Shares of Walmart Inc. (NYSE:WMT) were up 3.1% during the pre-market trading session, following the company’s solid fourth-quarter fiscal 2019 results. During the quarter, both top and bottom lines improved year over year and the latter marked its fourth consecutive beat. The company’s U.S. division continued to post solid results, courtesy of the company’s robust e-commerce performance.

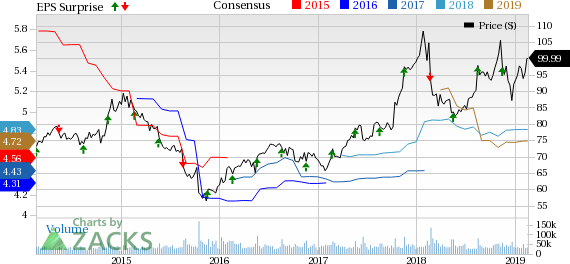

Notably, the company has long been gaining from its constant omnichannel efforts to combat the growing dominance of Amazon (NASDAQ:AMZN) . This has helped this Zacks Rank #3 (Hold) stock gain 6.7% in the past three months, almost in line with the industry..jpg)

Quarter in Detail

Walmart’s adjusted earnings came in at $1.41 per share, which came way ahead of the Zacks Consensus Estimate of $1.33. Further, earnings improved about 6% year over year. We believe that enhanced sales and higher operating income fueled bottom-line growth. Including one-time items, Walmart reported earnings of $1.27 per share, which surged 74% year over year.

Total revenues advanced 1.9% to $138.8 billion that fell slightly short of the Zacks Consensus Estimate of $139.3 billion. The year-over-year upside was driven by strength in the U.S. business. On a currency-neutral basis, total revenues grew 3.1% to $140.5 billion.

Consolidated gross profit margin contracted 27 basis points (bps) to 23.8% on account of pricing, elevated transportation expenses and e-commerce mix impacts.

Consolidated operating income jumped 35.8% to $6.1billion. On a constant-currency (cc) basis, operating income increased nearly 38% to $6.2 billion.

Segment Details

Walmart U.S.: The segment recorded net sales growth of 4.6% to $90.5 billion in the quarter. U.S. comps, excluding fuel, improved 4.2% backed by 0.9% rise in traffic and 3.3% in ticket. Notably, U.S. comps, on a two-year stack basis, marked its highest improvement in 9 years.

Further, e-commerce sales drove comps by 180 bps. E-commerce sales improved on the back of enhanced online assortment and increased grocery pickups. Operating income at the segment increased 7.3% to $5 billion.

Walmart International: Segment net sales slipped 2.3% to $32.3 billion. On a currency-neutral basis, net sales inched up 2.7% to $34 billion, with three (Mexico, Canada and U.K.) out of four largest markets registering positive comps. Operating income at this segment fell 9.9% to $1.2 billion. On a currency-neutral basis, operating income dropped 2.8% to $1.3 billion.

Sam’s Club: The segment, which comprises membership warehouse clubs, saw its net sales decline 3.7% to $14.9 billion. Sam’s Club comps, excluding fuel, rose 3.3%. Tobacco dented comps by nearly 200 bps. While traffic increased 6.4%, ticket was down 3.1%. E-commerce fueled comps by nearly 90 bps. Segment operating income came in at $0.4 billion.

Other Financial Updates

In fiscal 2019, Walmart generated operating cash flow of $27,753 million and incurred capital expenditures of $10,344 million, resulting in free cash flow of $17,409 million. Walmart allocated $1,505 million toward dividends and made share buybacks worth $3,249 million during the fourth quarter.

Capital expenditures are expected to be nearly $11 billion in fiscal 2020.

Also, the company plans to open less than 10 U.S. stores and little more than 300 international stores in fiscal 2020. Walmart International store openings will be mainly concentrated on China and Walmex.

Recent Developments & View

Management is impressed with its solid results and encouraged about the rosy U.S. economic scenario. Further, the company focuses on boosting innovations and leveraging technology to drive growth. Walmart also is hopeful about consumers’ continued favorable response to its omnichannel offerings. Notably, the company expects roughly 3,100 grocery pickup locations and about 1,600 grocery delivery locations by the end of fiscal 2020.

Considering these factors, the company reiterated its outlook for fiscal 2020, which was issued on Oct 16. The company anticipates consolidated net sales to rise at least 3%, including benefits from Flipkart, adverse impacts from Walmart Brazil’s deconsolidation and planned tobacco sales cut downs at Sam’s Club.

Notably, Walmart U.S. e-commerce net sales are expected to surge about 35% year over year and Walmart International net sales are expected to increase approximately 5% at cc.

U.S. comps are expected to advance 2.5-3% (excluding fuel). Comps at Sam’s Club are likely to grow roughly 1%, excluding fuel, and nearly 3%, excluding tobacco fuel.

Further, management expects consolidated operating income to fall low-single digits, including Flipkart, and rise low-single digits, excluding Flipkart.

Finally, earnings are envisioned to decline at a low-single-digit rate year over year, whereas the same is expected to increase in a low to mid single-digit rate, excluding Flipkart.

Retail Stocks You Can’t Miss

Kroger (NYSE:KR) , with a Zacks Rank #2 (Buy), has long-term earnings per share growth rate of 6.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar Tree (NASDAQ:DLTR) , also with a Zacks Rank #2, has long-term earnings per share growth rate of 13.8%.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

Original post