On Wednesday, IAC/InterActiveCorp (NASDAQ:IACI) the conglomerate run by Barry Diller, announced that the company’s Match Group -- Match.com, Tinder and OKCupid -- plans to pursue an initial public offering during the fourth quarter of this year. According to the press release, IAC will issue less than 20% of its shares in the offering, with IAC’s remaining stake in The Match Group represented by both high-and low-vote common shares. IAC believes that their dating sites are an attractive combination of large cash flows, solid growth potential, and strong margins.

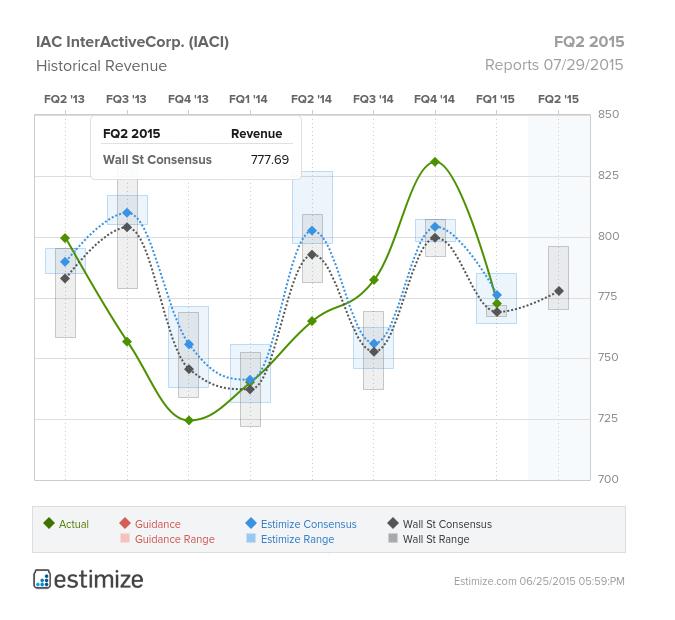

In general, dating sites in the United States are a hot market, expecting to generate $1.17B this year, while dating apps are expected to make $628.8M, up from $1.08B and $572M last year. IAC has a market capitalization of $6.35B. Match Group’s portfolio is made up of 40 global brands, has generated more than $780M in revenue, and has made profits of over $260M in 2013. Evidently, IAC’s dating sites’ successes have encouraged the movement towards an IPO, and the market is seemingly in favor. In fact, IAC shares increased over 5% in premarket trading on Thursday after the announcement of this planned stock offering. This year alone, IAC shares are up more than 33%, and have climbed 4.6% to $80.83 in recent trading.

IAC’s Match Group’s revenue is soaring faster than any of Diller’s other business segments, as it gained 11% last year, rising up to $897M. As a result, the Match Group now makes up 31% of IAC’s top-line. However, while paid subscribers have grown 16% this year, profits for the segment fell 36%, likely due to stiff competition in the on-line dating space.

![]()

IAC’s first matchmaking service, Match.com, was launched in 1995, and is now represented globally in 24 countries. The Match Group overall is valued at $5.7B, and Tinder is worth around $2B by itself. Although Tinder has been a big hit with users, most are still using the free app, which continues cannibalize profits from Match.com, a paid service. Even as IAC works to monetize Tinder, recently laying out a suite of new premium features, it will be sometime before it is profitable. Tinder’s new premium services costs $9.99 for younger users and $19.99 for people over 30 years old. Analysts fear that these customers will continue to resent the payment system, and thus go elsewhere for a free dating source.

It will be intriguing to see whether this IPO will lead to a match made in heaven with Wall Street. Definitely keep a look out for this love affair, as it could certainly be a scandalous one.