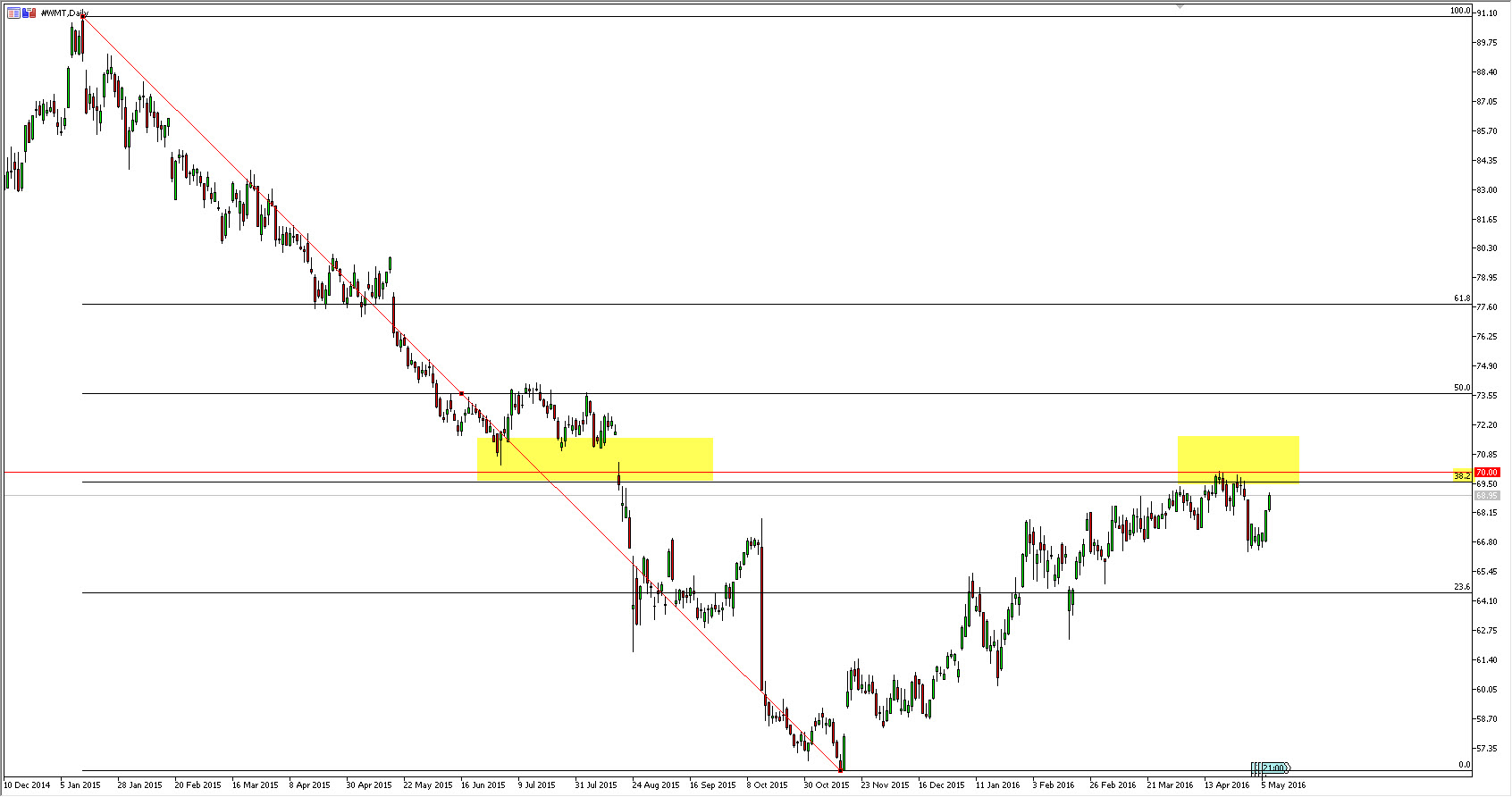

Walmart (NYSE:WMT) has recently seen quite a bit of bullish pressure lately, and as a result we have rallied from the $56.30 level to the $70 handle since the lows in November of last year. This has been a good run, but we could now be looking at a serious barrier to overcome based upon the technical analysis, as Walmart is facing resistance.

The $70 level will of course have a certain amount of psychological significance to it, but also was the scene of a gap in 2015. This typically leads to ‘market memory’, and sellers there will often reemerge as there are a lot of orders to ‘chew through’ in order to continue upwards. This rally has been in spite of the fact that Walmart has been struggling with competition from outlets ranging from dollar stores to Amazon (NASDAQ:AMZN), as there is a lot of discounting going on out there at the moment.

Walmart rallied, but now what?

When looking at the chart, it is obvious that we have seen a massive jump, but in the end no market can move in one direction forever. Besides, we have recently pulled back, and this could either be a sign that we are going to try to build up momentum, or we are simply far too resisted in this area. Either way, the buyers will have to beware of this region in the next several sessions. At the first real signs of weakness, we are looking to sell.

On the other hand, there is the possibility of this stock climbing higher. However, we feel that a move above $73 is necessary in order to clear the gap, and get beyond the resistance that is expected to be seen there. Also, it should be noted that some charts in the US indices aren’t exactly screaming strength at the moment, and one of the first stocks that funds will play in terms of retail is Walmart. In other words, if the large funds start dumping retailers, this market is one of the first to show it. At this point, we obvious have a lot of decisions to make as far as Walmart is concerned, and soon as more and more people recognize that Walmart is facing resistance. They will have to decide if that matters, or if we fall.