Wal-Mart Stores Inc. (NYSE:WMT) is leaving no stone unturned to attract holiday shoppers with great deals this year. This year, in the holiday layaway program, initiated on Sep 1, the company plans to offer more than 1,000 new toys, including more than 300 exclusive toys, to have an edge above competitors. Notably, these items were witnessing sluggish sales for quite some time owing to tough competition from videogames and YouTube videos. The company is thus planning to unveil the much awaited "Star Wars" Droid kit, "Frozen"-branded sleigh and "Paw Patrol" lookout tower from Hatchimals and Fingerlings. Walmart anticipates demand for toys to improve this year, thanks to the Star Wars items. About 25% of the toys will be available exclusively at Wal-Mart stores and on Walmart.com.

Layaway programs, which starts with 'Toy Week', allow shoppers to buy holiday merchandise like electronics and toys and pay in installments. Further customers can also enjoy the privilege of picking up products at a later date. This program helps the company to gain 15% of holiday revenues at Walmart stores in remote areas of the United States. In this year’s annual holiday season layaway program, customers can pay as low as $10 for items worth $50 and can also shop till Dec 11 at no extra fee.

The holiday shopping season is crucial for retailers like Walmart, Best Buy Co. Inc. (NYSE:BBY) , Amazon.com Inc. (NASDAQ:AMZN) and Target Corp. (NYSE:TGT) and they try all means to drive footfall. Be it early-hour store openings, promotional events, free shipping on online purchases or heavy discounts, retailers try every mean to boost sales during the holiday season.

Apart from boosting store traffic, Walmart is also trying to gain traction in the e-Commerce market and to catch up with online giant Amazon. In a recent move, the company has opened its 1,000th Online Grocery Pickup location, which enables customers to order groceries online and pick them up at their local Walmart store.

Walmart’s Other Services to Take on Amazon

Walmart is trying every means to develop an impressive digital brand portfolio and has been aggressively adopting a number of initiatives in this regard. Recently, it has teamed up with Alphabet (NASDAQ:GOOGL) Inc's Google to enter the budding voice-shopping market, following the footsteps of Amazon.

In order to expand in the online grocery and delivery market, the retailer has partnered with the ride hailing service provider Uber and Lyft for speedy online grocery deliveries. Walmart now operates online grocery delivery service in six markets. The giant retailer also enables customers to order groceries online and collect them from 900 locations. Also, with Easy Reorder on walmart.com, customers can repurchase items by looking into their previous in-store and online purchases records. The company also has a dedicated back-to-school destination on walmart.com which enables customers to shop school supply lists for more than 1 million classrooms across the country.

The company’s free two-day shipping service to U.S. shoppers on a minimum order of $35 and that too without a membership fee has also proved to be a success. This service replaced Walmart's existing two-day shipping program named 'Shipping Pass' that charged shoppers an annual membership fee of $49 and competed strongly with Amazon’s Prime shipping program, which charges customers $99 a year for two-day shipping with additional features like a streaming video service. In April, Walmart introduced a program wherein it offered discounts on online items, only if shoppers picked their orders from a nearby store. The discount given had an added feature to Walmart’s already existing delivery service called Walmart Pickup, which enables customers to place orders online and then pick them up from a store for free.

Not only this, Walmart continues to make huge investments in e-Commerce initiatives, including acquisitions, in order to compete with brick-and-mortar stores and online retailers. The company has acquired four e-Commerce businesses (Bonobos, ShoeBuy, Moosejaw, ModCloth) since the Jet.com acquisition (in September 2016) is in line with the Walmart’s expansion efforts. Recently, the company plans to invest in online cosmetics startup Birchbox. If the deal materializes, it will become the fifth e-Commerce acquisition, since the buyout of Jet.com. The company is also expanding in Mexico and China to gain substantial market share in those regions.

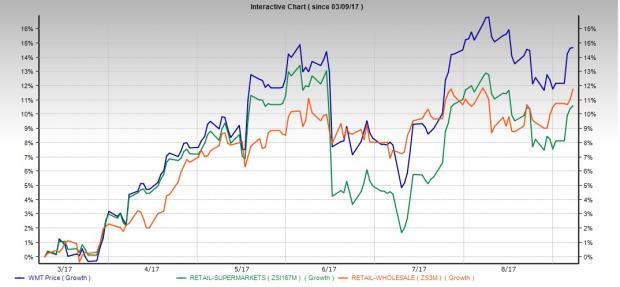

If we look into the last six months’ performance, we note that Wal-Mart’s shares have rallied 14.7%, higher than the industry, which grew 10.6%. The broader Retail-Wholesale sector has increased 11.7% in the said time frame.

Our Take

As we can see, this Zacks Rank #3 (Hold) company has been undertaking a number of initiatives to boost sales. While the layaway program is expected to help the company increase store traffic, it will also help shoppers with a long shopping list but limited credit.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Original post

Zacks Investment Research