Market movers today

Focus today will be on the ECB Forum at Sintra , where ECB President Mario Draghi will give an introductory speech at 10.00 CEST and also participate in a panel with the Bank of England's Mark Carney and former Fed vice chairman Stanley Fischer at 16.00 CEST, see the full programme for the forum here . We expect Draghi to strike a dovish tone at the conference.

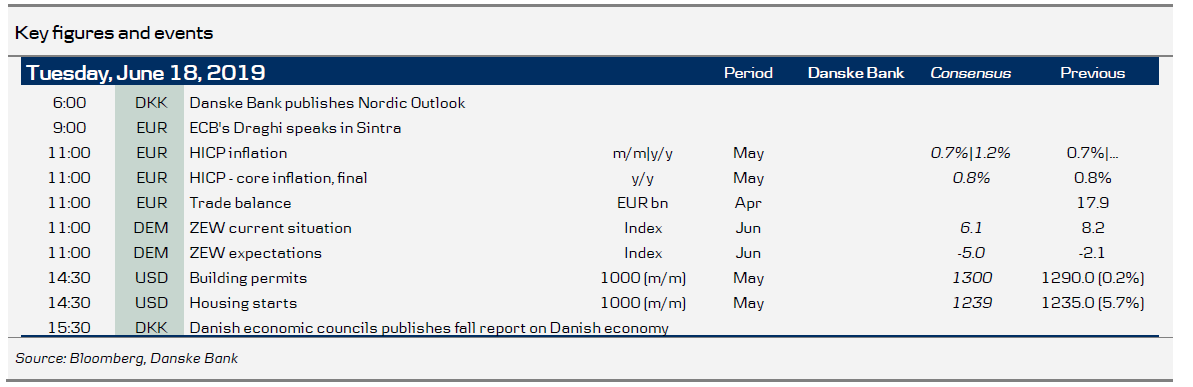

On the data front ,we have final Euro inflation for May and the German ZEW sentiment index for June. In the US, data on building permits and housing starts are due to be released. Housing should perform well following the sharp decline in mortgage rates and high consumer confidence.

We have just published our Nordic Outlook with updated economic forecasts and overviews for the Nordic countries. The Nordics have been resilient in general in the face of recent global weakness, with exports still supporting growth, but domestically, the Nordics are moving in different directions. We see very little domestic demand growth in Sweden and it is also slowing markedly in Finland. Norway, on the other hand, is supported by oil investments. The Danish economy is slowly decelerating with growth still above trend.

Selected market news

It was another miscellaneous and cautious trading session in Asian stock markets as they were in 'wait-and-see' mode ahead of decisions by the US Fed and other central banks. Today the Fed starts a two-day meeting. Both the USD and Treasuries remained steady, while the JPY headed up. Crude stayed lower on OPEC's inability to set the exact date for the next meeting on oil production cuts.

The AUD slid to a five-month low as the RBA's dovish minutes from the June meeting revealed that the central bank could ease further in order to boost inflation and wage growth. In June, the RBA already cut to 1.25% to keep the economy running.

New home prices in China climbed at the fastest pace in five months, increasing 0.7% m/m in May versus a 0.6% m/m rise in April, making it harder for the government to control bubbly housing markets. This rise marks the 49th month of consecutive increases. China has constantly pressed local governments to keep housing prices under control. However, the latest easing of credit conditions by the government has kept the housing market strong.

The US declared it will deploy 1,000 more troops to the Middle East for defensive purposes, emphasising concerns about a threat from Iran. The latest deployment is a new addition to the 1,500-troop build-up announced in May.

UK Finance Minister Philip Hammond is "prepared to resign" over Prime Minister Theresa May's legacy spending plans, as tension between officials at the Treasury and the prime minister's office have reached boiling point over May's spending intentions.

Fixed income markets

The global bond market is still in a kind of ‘wait-and-see’ mode ahead of the global central bank meetings this week. The first communication will be from Drahgi this morning. However, as Draghi is about to leave the ECB, we expect that his main message will be towards maintaining a stable environment until his successor takes over.

Yesterday, we published An auction preview on the Danish government bond auctions on Wednesday. We are closing our long position, where we bought 10Y DGBs versus 10Y Bunds.

FX markets

Two weeks ago, the market bought EUR/USD as Fed officials hinted rate cuts could be coming and the ECB revealed a reluctance to follow the Fed down the road of monetary easing. Today, Draghi will get a second chance to talk down the EUR when he speaks at Sintra. He will have to come up big, i.e. signal rate cuts and/or that QE is coming, to convince the market to sell EUR/USD before the Fed likely makes a dovish shift tomorrow. It is crunch time for the ECB and the Fed and we stick to our call for EUR/USD to rise to 1.15 in 3M (NYSE:MMM) as the Fed is set to ‘out-ease’ the ECB.

EUR/GBP is moving towards 0.90, in line with our expectations. Macro surprises continue to be slightly negative versus the euro area and the global backdrop likely favours a dose of dovishness from the BoE that the ECB will not match. A near-term key event will be how the ECB handles itself at Sintra. We think the bar for surprises is high and continue to expect the EUR leg to push EUR/GBP higher.

Leading indicators have been declining for over a year. US capacity utilisation has been falling since December. Commodities and inflation expectations have been falling since May. The net asset class behaviour and macro data are strongly telling us external conditions are too tight and need to be adjusted to avoid more gloomy outcomes. The most likely response is solidly placed with a change in Fed policy. The required adjustment of US real yields could easily take USD/JPY to 105, or lower, over 3M.

This becomes the second time the Fed has failed in keeping real yields above zero and is a direct result of Chinese deleveraging, a continued too tight policy stance, a negative shock from the ongoing trade war and fading US fiscal impulse. We expect EUR/JPY to remain broadly stable. Please, see more in our FX Strategy - USD/JPY - Accept defeat: 105 is easily within reach, 17 June.