US indices slumped for a second straight day yesterday amid fears of an escalation of virus cases outside of China. US Treasury yields hit record lows on flight to safety. The US’ Centers for Disease Control and Prevention is preparing contingencies, even if President Donald Trump says the virus doesn’t post a threat. A report showed global trade contracted last year for the first time since 2009.

US30USD Daily Chart

The US30 index gave up a positive start to close lower again yesterday. Total losses over the last two weeks are now just under 10%, a level which technically would suggest a shift to a bear market

The index closed below the 200-day moving average at 27,285 for the first time since August 14

New home sales probably rose 3.5% m/m in January, according to the latest survey of economists, a turnaround from December’s 0.4% drop.

DE30EUR Daily Chart

The Germany30 extended the recent decline to a fourth day yesterday as more companies warned that CoVid-19 would impact Q1 numbers

The index tested and closed below the 200-day average at 12,636 for the first time since August 23

Germany’s Q4 GDP growth was unchanged from preliminary estimates at 0% q/q and +0.3% y/y. There are no major data releases scheduled for today.

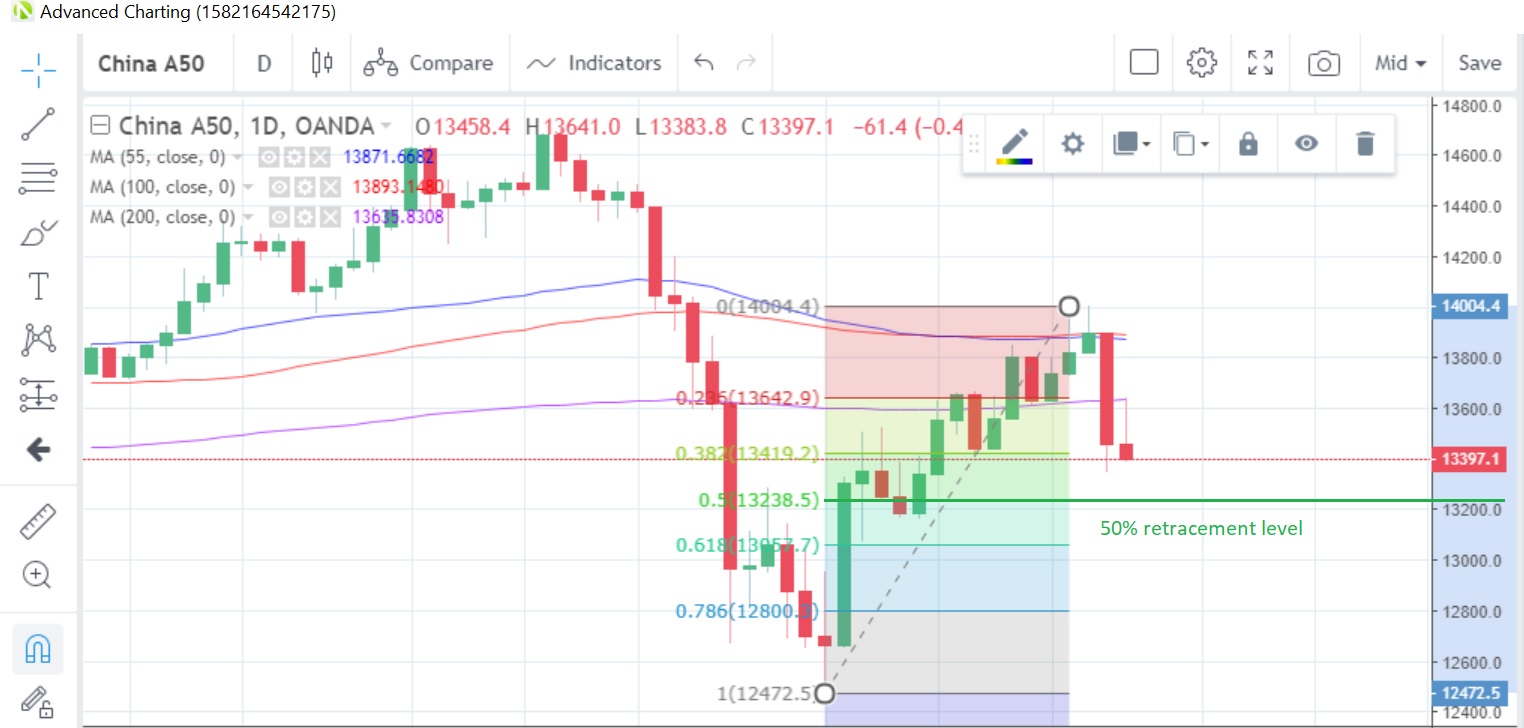

CN50USD Daily Chart

The China A50 index fell for a second consecutive day yesterday, dropping to a more than two-week low

The 50% retracement of the February 3 to February 20 rally is at 13,239

A number of China provinces have started to reduce their virus alert levels as the number of new cases stabilizes and recovery rates improve. Jiangsu province is the latest one.