Hopes that the China stimulus measures will be enough to shore up the China economy lifted most US indices to new highs, while FOMC minutes suggested the Fed’s wait-and-see policy remained intact. The Australian jobs data for January came in stronger than expected.

US30USD Daily Chart

The US30 index rebounded yesterday and is looking to extend those gains into today after Fed minutes mentioned that the distribution of risks to the outlook were more favourable than previously

The 55-day moving average has risen to at 28,773 while the 100-day moving average is at 28,090

The Philadelphia Fed manufacturing survey is expected to fall to 12 in February from 17 last month.

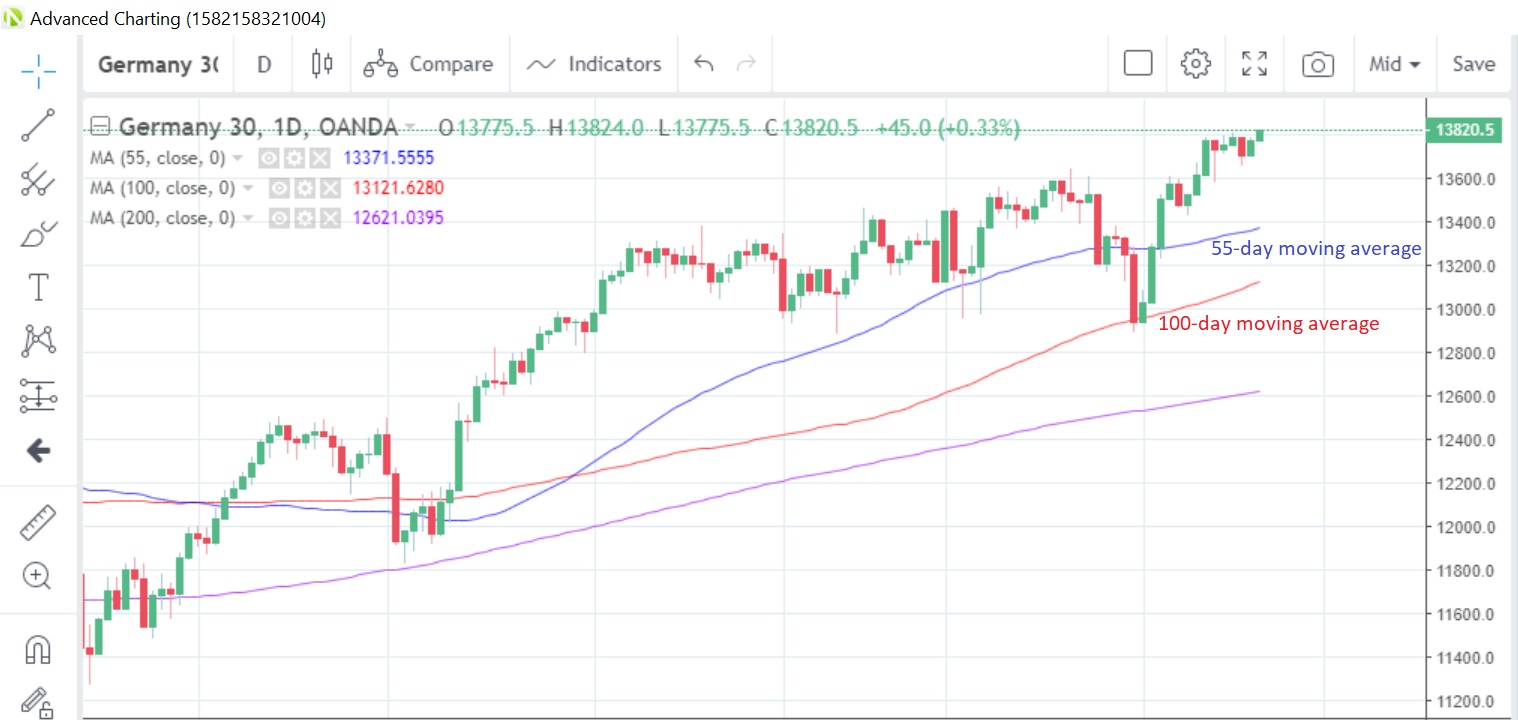

DE30EUR Daily Chart

The Germany30 index has climbed to the highest level on record since 2003, boosted by Wall Street’s advance and comments from the German finance minister that there are no signs of the German economy slipping into recession and maintained the 2020 GDP growth forecast st 1.1%

The index remains above the 55-day moving average at 13,371 while the 100-day average provides longer-term support below at 13,122

Germany’s Gfk consumer confidence index for March is seen little changed at 9.8 from 9.9 this month, according to the latest survey of economists. ECB’s De Guindos is scheduled to speak.

CN50USD Daily Chart

The China50 index rose yesterday, buoyed by the belief that the China stimulus measures announced last weekend will be enough to support the economy during the CoVid-19 period

The index is holding above the 200-day moving average at 13,620 while the 55- and 100-day moving average offer technical resistance at 13,877 and 13,886, repectively

We are still awaiting the release of the January new loans data, which are expected to show 3.0 trillion yuan of loans granted. That’s an acceleration from December’s 1.14 trillion yuan and echoes the numbers from last year, where loans were boosted at the start of the year.