Anyone who’s been in Elliott Wave analysis long enough has noticed how often some external factor “makes the price move” in the direction the analysis had identified much earlier. We’ve seen it happening in crypto, we’ve seen in happening in stock indices. Now, it happened with Walgreens stock.

Walgreens (NASDAQ:WBA) jumped on November 5th after CNBC reported the company was exploring a go-private deal. The rumor turned out to be true on November 11th, when the drug-store chain was officially approached by private equity firm KKR (NYSE:KKR).

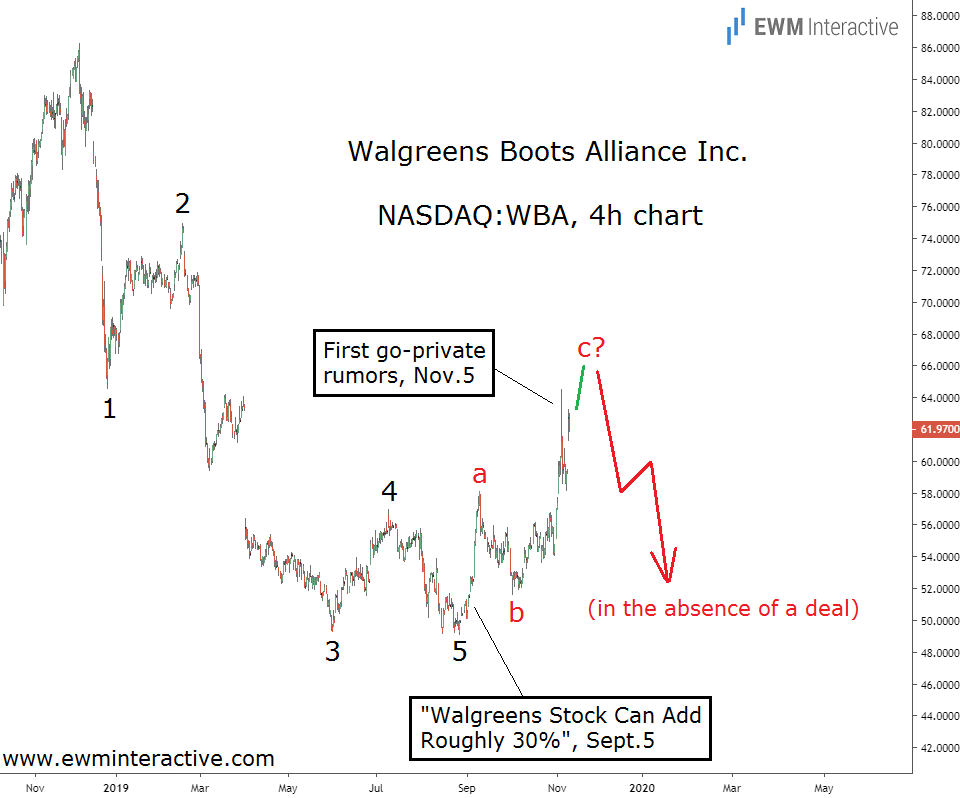

Walgreens was down to a multi-year low of $49.03 in late-August but spiked to $64.50 after the rumor first came out. What is more interesting is the fact that there was a bullish Elliott Wave setup in place two months earlier. Take a look at it below.

This chart was published on September 5th in an article titled “Walgreens Stock Can Add Roughly 30%.” It revealed that the decline between $86 and $49 was a complete five-wave impulse pattern. To every Elliott Wave analyst this meant that a move in the opposite direction can be expected.

Elliott Wave Analysis ahead of the Walgreens Buyout Rumor

The anticipated rally had to be of respectable size in relation to the preceding impulse. So, we thought “we can expect a notable recovery to roughly $65 a share for a total gain of nearly 30%.” In addition, there was a strong bullish MACD divergence supporting the positive outlook.

The next chart shows Walgreens stock as it is today, over two months after the September 5th analysis.

One, KKR takes Walgreens private at a price not much higher than the current market price. And two, the companies fail to reach a deal and Walgreens remains a public entity. That second possibility is probably keeping arbitrageurs up at night.

If a deal is not reached, WBA stock will be at the mercy of pure market forces again. The problem is that with a complete bearish 5-3 wave cycle already in place, another selloff is going to be very likely. In other words, if KKR fails to pull off the largest leveraged buyout in history, Walgreens stock may revisit the sub-$50 area once more…