Friday’s excitement over a mini trade deal was short lived as the President, the Secretary of the Treasury and the Government of China began to backpedal from the initial announcement. The pressure remains on the White House to come to a deal and the Chinese negotiators know this. Not only have the public polls for a House impeachment climbed into the majority, but the U.S. economic data continues to deteriorate. And with no trade deal or tariff relief in sight, there is still little reason for CEOs to spend on CapEx and increase hiring.

China trade talks will continue until a deal is done. While we wait, the upcoming calendar is a full one. Earnings start big this week led by the major banks. Then the EU Summit continues on the 17th to talk Brexit. There is an ECB meeting on the 24th, followed by the FOMC one on the 30th (expect another rate cut). And then on Halloween, the U.K. gets Brexit while the U.S. gets candy. Bring on the candy corn!

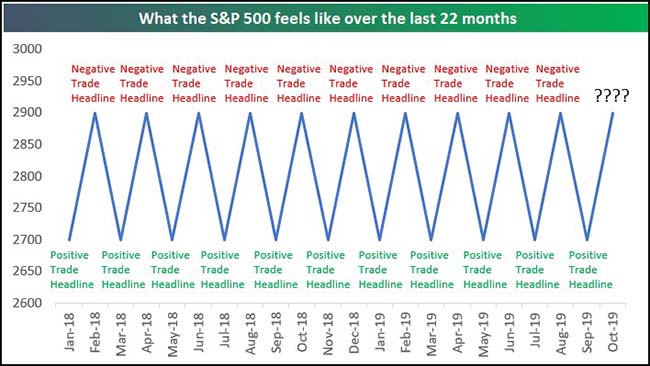

Just when you thought they were close…

China calls ‘time out’ on phase one and invites the U.S. for more talks.

China wants to hold more talks this month to hammer out the details of the “phase one” trade deal touted by Donald Trump before Xi Jinping agrees to sign it, according to people familiar with the matter.

Beijing may send a delegation led by Vice Premier Liu He, China’s top negotiator, to finalize a written deal that could be signed by the presidents at the Asia-Pacific Economic Cooperation summit next month in Chile, one of the people said. Another person said China also wants Trump to scrap a planned tariff hike in December in addition to the hike scheduled for this week, something the administration hasn’t yet endorsed. The people asked not to be named discussing the private negotiations…

Treasury Secretary Steven Mnuchin, speaking in an interview Monday on CNBC, said he expects officials to work in coming weeks to get the first stage ready for both sides to sign. If that doesn’t happen, the new U.S. import taxes on Chinese products will be imposed starting Dec. 15, he said…

“The U.S. must concede on its December tariff threat if they want sign a deal during APEC summit, otherwise it would be a humiliating treaty for China,” said Huo Jianguo, a former Chinese commerce ministry official who is now vice chairman of the China Society For World Trade Organization Studies. “The U.S. has definitely shown some good gestures but we shouldn’t exclude the possibility of another flip-flop.”

China has a different take on “IMMEDIATELY start buying very large quantities of our Agricultural Product”…

Read it for yourself…

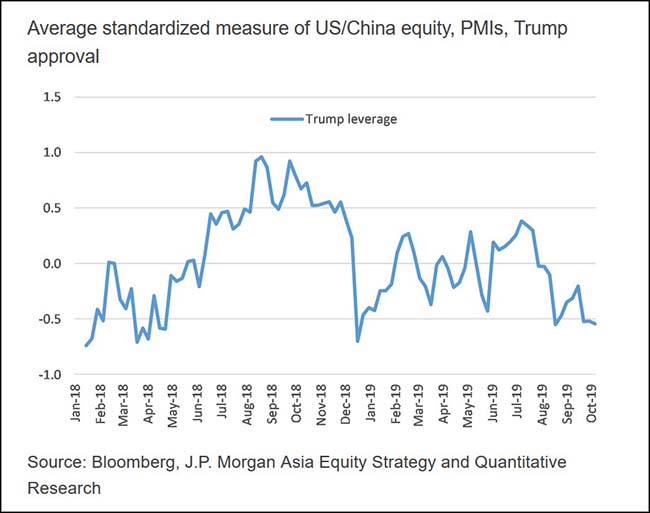

China’s leaders probably have their own measures of Trump’s negotiating position…

And it likely includes many of the inputs that J.P. Morgan’s does below.

Morgan Stanley (NYSE:MS) thinks “phase one” will only disappoint the markets…

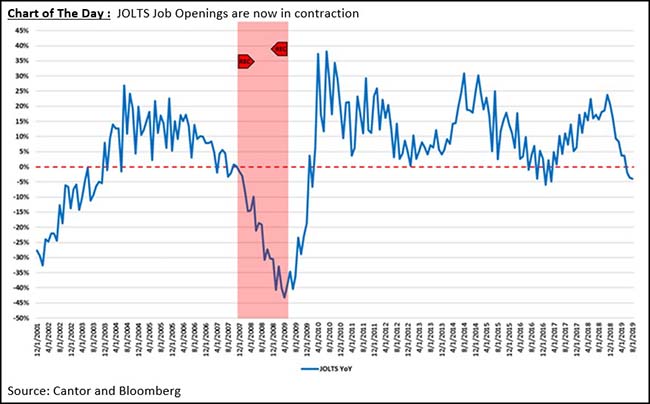

Cantor Fitzgerald has a good visual summary for you of the weights in the market…

Unfortunately, the Trade War did not shift to the right scale last week. And Syria just became twice as heavy.

Call it what you will, but it is still liquidity being added to the system which is a positive for the right side of the scale pictured above…

The Fed will buy Treasury bills beginning next Tuesday at an initial pace of $60 billion a month and continue those purchases into the second quarter of 2020.The announcement Friday marked a U-turn for the central bank, which until August had been shrinking its nearly $4 trillion asset portfolio.

The Fed said the actions were “purely technical measures to support the effective implementation” of the rate-setting committee’s policy “and do not represent a change in the stance of monetary policy.”

Back to global trade, Jared Dillian had an important viewpoint last week…

I think it’s important to emphasize how important international trade is, if I haven’t emphasized it already. If goods don’t cross borders, armies will. It’s not an accident that relations started going sideways when Trump enacted the tariffs. Funny thing about the tariffs. I am a free trader to the core—I think we should trade with everyone, including Cuba and North Korea. It is kind of hard to be enemies with someone you are doing business with. We should be doing business with everyone in the world.

Texas is about to have another hurricane…

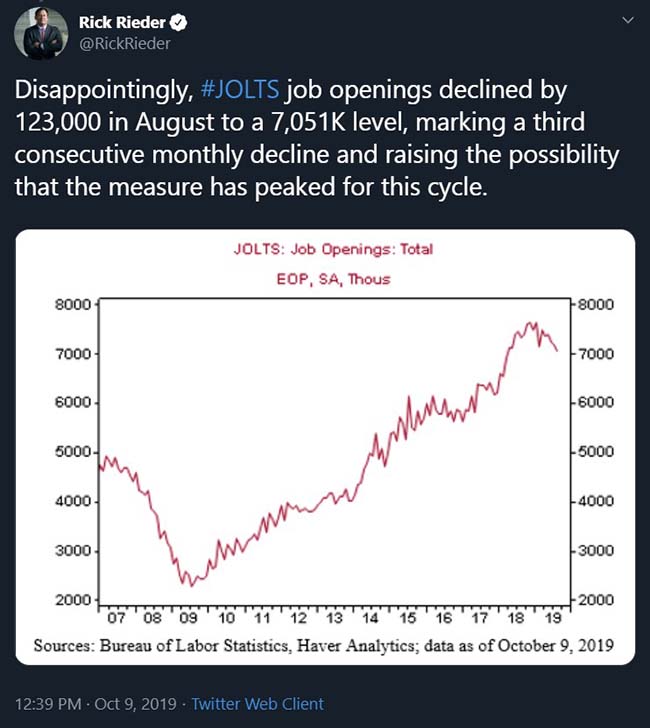

It sure looks like the number of job openings has peaked…

And rapidly shrinking job openings was not good for the markets back in 2007….

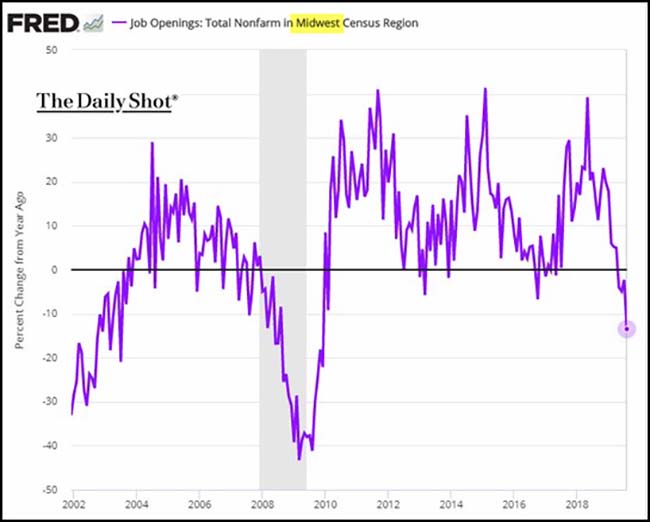

Midwest job openings are really starting to curdle…

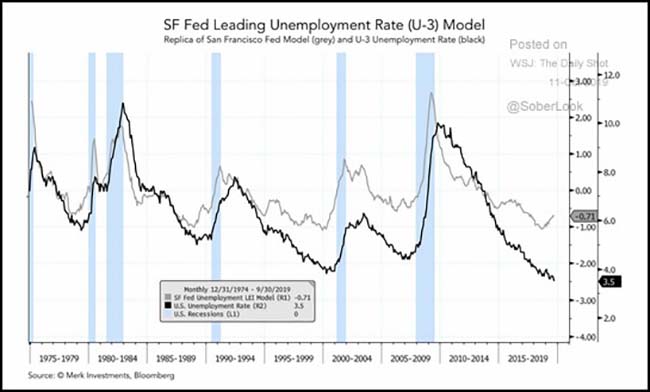

Meanwhile, San Francisco is seeing a certain rise in unemployment…

Morgan Stanley (NYSE:MS) is becoming more concerned about the credit worthiness of consumers…

“The strength of the US consumer has been the bedrock of the current economic expansion. Just a few weeks ago, in a CNBC interview, Fed Vice Chair Clarida said that “I cannot think of a time where in the aggregate the consumer has been in better shape.” While the US consumer’s balance sheet is in fine shape overall, mainly because levels of debt and debt-servicing costs remain low, there’s a segment whose income statements are under stress – rental households with lower income and lower credit scores. How big are they? Not small, at least on one metric: borrowers with FICO scores below 650 account for about 28% of the population. If the direction of gains in employment reverses, look for the cracks highlighted by our US economics, cross-asset and equity strategy teams to widen. These cracks tend to lead an overall downturn in household creditworthiness, so we’re keeping a careful watch to see if they spread to other segments of consumer debt and eventually creep up the income chain”

Back to global trade, the air freight metrics are in a free fall…

Global air freight dwindled for the 10th straight month in August, marking the longest declining streak in more than a decade, as the year-long tit-for-tat tariffs between the world’s two biggest economies crimped shipments.The world’s air freight, measured in freight-tonne kilometres, fell 3.9 per cent in August from a year ago, according to data by the International Air Transport Association (IATA). Asia-Pacific airlines, which account for the lion’s share of worldwide air cargo, or 35.4 per cent, saw their traffic falling by 5 per cent, the biggest decline after the 6.7 per cent decrease in the Middle East, the data showed.

“This is deeply concerning,” said IATA’s Director General Alexandre de Juniac. “Not since the Global Financial Crisis in 2008 has demand fallen for 10 consecutive months … and with no signs of a detente on trade, we can expect the tough business environment for air cargo to continue.”

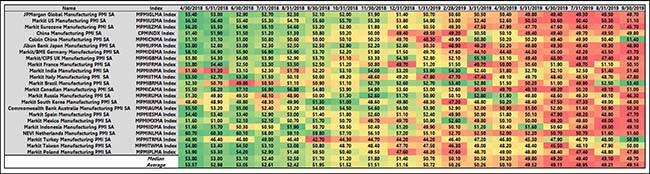

This Global PMI Heatmap has way too much red on it…

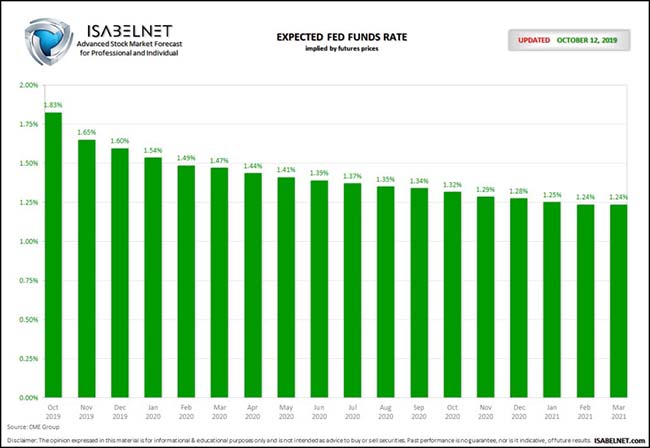

It’s no surprise that with all of the weakness, the forecast for the Fed Funds rate is lower and lower…

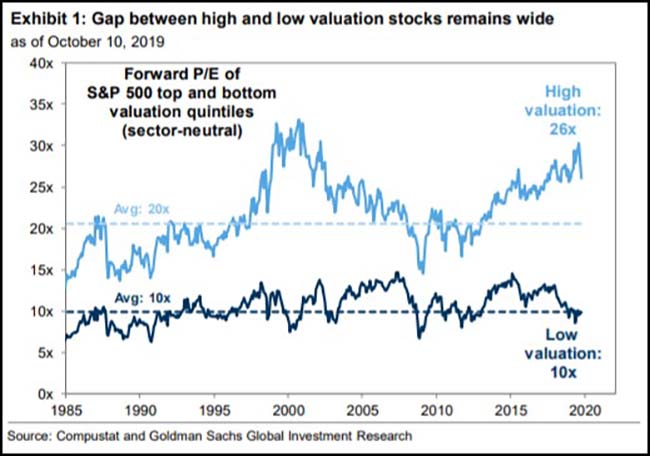

If only economic growth could accelerate, there would be pots of gold waiting for owners of value stocks right now…

Meanwhile, investors are heavily overpaying for stable earners…

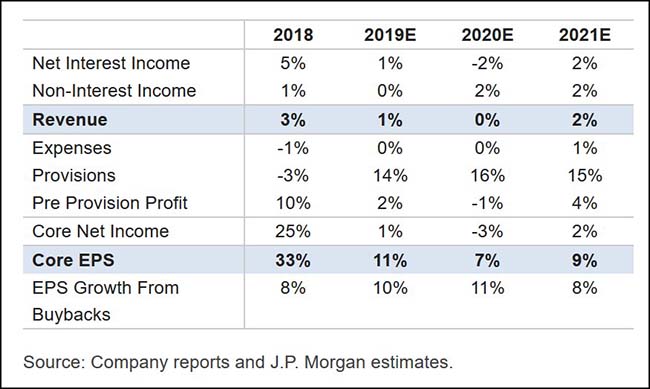

Here come earnings!

Bank stocks no longer grow their operating earnings. Thank goodness for stock repos…

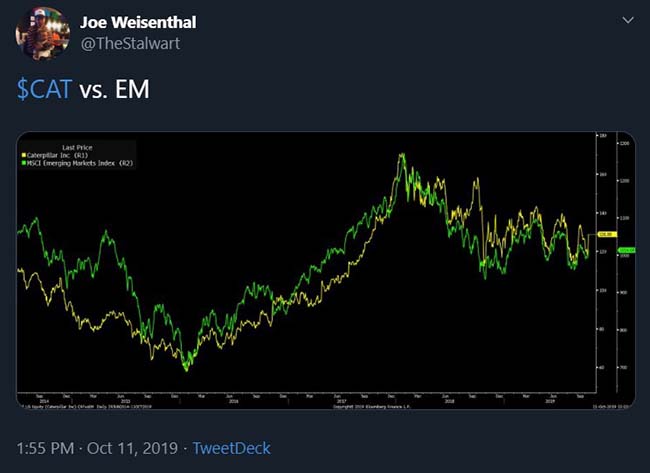

If you are long Caterpillar (NYSE:CAT) but don’t like emerging markets, then you are arm wrestling with yourself…

And over the long term, energy stocks look equally joined at the hip of emerging markets…

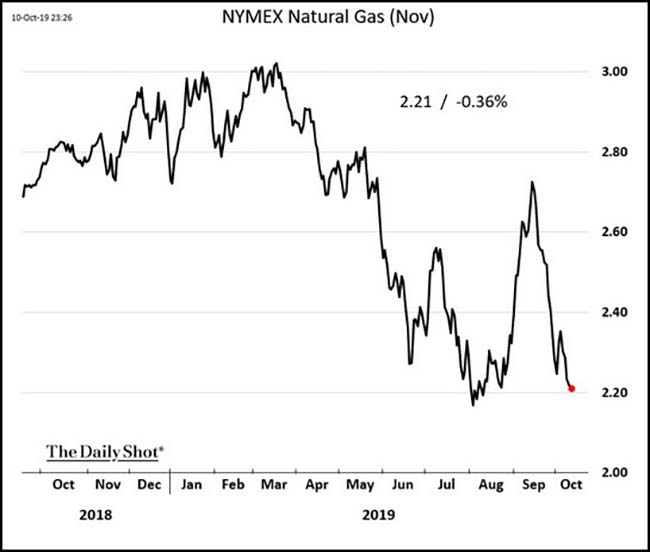

Natural gas prices smell like rotten eggs…

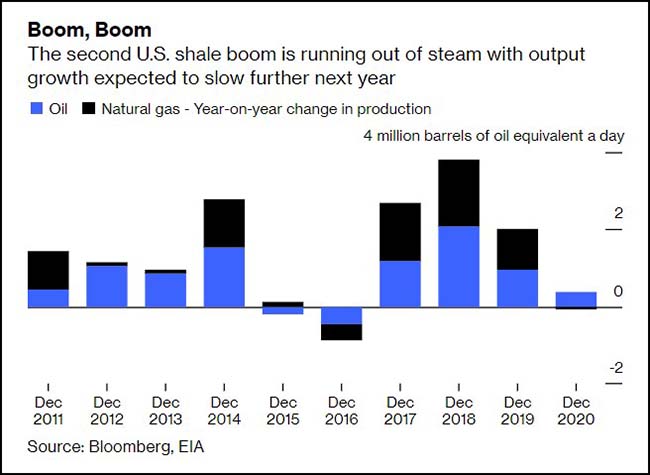

This is due to too much U.S. production…

The U.S. Energy Information Administration published its latest short-term energy outlook last week and has cut its forecast of oil production by the end of 2020 for the fourth straight month. It now expects American output to rise by just 370,000 barrels a day over the course of next year. That will be the slowest growth in four years and is yet another indicator that the latest period of rapid shale expansion is faltering.The number of rigs drilling for oil in the U.S. has fallen in each of the last 10 months, dropping by a total of 20% since November. And productivity gains are waning. Drilling in the Permian, the most prolific of the shale basins, fell by 11% in the nine months to August, according to the EIA.

And the downturn in energy production hit Colorado last week…

178 jobs times $150,000 equals $27m in payrolls which will definitely be felt on our western slope.

Halliburton (NYSE:HAL) Energy Services let go of 178 workers at its Grand Junction facility on Monday, part of a larger layoff it made across the region.“The layoff is expected to be a permanent employment loss. At this time it is expected that the facility will remain open,” Justin Slaugh, the company’s district manager for the Rock Springs District, wrote the Colorado Department of Labor and Employment.

Slaugh submitted the letter under the Worker Adjustment and Retraining Notification Act, on Oct. 7, the same day the job cuts were made.

The cuts in Grand Junction were part of a larger reduction of 650 oil fieldworkers in Colorado, Wyoming, New Mexico and North Dakota, said Halliburton (NYSE:HAL) spokeswoman Erin Fuchs.

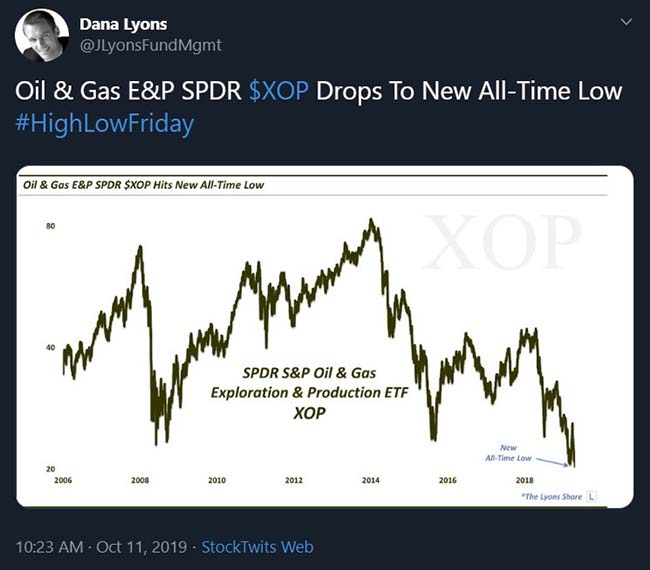

It thus only makes sense that oil & gas drillers would be making decade lows…

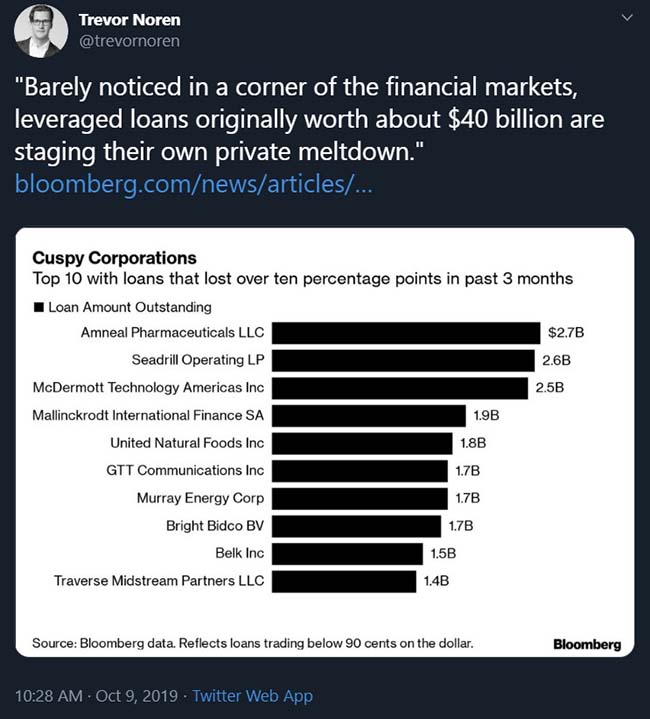

And energy credits continue to lead the lists of problem paper…

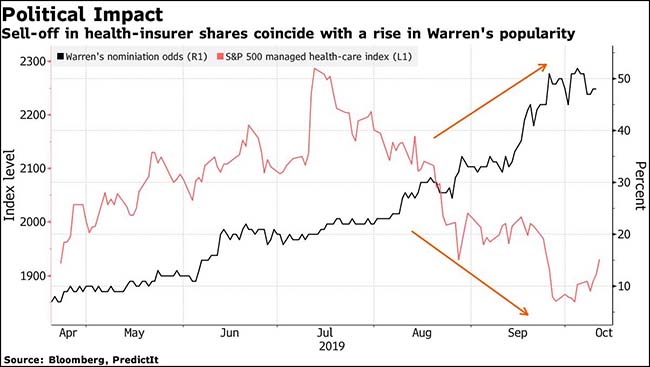

Healthcare stocks continue to pull back smartly…

Elizabeth Warren has gained in the Democratic race, while President Trump’s odds of impeachment have also moved sharply higher raising the uncertainty for the future of healthcare companies.

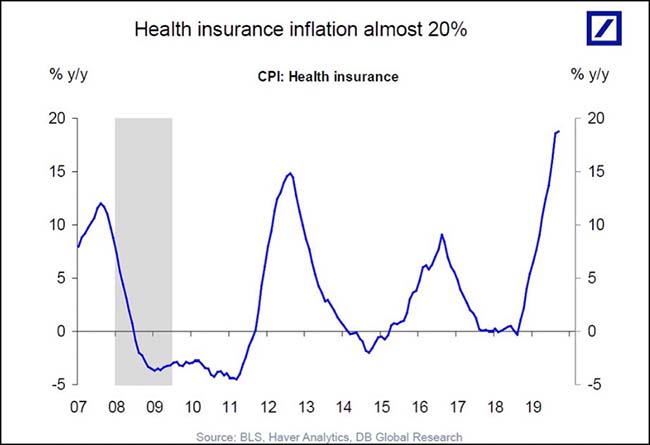

And no doubt all politicians have this chart on their 2020 to do list…

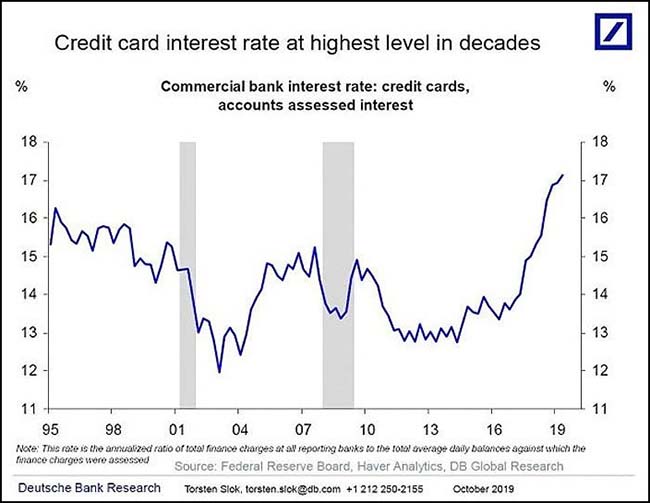

Credit card companies might also want to pay attention to Elizabeth Warren’s move in the polls…

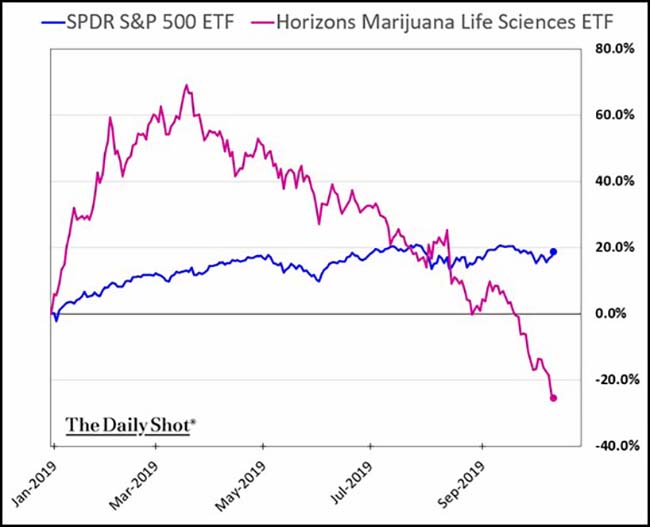

It is called weed for a reason…

Will this be the quarterly earnings call where a question about an investment in China becomes a long-term negative?

American brands now face two major challenges in a country that is increasingly a foe of the U.S. on matters of trade and geopolitics. One is that local Chinese brands are getting stronger. The other is that Chinese consumers are increasingly turning away from foreign brands because they have run afoul of Chinese politics. The result is that some American brands that used to be cool are falling out of fashion.The recent NBA flap in China was a reminder of just how quickly Chinese attitudes can turn on Western brands. Within hours of a tweet—later deleted—by the Houston Rockets’ general manager expressing support for Hong Kong antigovernment protesters, stores removed Rockets gear and sponsors pulled deals with the NBA. All game broadcasts were canceled. Searches for Rockets merchandise on e-commerce sites yielded friendly error messages encouraging shoppers to consider something else— perhaps a toy rocket…

The shift signals a possible end of an era. For years, it was customary for Western executives to tout their plans for dominating China—a market they felt they had to win as markets elsewhere matured. But foreign consumer brands now hold a smaller market share in the categories tracked by McKinsey & Co. than at any time since the global financial crisis, according to a Wall Street Journal analysis of research from the U.S. consulting firm, incorporating data from Euromonitor and IHS Markit. Market share losses were particularly evident in categories such as pet food, passenger cars, videogames, smartphones and appliances.

I wonder if Ford is cash-flow positive on their total China investment?

Whoa, New York State goes full disclosure on all real estate listings…

A dispute about home conversions in New York’s suburban Rockland County threatens to upend Manhattan’s luxury-condominium market.Lawmakers in the county drew up state legislation to prevent the anonymous purchase of homes through the creation of limited-liability companies. Some residents suspected their new neighbors of making illegal home conversions or subdivisions. If a property is owned through an LLC it is more difficult to get local authorities to enforce the rules.

Now the legislation—which took effect last month—is having unintended consequences for the legions of billionaires, celebrities and other privacy-seeking condo owners: Every buyer’s name will be publicly available under New York’s Freedom of Information Law.

Many wealthy owners prefer to purchase through LLCs, also known as shell companies. Some want privacy, and others want to protect assets from lawsuits.

Look for Comcast (NASDAQ:CMCSA) to dispatch a entire team of Roto-Rooter trucks to 30 Rockefeller Center this week…

But the more reporting we gathered, the more nervous the network got. They began raising a range of strange and convoluted concerns about our work. Maybe Ronan had a conflict of interest, they argued, because his father, Woody Allen, had helped Weinstein’s career nearly 30 years earlier. Or maybe we were engaging in what is known as “tortious interference” by speaking to women who had signed nondisclosure agreements with Weinstein. Time after time, despite the fact that our reporting had been vetted and cleared by NBC’s lawyers, they ordered us to “pause” our reporting so they could “wrap our arms around this thing.” Sensing that our bosses were getting cold feet, Ronan and I agreed that he should quietly approach the New Yorker about publishing the story, in case NBC wound up shutting us down.Then, on August 18, 2017, eight months after Ronan and I began our investigation—and one day before we were to head to Los Angeles to interview a woman with a credible allegation of sexual assault against Weinstein—I was called in to meet with Greenberg. “Noah was very, very clear,” he told me. “No further calls. You are to stand down.”

An order from the president of NBC News doesn’t get much clearer than that. It was four o’clock in the afternoon. I went back to my desk, furious. I wrote an email to myself, documenting what I had just been told, and copied Ronan.