Positive steps have been taken in the UK and US that will benefit Walker Greenbank (LON:WGB) in future periods and although the domestic market remains challenging, management’s full year expectations are unchanged. The upcoming strategic update may bring the prospects for re-building earnings and associated valuation metrics into sharper focus for investors.

UK market soft, international improving

H120 revenue looks to have been at a broadly similar level to the prior year on a reported basis. Core UK sales are still tracking below prior year levels in both Brands (products -3.1%) and Manufacturing (Edison estimates UK third-party sales down c 10%). In the former case, this represents the net effect of lower heritage brand sales partly offset by growth at Clarke & Clarke and in ancillary lines and the overall rate of decline is lower than seen in FY19 as a whole. There has been progress in international markets for manufactured products (sales +17.2%) though LFL Brands export turnover was modestly down. US channel disruption makes the underlying trend here difficult to interpret but migrating distribution arrangements to Kravet Inc (announced 1 July) should result in improved momentum in that market. Lastly, non-apparel licence income is growing with existing licensees, though of course the significant apparel licence income seen in FY19 will not recur this year.

Cost reduction, cash control and strategy update

Management maintained existing full year expectations though no specific comments were made on H120 profitability. Consolidating Clarke & Clarke infrastructure with Style Library/heritage Brands is substantially complete and accounts for the majority of an anticipated £2m annualised cost savings, £1m of which is set to accrue in the current year underpinning our existing estimates, which are unchanged. End July net cash is likely to be similar to, and possibly slightly better than, the year end £0.4m. This provides a flexible backdrop for the expected strategic update from new management accompanying the interim results announcement in October.

Valuation: Single-digit rating on trough earnings

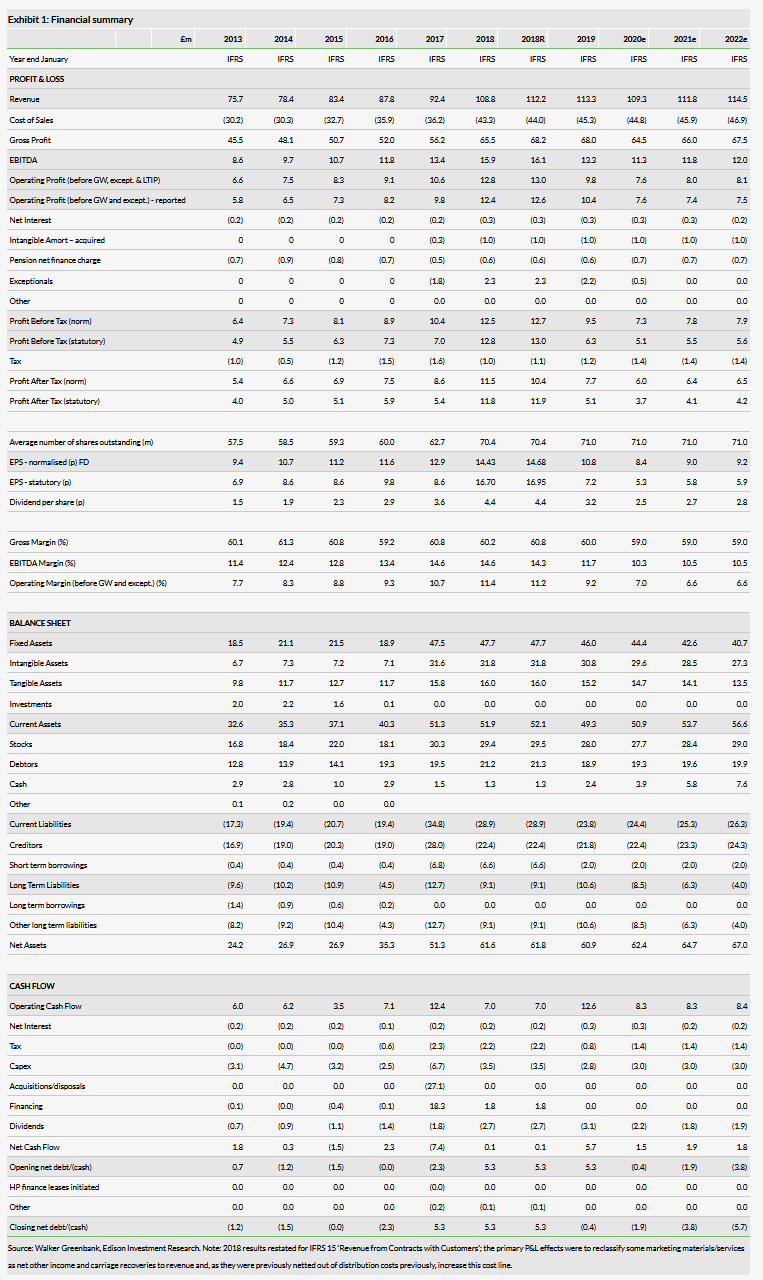

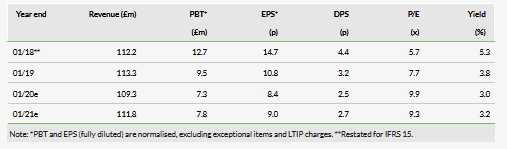

After a dip following the February trading update, Walker Greenbank’s share price has regained levels seen earlier in the year. However, some of the recent gains have been given up in the last week and the company’s rating remains in single digits for this year (ie P/E 9.7x and EV/EBITDA, adjusted for pensions cash of 6.1x) on what we believe might be trough earnings.

Business description

Walker Greenbank is a luxury interior furnishings group combining specialist design skills with high-quality upstream UK manufacturing facilities. Leading brands include Harlequin, Sanderson, Morris & Co, Scion, Anthology, Zoffany and Clarke & Clarke. FY18 revenue was split UK 58%, international 39% and licence income 3%.