Commodity Bulls were easy to find in April of 2011, as 70% of investors felt like Commodities were the place to be. Since then the PowerShares DB Commodity Index (ARCA:DBC) is down 20%. Did it pay to follow the crowd or go against it in 2011?

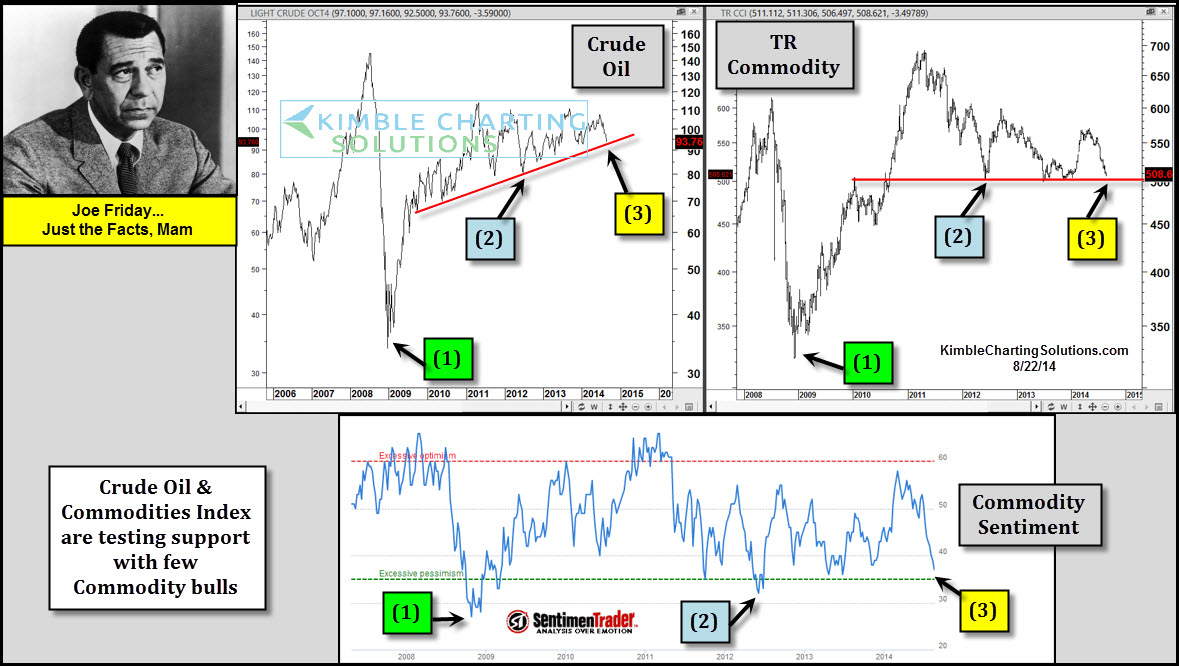

Investors feel a little bit different about commodities right now, as bullish sentiment at (3) has declined to 30% bulls.

Crude Oil (upper left chart) is testing a 5-year support line and the Thompson Reuters Commodity Index (upper right chart) is testing a 4-year support line at the same time.

It paid to go against the crowd in April of 2011. Will it pay to go against the crowd now at (3)?

Interest rates have been falling this year, as bond traders have not been concerned about too much global inflation or growth, as yields on the 10-Year and 30-Year bonds continue to fall this year. Are bonds telling us the truth about global inflation or a lack thereof?

From a global macro growth point of view, it would appear very important that commodities hold at these support lines.