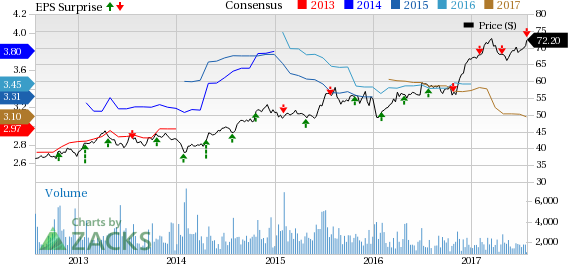

W.R. Berkley Corporation’s (NYSE:WRB) second-quarter 2017 operating income of 65 cents per share missed the Zacks Consensus Estimate of 75 cents by 13.3%. The bottom line also deteriorated 20.7% year over year.

The company witnessed improved revenues and slightly lower expenses in the reported quarter. However, reinsurance results remained affected by a competitive environment, which mainly resulted in the decline in earnings. Nonetheless, the company recorded improved investment results in the quarter. Plus, it continues to witness new opportunities in specialized areas.

Notably, the company expects the previously announced pre-tax gain of about $120 million from the sale of a real estate investment to contribute to its third quarter results.

Including net realized investment gains of 20 cents per share, net income remained unchanged from the year-ago quarter and stood at 85 cents per share.

Behind the Headlines

W.R. Berkley’s net premiums written for the quarter were $1.6 billion, down 4.8% year over year. Lower premiums written at both the Insurance and Reinsurance segments resulted in the downside.

Operating revenues came in at $1.70 billion, up 0.9% year over year. However, the top line missed the Zacks Consensus Estimate of 1.77 billion.

Investment income improved 4.8% year over year to $135.3 million.

Total expenses dipped 0.6% to $1.7 billion, primarily due to lower expenses from non-insurance businesses.

Consolidated combined ratio (a measure of underwriting profitability) deteriorated 20 basis points (bps) year over year to 95.1%.

Segment Details

Net premiums written in the Insurance segment dipped 1.7% year over year to $1.4 billion in the quarter. This decrease was attributable to lower premiums written under other liability, short-tail lines and professional liability. Combined ratio in this segment improved 10 bps year over year to 94.1%.

Net premiums written in the Reinsurance segment plunged 29.5% year over year to $126.1 million due to substantially lower premiums written under casualty reinsurance and property reinsurance. Combined ratio declined 350 bps to 104.4%.

Financial Update

W.R. Berkley exited the second quarter with total assets worth $23.9 billion, up 2.8% from the year-end 2016.

Book value per share rose 4.7% from the year-end 2016 to $43.59 as of Jun 30, 2017.

Cash flow from operations plunged 39.5% year over year to $115.9 million.

The company’s return on equity deteriorated 90 bps to 8.6%.

Dividend Update

During the second quarter, the company approved of a special dividend of 50 cents per share, amounting to $61 million.

Zacks Rank

Currently, W.R. Berkley has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other P&C Insurers

Among other players from the same space that have reported their second-quarter earnings so far, the bottom line at The Progressive Corporation (NYSE:PGR) and The Travelers Companies, Inc. (NYSE:TRV) missed their respective Zacks Consensus Estimate, while RLI Corp. (NYSE:RLI) beat the same.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

W.R. Berkley Corporation (WRB): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post