As is often the case before the Federal Reserve announces its rate decision (Wednesday afternoon), currency market movements are limited at present. We should take this opportunity for a quick update on the EUR/USD pair.

The most recent economic indicators, including growth, inflation and jobs, have surprised with their strength. The EUR/USD pair, which had fallen from 1.1100 in November to 1.0350 in December, rallied sharply toward its 100-day moving average at 1.0800. The European Central Bank is continuing with its policy of quantitative easing (to keep the currency weak?), leading the new Trump administration this morning to accuse Germany of “using a grossly undervalued EUR to exploit the United States.” Is this the opening shot in a currency war? The issues for Europe will be important this year with elections in France and Germany as well as the situation in Greece, which is likely to resurface.

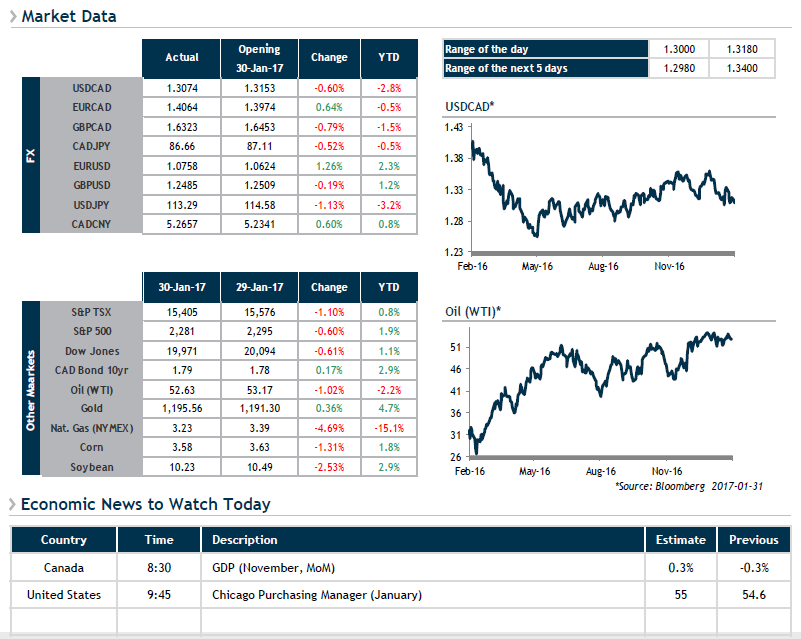

Closer to home, Canadian GDP growth for November will be announced this morning at 8:30. We are approaching 1.3000 again, which remains the level for buyers. Will we see Bank of Canada Governor Poloz tell us again that our dollar is too strong? Is a currency war in the cards here too?