By Alex Kimani

- The first half of the year was characterized by supply-side constraints that pushed commodities prices up significantly.

- A growing number of Wall Street banks is turning bullish on commodities again.

- China’s economic growth and zero-COVID policy remain a big uncertainty for commodity traders.

Even with oil prices now around $95, and commodities across the board dropping amid bearish economic prospects, a lineup of analysts still see another bull run by year’s end.

Earlier this week, oil prices fell to a low not seen since January, as traders weighed recession fears, China’s slowing economy, and the potential outcome of a nuclear deal with Iran that would release more product onto the market. And while Wednesday saw another rally sparked by data from the Energy Information Administration (EIA) showing a large drop in U.S. crude inventories (7.1 million barrels), it’s not enough to push prices back into the $100+ territory.

Natural gas futures have also shed gains earlier this week, though the outlook ahead of winter remains bullish.

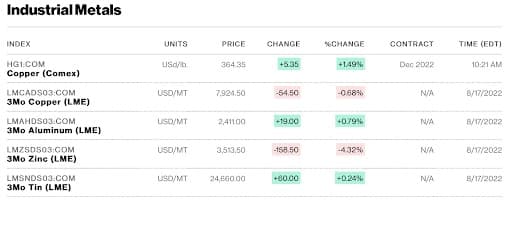

Other commodities also seem to be losing their steam over Chinese economic data, and if it’s not oil and gas that hold the key, it’s definitely heavy industrial metals and steel.

Wall Street, however, will not be shaken from its faith in commodities. Another rally is imminent, they say, and it will happen before we hit the New Year.

It’s All About China (Everything Is)

China remains a big uncertainty for Wall Street, which can’t get a grip on future demand while Beijing continues to struggle with the re-emergence of COVID-19 and responds with its “zero-COVID” policy, which includes harsh lockdowns that hamper economic growth and suggest lower demand for commodities. Compounding the economic torpor is a major real estate and housing crisis in China.

The Chinese view on its own economic data is one of “continued recovery, lingering pressure”, as noted by the Global Times, which suggests that we’ll see a strong rebound in growth in Q3.

On Monday, China’s key economic indicators were released, showing growth in both industrial profits and retail sales, but still a slowdown from June’s numbers. Expansion was disappointing and slower than Wall Street was hoping for.

While industrial profits saw a 3.8% increase year-on-year, it was below the 3.9% achieved in June when recovery from COVID lockdowns picked up pace. And it was well below the market’s expectations of 4.6% growth. Retail sales growth also ended up below June’s numbers.

Stagflation remains a risk

"The national economy maintained a recovery momentum," but “the foundation for the recovery of the domestic economy has yet to be consolidated”, NBS spokesperson Fu Linghui said, as reported by the Global Times.

"Looking forward, we will seize the critical period of economic recovery, focus on expanding domestic demand, stabilizing employment and consumer prices, and effectively guaranteeing and improving people's livelihoods," Fu said.

The data was dismal enough to prompt the Chinese Central Bank to make the surprise move of slashing its key interest rate by 10 basis points. The market was taken by surprise because the move was made only days after the bank had indicated it has no plans to cut rates in the immediate future.

The View from Wall Street

One of the prime indicators of commodity prices is the Constant Maturity Commodity Index, UBS CMCI, which we’ve seen plunge by 11% since its June peak. That’s still 16% higher year-on-year, but it’s been flatlining for the past 7 weeks.

UBS, however, remains undaunted, eyeing up to 20% returns for commodities–across the board–over the next six to 12 months, according to interviews with analysts on CNBC.

Likewise, Goldman Sachs is anticipating a rally in another key index, the S&P GSCI commodity index, of over 23% by year’s end.

The first half of the year was characterized by supply-side constraints that pushed commodities prices up significantly. Now, supply is not the biggest issue, says UBS. Instead, the issue is a less-than-ideal outlook for global economic growth, coupled with a strong U.S. dollar and China’s real estate problems.

In a note to clients published on CNBC, UBS’ Mark Haefele left room for commodities prices to drop further amid recession fears, but said we could just as easily see a “soft landing”, warning against adopting an overly bearish stance that conveniently forgets about the supply-side constraints that have not disappeared.

He also expects Chinese demand to rebound, and sees fears of a recession in the U.S. as jumping the gun. In fact, Haefele sees the potential for another supply shortage, noting that industrial metals and steel are the key commodities to watch.

“In general, commodity supply is constrained due to years of underinvestment — official inventories are low across multiple sectors — and because of weather-related and geopolitical factors. Meanwhile, we see positive demand trends,” Haefele said.

“[...] utput will struggle to keep pace with rising demand. In the oil market, where there has been similar underinvestment, OPEC+ producers have limited or no spare capacity,” he added.

Goldman Sachs is also on board with a less gloomy view of commodities, most notably positing in a Thursday note to clients carried by CNBC that the market has become irrational.

“Today, commodity markets appear to hold irrational expectations, as prices and inventories fall together, demand beats expectations and supply disappoints,” Goldman’s Global Head of Commodities Research Jeff Currie told clients, as reported by MarketWatch.

“The only rational explanation in our view is destocking as commodity consumers deplete inventories at higher prices, believing they can restock once a broad softening creates excess supply,” Currie added.

Like UBS, Goldman is predicting a “soft landing” and a commodity index rally of 23.4% by the end of 2022.