U.S. indices closed higher yesterday following more strong banks’ earnings reports. British PM Boris Johnson has done the easy part, negotiating a deal with Europe, now he has the tough task of getting it passed in Parliament. A Turkey-Syria ceasefire also helped sentiment. China releases Q3 growth numbers today.

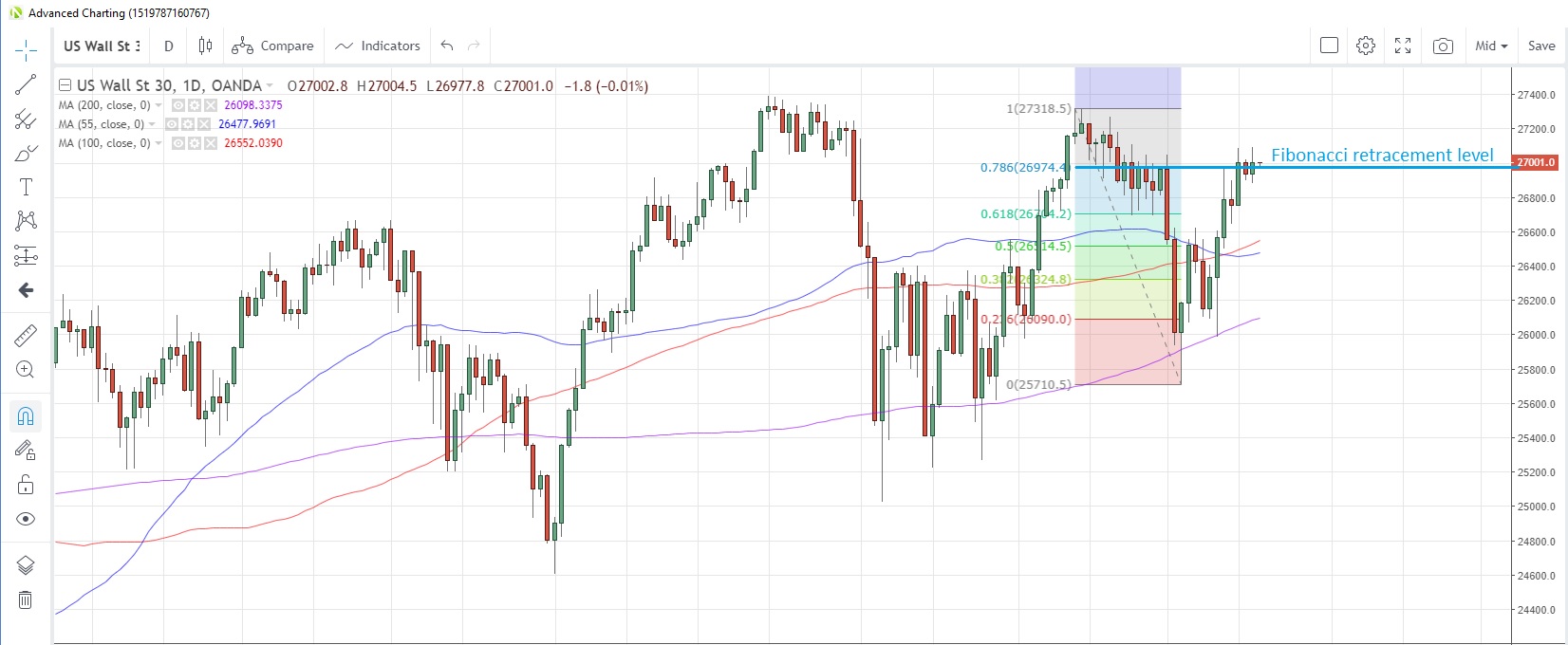

US30USD Daily Chart

The US30 index reversed early losses to finish higher yesterday as banks’ earning continue to meet or beat expectations

The index has been pivoting around the 78.6% Fibonacci retracement of the drop from September 12 to October 3 at 26,974. The 100-day moving average has risen to 26,552

It’s an almost barren US data/events slate today with speeches from Fed’s George, Kaplan and Clarida the only items on tap.

DE30EUR Daily Chart

The Germany30 index spiked to a 14-1/2 month high on the Brexit deal news but gave back those gains to close in the red for the first time in seven days as the difficulties facing British PM Johnson in getting it passed by Parliament became apparent

The index failed to get past the July 2018 high of 12,890. A possible candlestick Doji pattern may be forming, which would require a lower close today to be confirmed

The only major data point today is the Euro-zone’s current account balance for August, which is expected to show a seasonally-adjusted widening of the surplus to €26.7b from €20.6b in July.

CN50USD Daily Chart

China shares hovered near 2-month highs yesterday as the market braces for third quarter growth numbers today

A better-than-forecast print could see the index challenge the 2018 high at 14,928

Surveys suggest the Chinese economy grew 6.1% y/y in the third quarter, a slower pace than Q2’s +6.2%. Forecasts range from +5.9% to +6.2%, according to a Bloomberg survey, and a sub-6% print would be bad for the index and risk appetite generally.