A period of breakneck development since IPO culminated with the company securing its first big data customer. A strong start to 2013 prompts a 20% upgrade to bookings. Conversion of only a modest proportion of Hadoop opportunities could significantly transform the P&L.

Textbook debut year

WANdisco’s (WAND.AIM) progress since its June 2012 IPO has been impressive, with the company delivering strong financial performance and significantly exceeding operational expectations. Enabled by the IPO fundraising, the sales team is now translating into an acceleration in growth. Facilitated by its listed share capital, the acquisition of AltoStor helped bring on board key staff, significantly accelerating the company’s big data development programme and broadening the product offering.

Accelerated Hadoop progress

Having released its first Hadoop products to market 12 months ahead of schedule, the company has secured a major UK telco as is first customer. The pipeline looks extremely strong, fueled by the promise of WANdisco’s Non-Stop Name Node product to improve the availability and resilience of Hadoop implementations. If proof of concepts convert into broader implementations, contract values significantly in excess of $1m seem likely. A number of OEM opportunities are also being explored, which would serve as a further validation of the company’s technology and open up the possibility of rapidly scaling growth.

Multiple growth vectors

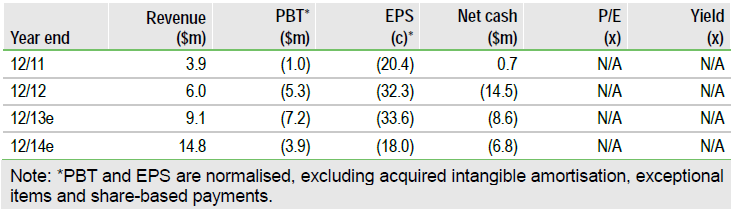

Meanwhile, the established Subversion ALM business is performing exceptionally well and was the sole driver behind the strong growth in bookings over the course of 2012 (up 71% y-o-y to $7.9m) and Q13 (up 93% to $3m). Expansion of the product set and sales capability should accelerate the run rate from here. Thus we are upgrading our bookings forecasts for 2013 and 2014 by 20% and 12% respectively. Respective sales estimates move up by 11% and 16%, although increased investment widens 2013 EBIT adj loss by 20%. Amodest number of enterprise-wide or OEM deals could drive significant further upside to estimates.

Valuation: Acceleration priced in, but scope for more

The 2013 EV/Sales ratio of 29x suggests a step change in financial performance is being priced in. However, if the company continues to cement itself as key player in Hadoop, financials should be transformed, giving the company ample potential to deliver upside on the current £168m market capitalisation.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

WANdisco: Accelerated Development

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.