I screened my database of the best dividend growth stocks in order to find the next pick for the Dividend Yield Passive Income Portfolio. I thought it makes sense to look this time for lower yielding stocks with a high degree of safety.

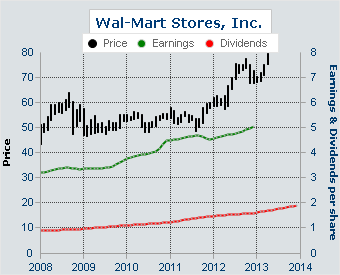

I found Wal-Mart (WMT) as attractive long-term opportunity. The current yield is at 2.37 percent and the P/E amounts to 15.79 while the forward P/E is at 13.48.

Wal-Mart Stores operates retail stores in various formats worldwide. The company operates in three segments: Walmart U.S., Walmart International, and Sam's Club. It operates retail stores, restaurants, discount stores, supermarkets, supercenters, hypermarkets, warehouse clubs, apparel stores, Sam's Clubs, neighborhood markets, and other small formats, as well as walmart.com; and samsclub.com. The company's stores offer meat, produce, deli, bakery, dairy, frozen foods, alcoholic and nonalcoholic beverages, and floral and dry grocery; health and beauty aids, baby products, household chemicals, paper goods, and pet supplies; and electronics, toys, cameras and supplies, photo processing services, cellular phones, cellular service plan contracts and prepaid service, movies, music, video games, and books.

WMT is still an American Tycoon. Still 78 percent of sales come from the Americans Countries. 17.33 percent of the revenue comes from the Asian Pacific Region.

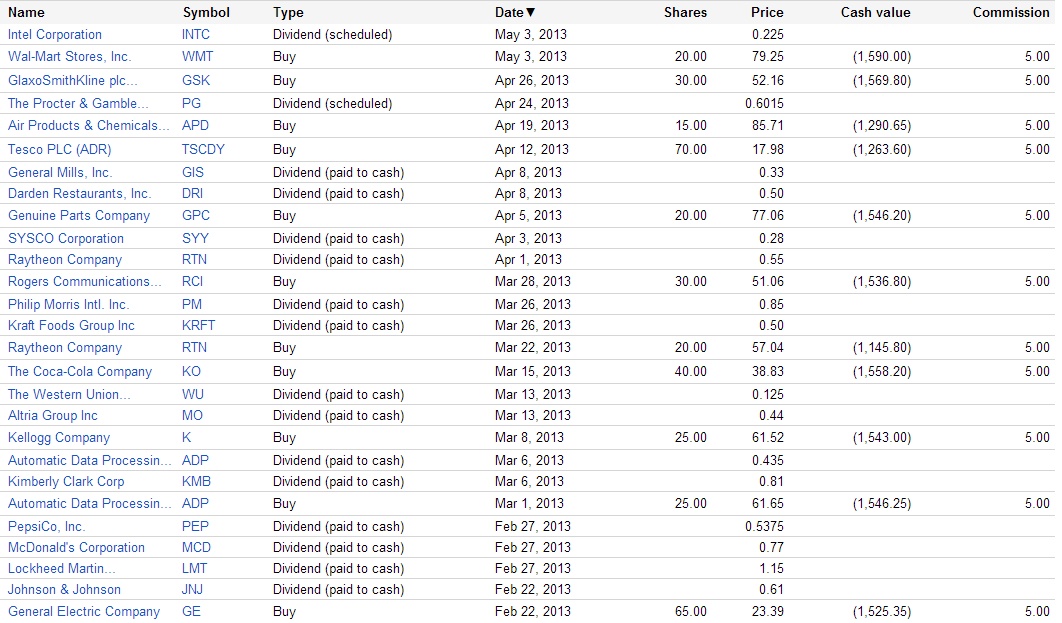

I bought 20 shares of the retail giant at 79.25. The company hit recently All-Time Highs. Normally I don’t like retail companies because of the low entry barriers. But Wal-Mart as the biggest player has definitely more values as discount operator than other competitors. But the competition doesn’t sleep. Target (TGT) and Costco (COST) are two good alternatives.

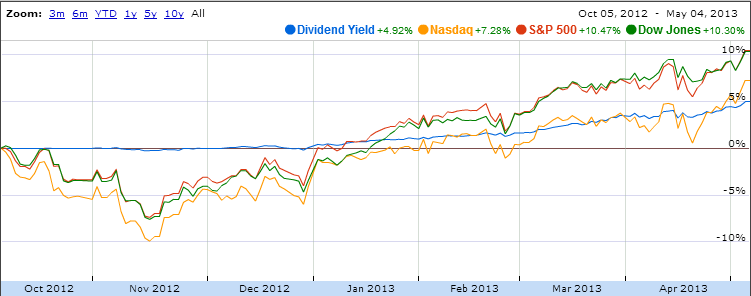

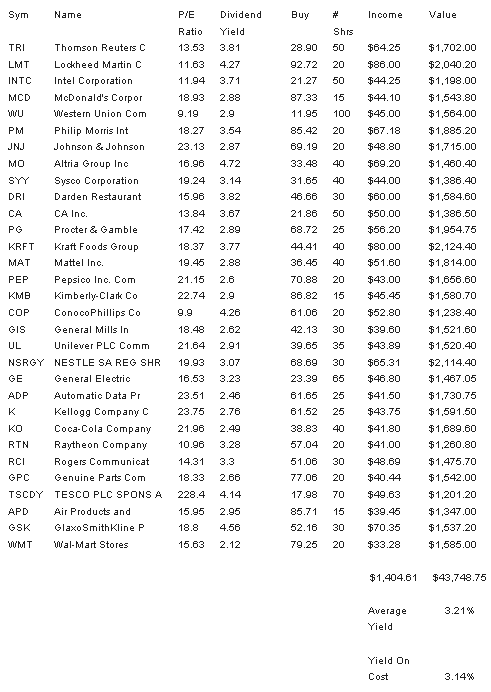

The total purchase amount was $1,590. The new position will give me additional $33.28 in dividend income. The full passive income of the portfolio is now estimated at $1.404.61. Exactly 31 stocks are now part of the long-term orientated income vehicle. The current performance of the dividend stocks is 10.13 percent. Because of the high cash amount (52.43 percent is still not invested), the full portfolio performance is only at 4.93 percent but has also a much lower volatility.

Here is the income perspective of the Dividend Yield Passive Income Portfolio:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Wal-Mart: Atttractive Long Term Opportunity

Published 05/06/2013, 01:34 AM

Updated 07/09/2023, 06:31 AM

Wal-Mart: Atttractive Long Term Opportunity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.