- Walmart shares have been flat since the beginning of 2022

- Supply chain issues, inflation worries and geopolitical tensions providing headwinds

- Price declines may offer an opportunity to invest

2022 has been a quiet year for investors in retail giant, Walmart (NYSE:WMT). The stock is down 0.8% year-to-date (YTD), but up 7.2% in the past 12 months compared to the Dow Jones Retailers which has declined 8.3% YTD, but returned 6.5% in the past year.

On Aug. 18, WMT shares went over $152 and hit a record high giving the stock a 52-week range of $130.99-$152.57.

The retailer has 10,000 stores worldwide, making it the largest brick-and-mortar retailer. It also has the largest share of the US grocery market. And during the pandemic, it enjoyed about a quarter of all ‘click-and-collect’ retail orders.

The Bentonville, Arkansas-based supercenter chain released Q4 FY22 figures on Feb.17, which beat consensus estimates. The quarterly revenue increased 0.5% year-over-year (YoY) to $152.9 billion. Adjusted EPS was $1.53.

Excluding fuel, US same-store sales went up by 5.6%. Meanwhile, management noted that quarterly supply chain costs were $400 million higher than initially forecast.

On the earnings call, CEO Douglas McMillon said:

“Our team delivered net sales growth of 7.6% and adjusted EPS growth of 9.3% excluding divestitures. We continued to gain market share in food and consumables in the US, and comp transactions were positive.”

In the new fiscal year, the big-box retailer expects to achieve EPS growth in the mid-single digits. However, analysts debate how inflationary pressures could affect its margins and therefore earnings, especially as stimulus-driven consumer spending comes to an end.

Prior to the release of the Q4 results, the stock was around $135, but now it stands at $143.80.

What To Expect From Walmart Stock

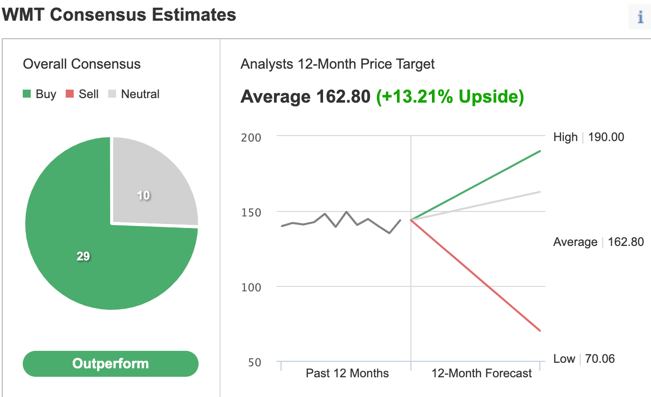

The 29 out of 39 analysts polled via Investing.com have given WMT stock an "outperform" rating.

Wall Street also has a 12-month median price target of $162.80, an increase of more than 13% from current levels. The 12-month price range currently stands between $70.06 and $190.

Similarly, according to a number of valuation models, including P/E, P/S multiples, or terminal values, the average fair value for Walmart stock stands at $168.51. So, fundamental valuation suggests shares could increase about 17%.

We can also examine financial health by ranking more than 100 factors against peers in the consumer staples sector.

For instance, in terms of cash flow, growth and profit, it scores 3 out of 5. Its overall score of 3 points is a good performance ranking.

At present, WMT’s P/E, P/B, and P/S ratios are 29.5x, 4.8x, and 0.7x.

Comparable metrics for peers stand at 20.4x, 2.7x, and 0.4x. These numbers show that despite the recent decline in price, the fundamental valuation for Walmart stock is not necessarily on the cheap side.

Those readers who also pay attention to technical charts would note that Walmart stock has significant resistance first around the $145 level, and then at $150. Our expectation is for Walmart stock to build a base between $135 and $145 in the coming weeks. Afterwards, later in the year, shares could potentially start a new leg up.

Adding WMT Stock To Portfolios

Walmart bulls, who are not concerned about short-term volatility, could consider investing now. Their target price would be $162.80, analysts’ forecast.

Yet, others who expect some profit-taking in WMT stock in the short run might consider initiating a bear put spread strategy. It might also be appropriate for long-term WMT investors to use this strategy in conjunction with their long stock position. The setup would offer some short-term protection against a decline in price in the coming weeks.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on WMT stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On Walmart Stock

Intraday Price At Time Of Writing: $143.80

This strategy requires a trader to have one long WMT put with a higher strike price and one short put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if WMT shares decline in price. Let’s now look at an example with intraday numbers from Mar. 22. Understandably, when the market opens tomorrow, these prices will be different.

However, the method of risk/return calculation is the same.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the WMT 20 May 2022 140-strike put option. This option is currently offered at $3.20. Thus, it would cost the trader $320 to own this put option, which expires in about two months.

At the same time, the trader would sell another put option with a lower strike, like the WMT May 20 135-strike put option. This option is currently offered at $1.90. Thus, the trader would receive $190 to sell this put option, which also expires in about two months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss (or risk) would be ($3.20 - $1.90) X 100 = $130.00 (plus commissions).

This maximum loss of $130 could easily be realized if the position is held to expiry and both WMT puts expire worthless. Both puts will expire worthless if the WMT share price at expiration is above the strike price of the long put (higher strike), which is $140 at this point (for example, at $141).

This trade’s potential profit is limited to the difference between the strike prices (i.e., ($140.00 - $135.00) X 100) minus the net cost of the spread (i.e., $130.00) minus commissions.

In our example, the difference between the strike prices is $5.00. Therefore, the profit potential is $500 - $130 = $370.

Finally, this trade would break even at $138.70 on the day of the expiry (excluding brokerage commissions). We arrived at this number, by subtracting the net premium paid (or $1.30 here) from the strike price of the long put (or the higher strike, which is $140.00 here)

Bottom Line

Shares of Walmart, the largest brick-and-mortar retailer globally, belong to most long-term portfolios. During the pandemic, management has responded to evolving consumer needs and wants, and increased revenues.

However, supply chain issues combined with inflationary pressures are likely to put pressure on margins. Therefore, it could be some months before WMT stock begins a new leg up.

Buy-and-hold investors could regard declines in the WMT share price as an opportunity to buy the stock. Alternatively, experienced traders could also set up an options trade to benefit from a potential decline in the price of Walmart stock.