Talking Points

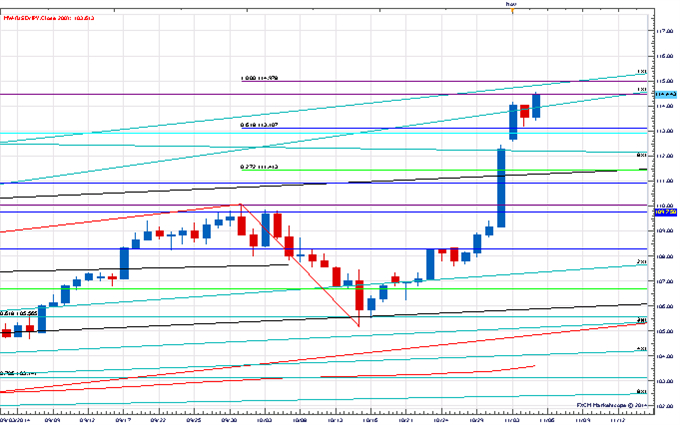

- USD/JPY closing in key extension level

- Crude nears important Fibonacci convergence zone

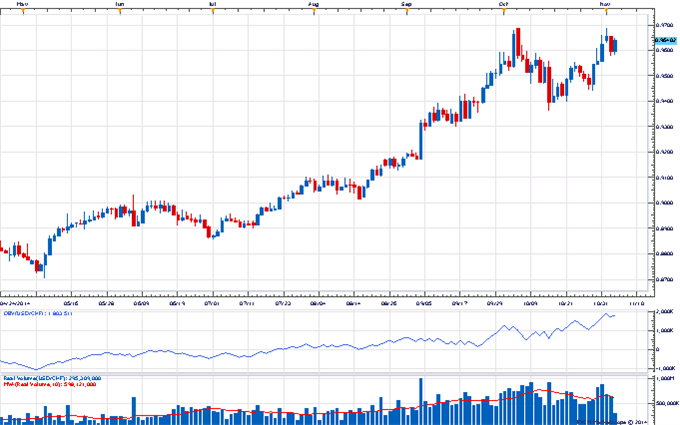

- Nagging divergence persists in USD/CHF

Foreign Exchange Price & Time at a Glance:

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY traded at its highest levels since December of 2007 earlier today

- Our near-term trend bias is higher in USD/JPY while above 113.15

- The 200% extension of the October decline near 115.00 in the next important resistance zone

- A minor turn window is seen early next week

- A daily close under 113.15 would turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while over 113.15.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

USD/JPY |

*113.15 |

113.75 |

114.45 |

114.45 |

*115.00 |

(NYSE:U.S. Oil)

Charts Created using Marketscope – Prepared by Kristian Kerr

- Crude Oil cracked the 2012 low yesterday to trade at its lowest level in three years

- Our near-term trend bias is lower in the commodity while below 82.80

- A convergence of the 50% retracement of the 2008-2011 advance and the 200% extension of the 1H14 range around 75.50/74.80 is the next major downside attraction/pivot

- An important turn window is eyed around the latter part of the month

- A close over 82.80 is needed to undermine the immediate negative tone in Crude

Crude Strategy: Like the short side while under 82.80

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

Crude |

*74.80 |

75.50 |

77.15 |

79.60 |

*82.80 |

The dollar is generally stronger this morning led once again by USD/JPY. There are signs that the latest push higher in the Greenback is becoming more broad based as Cable managed to eke out a new low for the year in early European trade. USD/CHF still remains a point of contention for us as we view the exchange rate in the same vein that Dow theorists view the Transports. USD/CHF printed a new high for the year this week, but only barely and failed to register a new closing high for 2014. We would like to see the exchange rate close over .9667 or break meaningfully above .9690 to negate this potential divergence with the euro and set the stage for a meaningful push higher in the USD into the end of the year. Cyclical analysis suggests that a failure to achieve a new high in USD/CHF over the next few sessions could delay meaningful gains in USD/Europe for several weeks.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com