Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- Everyone Loves the U.S. Dollar

- Euro Falls to Fresh 14-Month Lows

- GBP: Carney Signals Rate Rise in Spring 2015

- Commodity Currencies Drop to Fresh Lows

- USD/CAD Breaks through 1.10

- NZD: Beware of Increased Caution from RBNZ

- USD/JPY Hits Highest Level Since 2008

Everyone Loves the U.S. Dollar

The market's voracious appetite for U.S. dollars drove the greenback to fresh highs against most of the major currencies. USD/JPY rose to its strongest level in 6 years while EUR/USD dropped to a fresh 14-month low. Although euro ended the day in positive territory (more on that in the next section), the outperformance of the dollar is undeniable. The rise in Treasury yields and decline in U.S. stocks confirm that investors are pricing in tighter monetary policy from the Federal Reserve. This does not mean that the market expects the Fed to raise rates soon but ending Quantitative Easing in October is a move to unwind and not increase stimulus. In contrast, more easing is still expected from the Eurozone and Japan while political uncertainty in the U.K. has made sterling a very unattractive investment. Meanwhile weaker economic data out of Canada, Australia and New Zealand only highlights the economic and, in some cases, monetary policy superiority of the U.S. dollar, making it even more attractive to foreign investors. Everyone loves the dollar right now and we think this sentiment will be sustained going into Friday's retail sales report. Based on the uptick in spending reported by the International Council of Shopping Centers and Johnson Redbook, the U.S. retail number will see everyone forget about last week's softer non-farm payrolls report if they haven't done so already. Meanwhile, Fed President Tarullo did not touch on the economy or monetary policy Tuesday and no major U.S. economic reports are scheduled for release on Wednesday. That means traders should keep an eye on U.S. rates, which contributed to the rise in the greenback Tuesday.

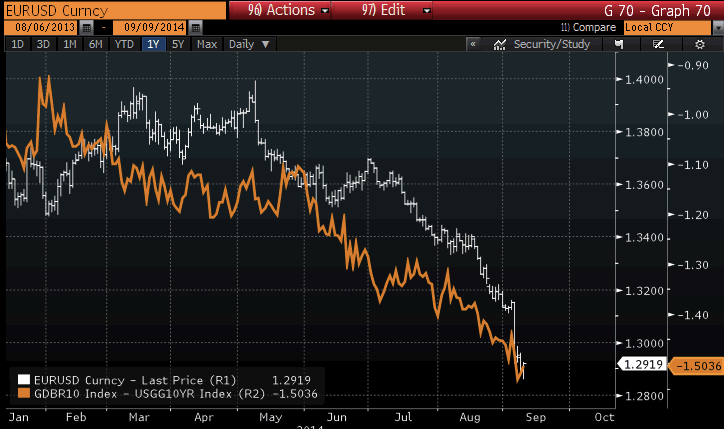

Euro Falls to Fresh 14-Month Lows

The euro dropped to a fresh 14-month low against the U.S. dollar before it rebounded to end the day in positive territory. No major Eurozone economic reports were released Tuesday and the only piece of data -- the French trade balance -- narrowed marginally in July. ECB member Liikanen spoke earlier Tuesday morning and according to his speech, the size of the ABS program has not been determined. While this may be true, we believe that it will be an ambitious package. The EUR/USD may be deeply oversold but the move in Eurozone rates are the main reason why EUR/USD rebounded on a day when the greenback was trading higher against all other major currencies. Ten-year Treasury yields extended their gains but the 2.3bp increase was smaller than the 6.3bp rise in French yields and the 4.4bp increase in German yields of the same tenure. As indicated in the chart below, the spread between German and U.S. rates dictated the trend for EUR/USD since the beginning of the year. So while U.S. rates are up, the larger increase in Eurozone rates helped to stabilize the currency. The question everyone is wondering now is whether the euro is still headed lower and we think that it is likely. Therefore we continue to look at bounces in the currency pair as an opportunity to sell at higher levels.

GBP: Carney Signals Rate Rise in Spring 2015

Stronger-than-expected economic data and hawkish comments from Bank of England failed to provide much support to the British pound. Sterling fell to fresh 10-month lows against the U.S. dollar erasing all of its earlier gains. The uncertainty surrounding the referendum continues to overshadow economic and monetary policy direction, which is the way it should be because if Scotland secedes, the uncertainty that it creates for the U.K. economy and the volatility it is bound to trigger greater volatility in U.K. assets that could delay the central bank's plans for tightening. BoE Governor Carney was surprisingly clear when he said that rates will rise by Spring of 2015. There was zero ambiguity in his comments or room for interpretation. The head of the U.K. central bank believes that the recovery has exceeded expectations and with the economy expected to improve and real wage growth expected to rise in the coming quarters, a rate hike will become necessary. While no one expected a rate rise this year, there was very little clarity on exactly when rates would increase in 2015. Most were looking for the spring or summer of next year depending upon how optimistic they were about the U.K. economy but Tuesday's comments from Carney takes the guessing away. Although the central bank could still change its mind, it is committed to raising rates, which is extremely positive for sterling but only if the "No" votes win. There are 7 more trading days to go before the September-18 referendum and in the meantime, we expect GBP/USD to remain under pressure and poised for a test of 1.60.

Commodity Currencies Drop to Fresh Lows

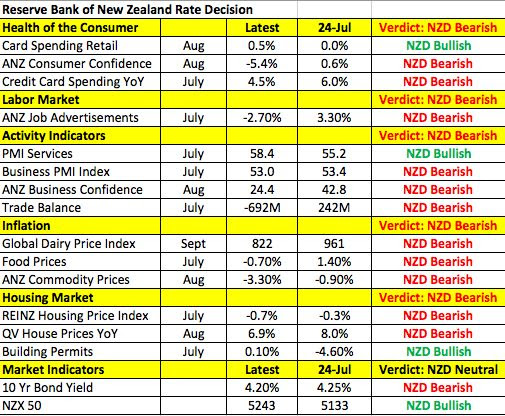

The commodity currencies fell to fresh multi-month lows against the U.S. dollar as investors continued to pile into the greenback. The New Zealand dollar hit a 7-month low, the Australian dollar a 5-month low and the Canadian dollar a 4-month low. Unfortunately Aussie remains the worst performing currency as softer data compounds the weakness. Monday night we learned that businesses grew less confident about current and future economic conditions in August. Although this comes off lofty levels in July, the weaker business survey data is consistent with the decline in Australian imports. Home loans also grew at a slower pace while investment lending increased. Consumer confidence was scheduled for release Tuesday evening and if it surprises to the downside, AUD/USD could hit 0.9150. Meanwhile USD/CAD broke through 1.10 on the back of softer housing market data. Housing starts rose 192.4k compared to 199.8k the previous month. While this is not the most market-moving piece of data for Canada, it reinforces the underperformance of Canada's economy and the strong possibility that the Bank of Canada will lag the Fed in tightening monetary policy. Finally, the Reserve Bank of New Zealand is scheduled to meet on Wednesday afternoon, Thursday morning local time. There's no question that interest rates will remain unchanged but taking a look at the following table illustrating how New Zealand's economy changed since the last monetary policy meeting in July, they have every reason to grow less hawkish and confirm that rates will be left at current levels for the rest of the year. After raising rates in July, the central bank said "it is prudent that there now be a period of assessment before interest rates adjust further towards a more neutral level." At the time, the decision to pause sent the New Zealand dollar to its lowest level in nearly 6 weeks versus the U.S. dollar and should this sentiment be reinforced on Wednesday afternoon, the currency pair could fall to fresh lows.

USD/JPY Hits Highest Level Since 2008

The prospect of higher rates in the U.S. and lower rates in Japan drove USD/JPY to its strongest level since September 2008. In the past 30 days, the currency pair climbed from a low of 101.50 to a high of 106.48. On both a percentage (approximately 5%) and pip (about 500 pips) basis, this is a very strong move for the currency pair -- we only see moves of this magnitude once or twice a year. However what makes the rally interesting is the lack of participation in other yen crosses. Of course this is due to the strength of the dollar and the pressure that it has put on the base currency such as the euro, British pound and Australian dollar. While Bank of Japan Governor Kuroda expressed confidence in his economy, there's been a lot of talk that the central bank will need to ease further. According to Abe Adviser Honda, the possibility is high that weakening economic activity could require further stimulus. Goldman Sachs (NYSE:GS) is calling for an extension of the current QQE program in October and is looking for further depreciation in the Yen. We agree that USD/JPY is headed higher but we do not see the BoJ increasing stimulus until next year at the earliest. In the meantime, the case for easing continues to grow with consumer confidence falling in August and machine tool orders growth slowing. Producer prices and machine orders were scheduled for release Tuesday evening.