Bullish commentators have been busy admonishing those who might be cautious. Their reasoning? Long-term investors should focus on signs that point to stable economic growth in the U.S., a recovery in China as well as unwavering stimulus by the Federal Reserve. Besides, with Treasuries offering more risk than reward, where else can you realize a worthwhile return on your money?

However, a number of Fed policymakers recently expressed reservations about the amount and the duration of the central bank’s bond-buying program. In other words, current monetary policy that artificially depresses interest rates may not continue indefinitely. Moreover, the idea that economic growth in the U.S. will demonstrate ongoing signs of stability and/or improvement discounts the high probability of a sequestration drag; indeed, automatic spending cuts are likely to hamper job growth, curb consumer spending and crimp investor confidence.

Between the finger-pointing in Washington and the release of the Fed minutes, the S&P 500 logged one of its worst performances of the year (-1.25%). At least in the immediate term, bulls and bears both appear to be growing more anxious about ownership of riskier assets.

Was this session merely a one-day bout of profit-taking? Or did the move to the downside represent a tipping point for future sell-offs? Here are 3 ETF indicators for evaluating the current investing environment.

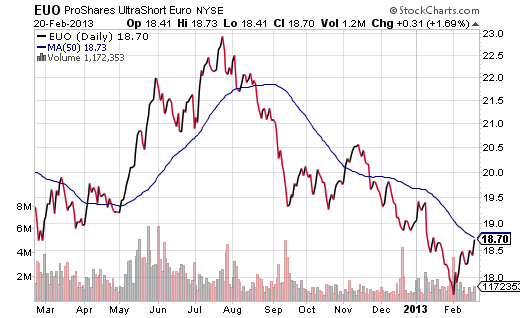

1. ProShares UltraShort Euro (EUO). Eager risk-takers have been climbing aboard the “Europe Express,” determining that central bank assurances to do whatever it takes to save the euro signaled an end to Europe’s debt crisis. I’m not so sure. Greeks are currently marching against austerity as I type, Spain’s recession is deepening and Italy’s upcoming election could upset the proverbial apple cart.

Equally worthy of note, the Fed may or may not scale back on its bond buying. That might bolster the greenback. Spain may find itself asking for a formal bailout, which would depress the euro.

As recently as the first day of February, the euro sat at 52-week highs, and EUO rested at 52-week lows. Today, EUO is on the verge of rising above a near-term trendline. The further EUO climbs, one might expect riskier stock assets to fall.

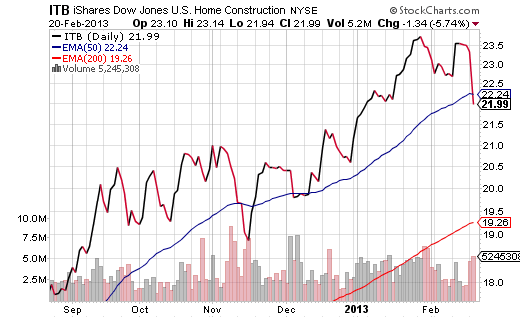

2. iShares DJ Home Construction (ITB). I experienced a bit of criticism for suggesting that it is a bad idea to buy any fund when its price is 22% above a 200-day moving average. Well, ITB has lost about 7% in value, so it’s not quite as overbought as it was when I last discussed the matter.

More critically, U.S. homebuilder confidence fell in February while actual housing starts dropped 8.5% in January. Equally disconcerting, the upcoming sequestration cuts may have an adverse effect on real estate, from Superstorm Sandy reconstruction endeavors to the processing of FHA-backed home loans.

Low mortgage rates and the real estate recovery story have fueled the stock market. If ITB continues to deteriorate below its 50-day trendline and struggle, a corrective phase for stock assets could take up residence.

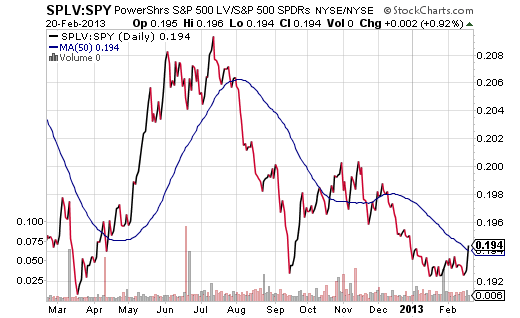

3. PowerShares S&P 500 Low Volatility (SPLV). One of the easiest mechanisms for tracking changes in relative strength is a price ratio. For example, when low volatility funds like SPLV are underperforming the S&P 500 market at large, the SPLV:SPY price ratio would decline. In 2012, market peaks occurred near April and early September… when the SPLV:SPY price ratio hit low points.

In contrast, when SPLV:SPY is rising, and when it climbs above key trendlines like the 50-day, risk aversion may be back in vogue. The higher this ratio climbs, the better non-cyclical sectors perform (e.g., staples, utilities, health care).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Waiting On A Market Correction? Watch These 3 ETFs Closely

Published 02/21/2013, 01:39 AM

Waiting On A Market Correction? Watch These 3 ETFs Closely

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.