Wal-Mart Stores Inc. (NYSE:WMT) was upgraded by analysts at Vetr from a "hold" rating to a "buy" rating in a report issued on Monday, MarketBeat.com reports. The firm currently has a $74.70 target price on the retailer's stock. Vetr's target price would suggest a potential upside of 7.42% from the stock's previous close.

Other equities analysts also recently issued research reports about the stock. Jefferies Group set a $86.00 price objective on shares of Wal-Mart Stores and gave the stock a "buy" rating in a report on Tuesday, October 4th. Guggenheim initiated coverage on shares of Wal-Mart Stores in a report on Friday, September 30th. They issued a "buy" rating and a $82.00 price objective on the stock. KeyCorp set a $90.00 price objective on shares of Wal-Mart Stores and gave the stock a "buy" rating in a report on Friday, October 7th. Robert W. Baird set a $80.00 price objective on shares of Wal-Mart Stores and gave the stock a "buy" rating in a report on Friday, October 7th.

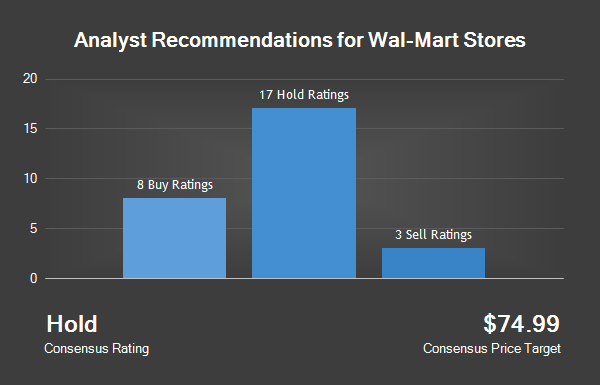

Finally, Barclays PLC set a $82.00 price objective on shares of Wal-Mart Stores and gave the stock a "buy" rating in a report on Monday, October 10th. Three equities research analysts have rated the stock with a sell rating, nineteen have assigned a hold rating and nine have given a buy rating to the company. Wal-Mart Stores presently has a consensus rating of "Hold" and a consensus price target of $75.09.

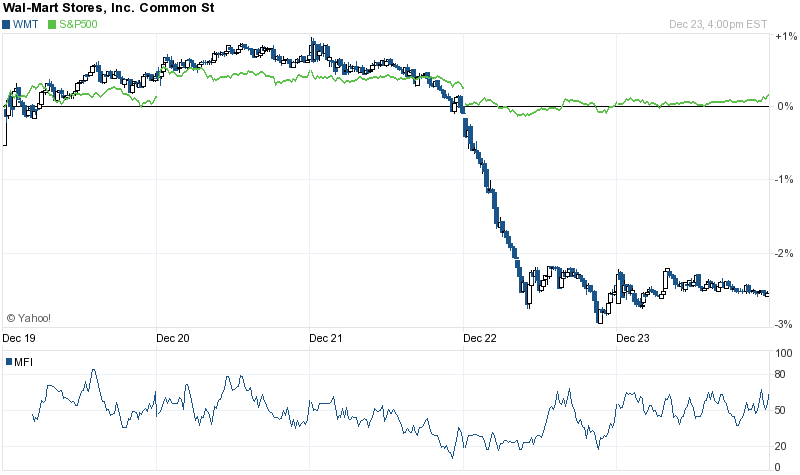

Wal-Mart Stores opened at 69.54 on Monday, MarketBeat.com reports. The company has a market cap of $213.71 billion, a price-to-earnings ratio of 15.08 and a beta of 0.11. Wal-Mart Stores has a one year low of $60.20 and a one year high of $75.19. The stock has a 50 day moving average of $70.62 and a 200-day moving average of $71.48.

Wal-Mart Stores last posted its quarterly earnings data on Thursday, November 17th. The retailer reported $0.98 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.96 by $0.02. The company had revenue of $118.20 billion for the quarter, compared to the consensus estimate of $118.69 billion. Wal-Mart Stores had a net margin of 2.98% and a return on equity of 17.71%. The firm's revenue was up .5% compared to the same quarter last year. During the same quarter last year, the firm posted $1.03 earnings per share. On average, equities analysts predict that Wal-Mart Stores will post $4.32 EPS for the current fiscal year.

In other Wal-Mart Stores news, CEO C Douglas Mcmillon sold 75,063 shares of the business's stock in a transaction dated Monday, November 21st. The shares were sold at an average price of $69.08, for a total value of $5,185,352.04. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 51.55% of the stock is currently owned by company insiders.

A number of institutional investors have recently made changes to their positions in WMT. Vigilant Capital Management LLC increased its position in shares of Wal-Mart Stores by 1,270.0% in the second quarter. Vigilant Capital Management LLC now owns 1,370 shares of the retailer's stock worth $100,000 after buying an additional 1,270 shares in the last quarter. Livingston Group Asset Management CO operating as Southport Capital Management purchased a new position in shares of Wal-Mart Stores during the second quarter worth approximately $100,000.

Itau Unibanco Holding S.A. purchased a new position in shares of Wal-Mart Stores during the third quarter worth approximately $104,000. Americafirst Capital Management LLC purchased a new position in shares of Wal-Mart Stores during the second quarter worth approximately $106,000. Finally, BKS Advisors LLC purchased a new position in shares of Wal-Mart Stores during the third quarter worth approximately $110,000. Institutional investors and hedge funds own 28.80% of the company's stock.

About Wal-Mart Stores

Wal-Mart Stores, Inc is engaged in the operation of retail, wholesale and other units in various formats around the world. The Company offers an assortment of merchandise and services at everyday low prices (EDLP). The Company operates through three segments: Walmart U.S., Walmart International and Sam's Club.