Wall Street rebounds after mixed earnings

Better-than-forecast earnings from Microsoft, PayPal and, for a change, Tesla helped sentiment on Wall Street, though disappointments from Caterpillar and Texas Instruments highlighted how fragile the outlook is. EU looks set to grant Britain’s request for a Brexit deadline extension, but can’t agree for how long. A decision will be made tomorrow.

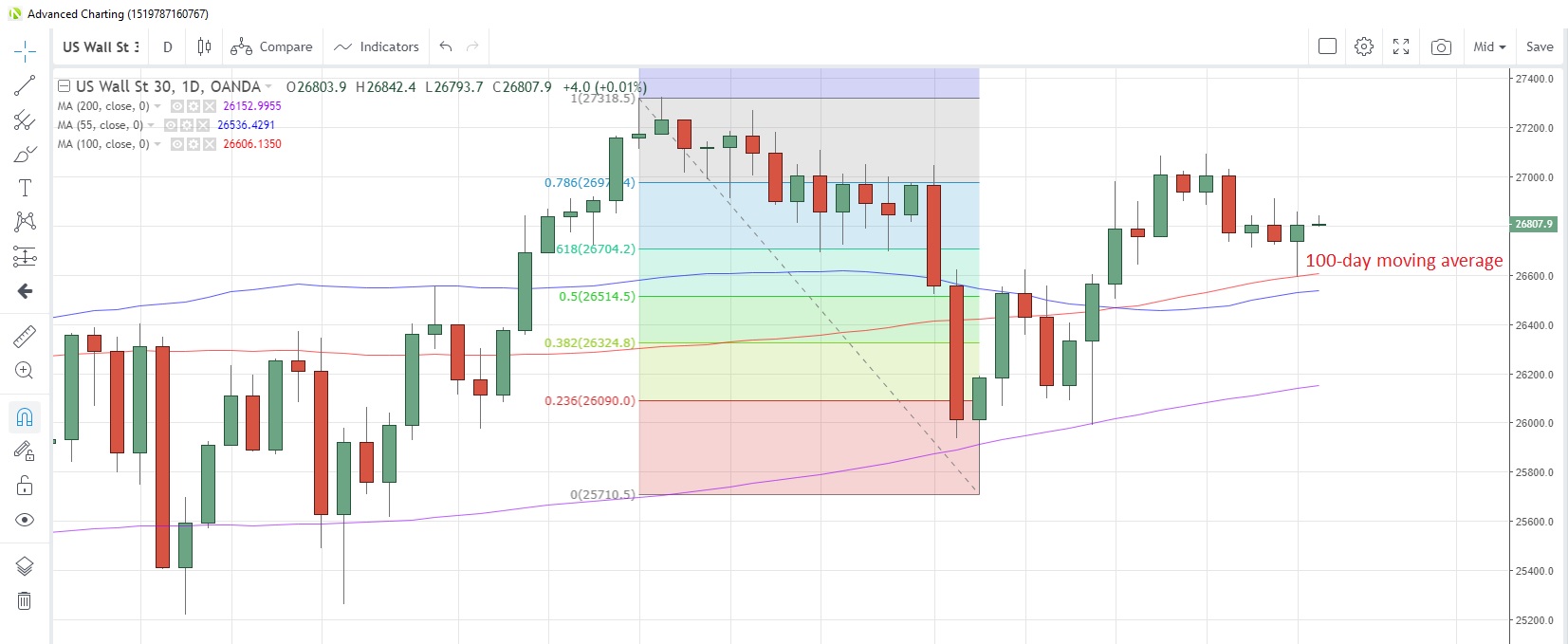

US30USD Daily Chart

- The US30 index bounced off near two-week lows yesterday as earnings out-performers exceeded disappointments.

- The 100-day moving average support at 26,594 survived its first test in two weeks yesterday.

- The flash manufacturing PMI from Markit is expected to dip to 50.7 in October from 51.1 last month. Durable goods orders and new home sales for September are also due.

DE30EUR Daily Chart

- The Germany30 index touched the highest since August last year in early trading this morning as it looks like the EU will grant Britain’s request for a Brexit extension.

- Yesterday’s gains were the most in a week and the index is nearing the July 2018 high of 12,890. The 100-day moving average has risen to 12,198.

- The flash estimate for Germany’s manufacturing PMI from Markit is seen improving to 42.0 in October from 41.7 the previous month. That would be the second monthly improvement in a row. Likewise, the Euro-zone’s PMI is expected to rise to 46.0 from 45.7.

CN50USD Daily Chart

- A lack of updates on the US-China trade talks has left the China A50 index vulnerable as it slid for a second straight day yesterday.

- The 55-day moving average has risen to 13,645, having supported prices on a closing basis since October 8.

- Western brands are starting to notice that consumer spending behavior in China is switching more to local brands rather than international ones as the tariff wars continue. One company feeling the pinch is Apple (NASDAQ:AAPL) (NASDAQ:AAPL), with Coach and Calvin Klein also hit, Bloomberg reports today.