The no-brainer, can’t-miss trade of 2014 was supposed to be betting on higher interest rates. So how’s that working out for you? Apparently, not so good for Wall Street’s largest bond dealers that have seen their bearish trades against Treasury bonds go awry as interest rates fall. (See Bloomberg Bond)

Remember, bond yields and prices move in opposite directions. Contrary to consensus expectations, rates have actually fallen this year, with the 10-year Treasury yield dropping to about 2.7% from 3% at the start of 2014. I’m reminded of one of the maxims of the renowned Merrill Lynch analyst Bob Farrell: “When all the experts and forecasts agree — something else is going to happen.”

MarketWatch reports that a full 100% of economists surveyed think yields will rise within six months. And investors continue to be inundated with articles about how to prepare for higher interest rates.

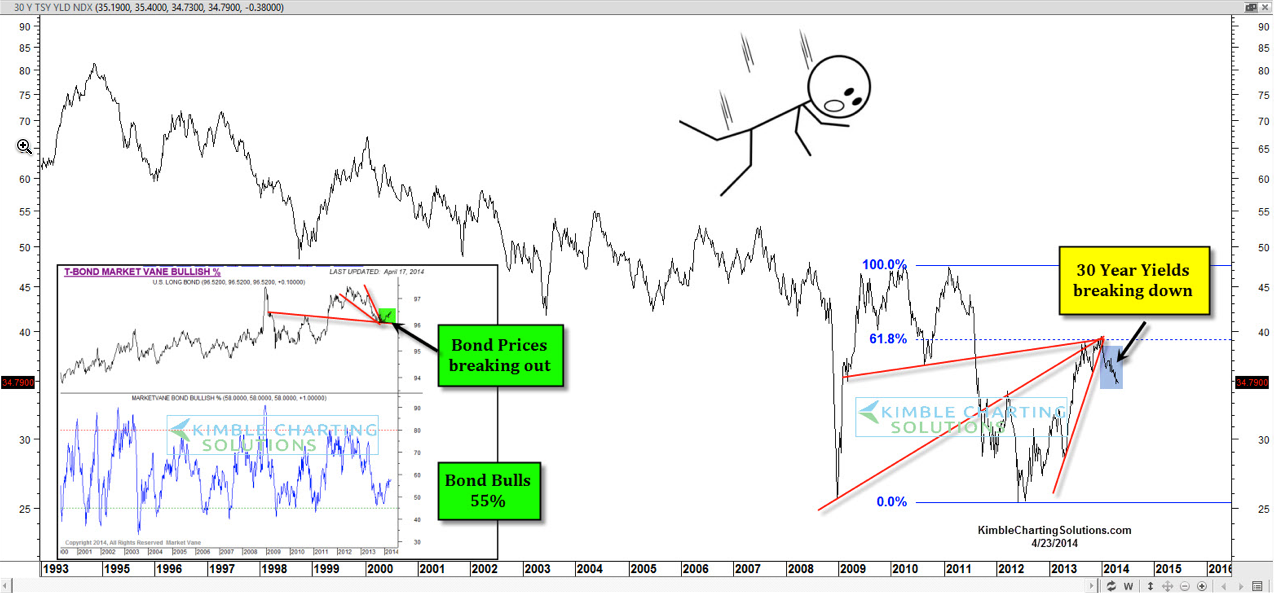

Of course, rates did rise last year, but the reality is that the 10-year Treasury yield has been stuck below 3% since the middle of 2011. Adding insult to injury, Treasury yields are falling in 2014 even though the Federal Reserve is tapering its bond purchases. It seems the 30-plus year bull market in U.S. government debt isn’t going to give up without a fight. And believe it or not, there signs that yields may be headed even lower, meaning that Treasury bond prices could rise.

Meanwhile, the number of bond bulls is near a multiyear low, so a further rally in Treasury prices would likely catch many investors by surprise. Many market “pundits” have been predicting that rates have to rise at some point after the financial crisis.

But so far, the bond market hasn’t gotten the memo.

The no-brainer, can’t-miss trade of 2014 was supposed to be betting on higher interest rates. So how’s that working out for you? Apparently, not so good for Wall Street’s largest bond dealers that have seen their bearish trades against Treasury bonds go awry as interest rates fall. (See Bloomberg Bond)

Remember, bond yields and prices move in opposite directions. Contrary to consensus expectations, rates have actually fallen this year, with the 10-year Treasury yield dropping to about 2.7% from 3% at the start of 2014. I’m reminded of one of the maxims of the renowned Merrill Lynch analyst Bob Farrell: “When all the experts and forecasts agree — something else is going to happen.”

MarketWatch reports that a full 100% of economists surveyed think yields will rise within six months. And investors continue to be inundated with articles about how to prepare for higher interest rates.

Of course, rates did rise last year, but the reality is that the 10-year Treasury yield has been stuck below 3% since the middle of 2011. Adding insult to injury, Treasury yields are falling in 2014 even though the Federal Reserve is tapering its bond purchases. It seems the 30-plus year bull market in U.S. government debt isn’t going to give up without a fight. And believe it or not, there signs that yields may be headed even lower, meaning that Treasury bond prices could rise.

Meanwhile, the number of bond bulls is near a multiyear low, so a further rally in Treasury prices would likely catch many investors by surprise. Many market “pundits” have been predicting that rates have to rise at some point after the financial crisis. But so far, the bond market hasn’t gotten the memo.