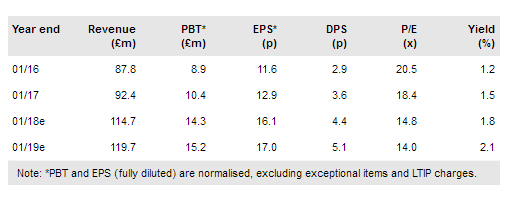

Our estimates show a good step forward in expected FY18 earnings for Walker Greenbank (LON:WGB) and H117 pre-close statement comments are consistent with this. Underlying progress is being supplemented by acquisition and positive translation effects against the prior year. The rating has risen following recent share price moves but a premium rating is fully justified in our view.

Mostly positive trading trends noted

Most of Walker Greenbank’s identified market segments will show a positive like-for-like performance against the prior year in H117. Manufacturing activities are naturally showing regained momentum after disruption at the end of FY15 and the beginning of FY16, and Brands’ international and licensing revenues are also running ahead of the prior year, boosted by a currency tailwind. Brands’ UK revenues have seen a small dip at the period end (ie -1.8% like-for-like in the first half, having been flat for the first four and half months’ trading), reflecting, we believe, some consumer and leisure sector uncertainty in the immediate aftermath of the election. That said, this will be more than compensated for by the inclusion of Clarke & Clarke’s maiden H1 contribution in the order of £10m revenue with EBIT margins at least in line with the divisional average. No profit guidance was given in the update though a tail of loss of profits insurance contribution will feature for the final time.

To read the entire report Please click on the pdf File Below: