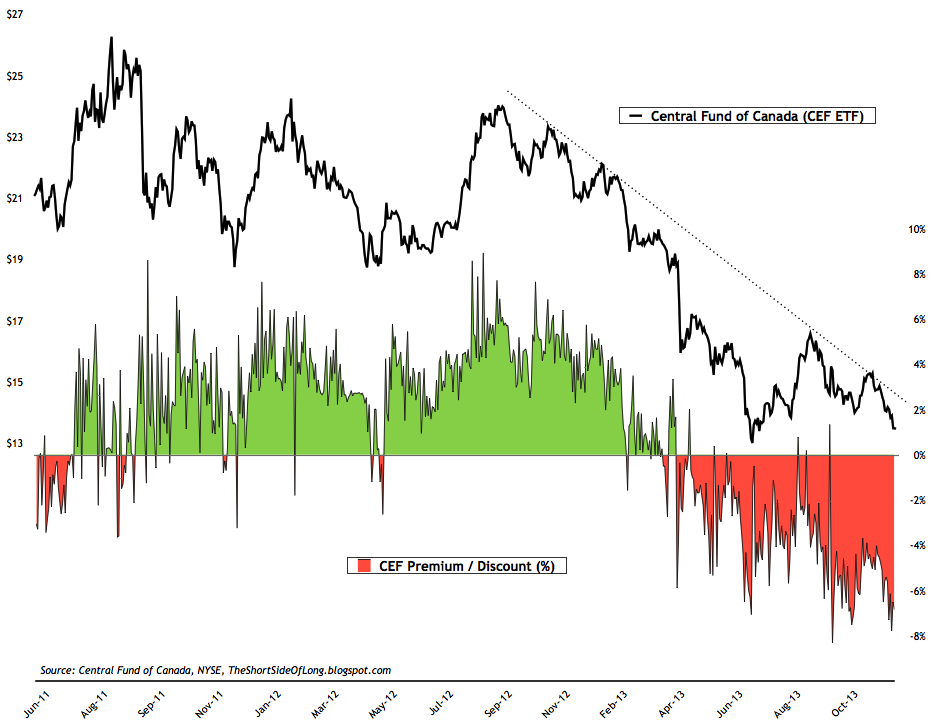

Chart 1: Gold and Silver CEF fund is currently trading at 7% discount

Source: Short Side of Long

The Central Fund of Canada (CEF) holds 50% physical Gold and 50% physical Silver, stored in Canada. Its net asset value (also known as NAV) links to the official market price of those two commodities with the stored physical holdings in tones. It is very possible for market mood to determine the price of the fund on the NYSE, regardless of its actual NAV, which creates a premium or a discount.

Interestingly enough, with the market sentiment for the PMs sector in total doldrums, traders have taken the CEF ETF price on the NY stock exchange below its actual true value by between 4 to 8 percent over the last few weeks. In other words, physical Gold and Silver are currently trading at a discount of about 7% as of yesterday. Stated differently, within the ETF, Gold is being sold for $1,150 and Silver for $18.40. Would you like to buy Gold at $1,150 per ounce today, a whole $100 below the current Comex price?

Contrarians should note that the ETF regularly shifts from premium to discount and back again. High premium levels usually, but not always, occur near intermediate peaks while high discount levels usually, but not always, occur near intermediate degree bottoms. A further sell off in Gold and Silver towards new lows could push the discount towards 10% and create a fantastic buying opportunity.