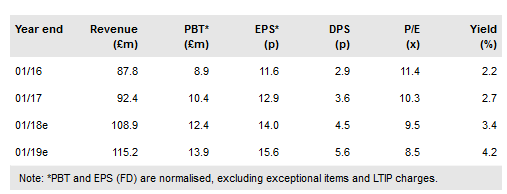

Walker Greenbank (LON:WGB): FY18 closed in line with management expectations showing good top-line progress overall despite some UK market variability. The latter appears to have affected sentiment – as reflected in single-digit prospective P/E multiples – but there are positive mix effects also that should not be overlooked. A rising dividend provides an additional attraction.

Progress evident, although UK weak at year end

As previously noted, some UK market variability was seen towards the end of FY18 but, in overall terms, both divisions made good y-o-y revenue and, we expect, profit progress. In constant currency, international Brands sales grew (+1.6% organic, +18.9% including Clarke & Clarke) and favourable FX effects boosted this progress in sterling terms. Clarke & Clarke’s positive full year contribution is underpinned by ongoing underlying growth while Licensing income (+21.2% y-o-y) continues to develop and contribute usefully to profitability. Manufacturing has recovered well from a flood-affected prior year and the fire-affected line at Anstey is in the process of being restored to operation. Underlying conditions for the important premium UK Brands activities remain difficult to read and Q4’s trading softness is reflected in 6.1% lower segment revenue for the year as a whole.

To read the entire report Please click on the pdf File Below: