If last week had gone a little differently, we might have lost the euro.

Fortunately, free-market centrist Emmanuel Macron cinched the French presidential election, assuring the currency bloc’s safety (for now).

Of course, that doesn’t mean that everything is hunky-dory in the world’s financial markets... or even America’s financial markets.

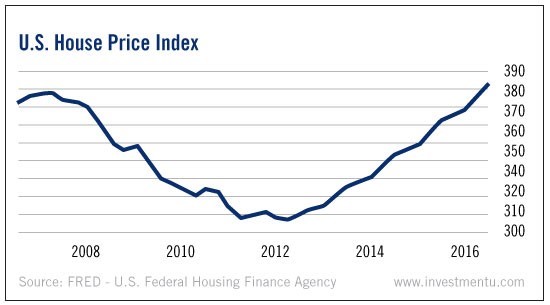

As we’ll see below, a critical report is due to be released by the government on Tuesday. If it doesn’t look good, investors could find themselves having some déjà vu... from 2008.

Housing Starts Press Release: Is Another Cooldown Coming?

This Tuesday, we’ll hear from the U.S. Census Bureau about one of the most important broad market indicators out there: housing starts.

Ordinarily, investors and real estate workers are excited to hear the April starts numbers. We’re getting into prime buying season in the States. But this year, the report may be cause for anxiety more than excitement. That’s because the housing market has been a little wobbly as of late, both abroad and at home.

You may have heard about how Canada is going through its own little 2008 crash. Moody’s recently downgraded the nation’s six biggest banks, as soaring housing prices (and mortgage debt) have concerned bondholders. Australia is similarly teetering - it has seen excessive growth in housing prices for the last five years.

The situation isn’t quite as dire back home... but it’s not great. Rents are starting to fall in formerly “hot” markets like New York and Dallas.

One thing that is clear is there is much weaker momentum now compared to six months ago, one year ago or even 18 months ago," says Lawrence Yun, an economist with the National Association of Realtors.

This housing market cooldown is even more concerning when you consider how little has changed in real estate pricing since 2008. As Oxford Club Financial Research Associate Brian Kehm recently wrote, rock-bottom interest rates have pushed the house price index back above precrisis levels.

Is the U.S. joining Canada and Australia in a new housing bubble? We’ll have to wait until Tuesday to see what the housing starts report adds to the picture.

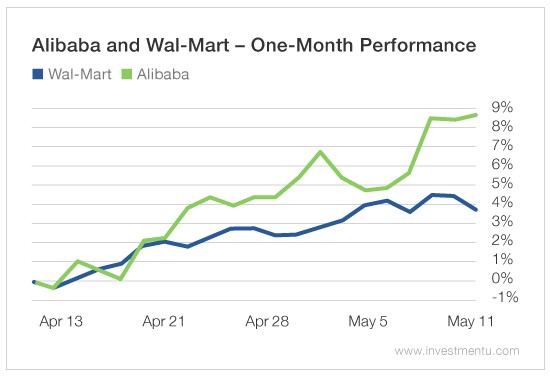

Big Earnings Reports: Wal-Mart (NYSE:WMT) and Alibaba (NYSE:BABA)

Wal-Mart is scheduled to report earnings on Thursday morning. Analysts expect the retail giant to post EPS of $0.96 for the quarter.

It will be joined by its Chinese e-commerce rival Alibaba the same morning. Wall Street is looking for EPS of $0.49 from Alibaba this quarter.

Both retailers have been trading upward over the last month.