Lies and rumors spread quickly.

They get halfway around the world before the truth has a chance to get its pants on, said Winston Churchill.

Sometimes, though, the truth doesn’t even get out of bed. And the uncontested lie becomes gospel truth. It’s never questioned. Just accepted.

There’s no better example of this on Wall Street than the oft-repeated mantra, “Higher risk equals higher return.”

It’s total hogwash.

Like I do every Monday, it’s time to bust this myth just like all the rest. So let’s get to it…

Embrace The Counterintuitive

The first concept we’re taught when investing is that by taking higher risk, we should expect to receive higher returns.

At some point, a financial professional probably thrust a graphic in front of your face to prove it, too.

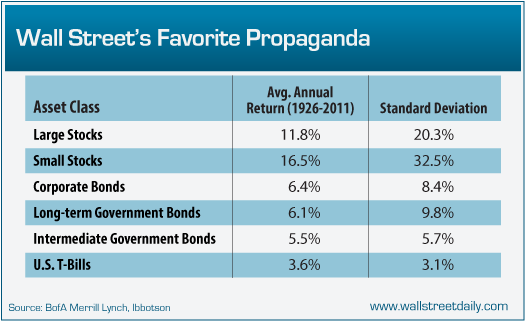

Like this one, which shows historical annual returns by asset class in the first column. And then historical standard deviations for each asset class in the second column.

The problem? Standard deviation isn’t the appropriate way to measure risk for investors.

When we invest, we do so to beat the market. But standard deviation doesn’t measure the risk of an asset relative to the market. It simply measures the volatility of prices for that asset relative to itself. The higher and lower the price swings, the higher the standard deviation.

The appropriate way to measure risk, relative to the market, is with beta.

Beta measures the fluctuation of an asset’s price in relation to the market. Or in finance terms, it measures systematic risk (i.e. the risk inherent to the entire market).

A beta greater than one means the asset is more volatile/risky than the market. And a beta lower than one means the asset is less risky than the market.

So if the investing mantra is true (and greater risk really equals a better return), then stocks with a higher beta should produce bigger profits. Right?

Guess what? They don’t.

Re-Assessing Risk

As Societe Generale’s Dylan Grice notes, “High risk doesn’t always equal higher return.”

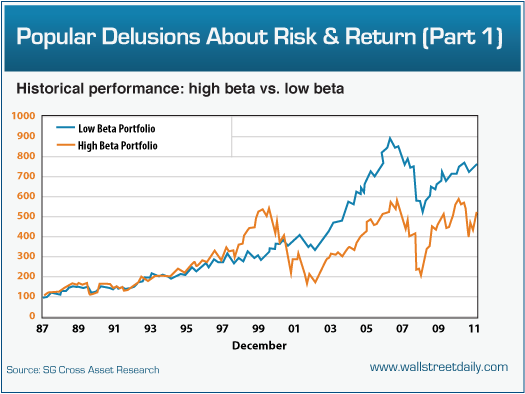

Truth is, low beta portfolios historically outperform high beta portfolios. Take a look:

Grice isn’t alone in his observations, either.

David Cowan and Sam Wilderman of investment management juggernaut, GMO LLC, have come to a similar conclusion:

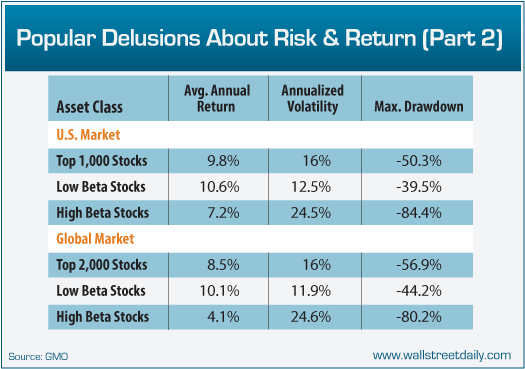

Both academics and practitioners have noted [that] portfolios of low beta stocks have historically matched or beaten broader equity market returns, and have done so with significantly lower volatility. At the same time, high beta stocks have significantly underperformed, exhibiting lower returns while appearing to take much more risk.

And they’re not simply regurgitating the observations of others. They conducted their own analysis that shows how low beta stocks outperform high beta stocks. In the United States and on a global basis. Take a look:

Moreover, they found that low beta portfolios have smaller maximum drawdowns. That means prices fall much less from peak to trough. That’s certainly relevant, since nobody wants to own an investment prone to massive price drops.

How could this be possible? I mean, the notion that higher risk equals higher return is a cornerstone of investing. Turns out, we can actually blame the cause on the myth itself.

As Grice explains, High risk offers high excitement, not high returns, because excitement is overvalued.

In other words, the myth entices many more people to invest in higher-risk stocks. The higher demand drives up prices -- and, in turn, drives down their profit potential.

Bottom line: As Jonathan Swift wrote in The Examiner on November 9, 1710: Falsehood flies, and the truth comes limping after it. And after years of limping, the truth about high risk and high return has finally caught up with the falsehood.

Despite what you’ve been told, high risk only equals higher risk. Not higher return.

Invest accordingly. And now that you know it, get busy spreading the truth!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Wall Street's Biggest -- And Most Harmful -- Lie

Published 11/05/2012, 02:40 PM

Updated 05/14/2017, 06:45 AM

Wall Street's Biggest -- And Most Harmful -- Lie

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.