In terms of assets iPath's “S&P 500 VIX Short-Term Futures” ETN (VXX) is the leader in volatility ETFs currently with $1.6 billion under management. I suspect it’s also one of the leaders in investor confusion.

Although VIX is in its formal name VXX doesn’t actually track the CBOE’s VIX index with any degree of precision. In fact it’s not unusual for VXX and VIX to move in opposite directions for a day or two. VXX can’t directly follow the VIX index, because nobody has figured out a way to cost effectively make a market in the VIX index. The best that can be done is to invest in VIX futures—which tend to have a mind of their own.

VIX futures come in monthly series that expire the 3rd or 4th Wednesday morning of each month. The next VIX future series to expire is called the first or near month and its settlement value is determined by a special calculation that closely corresponds to the opening quote of the VIX index on expiration day. This is the only linkage between all the various series of VIX futures to the VIX index—a once a month synchronization point with the just expired future. It’s much worse than a stopped clock—which is right twice a day.

Just holding contracts for one futures expiration month at a time would give VXX a variable maturity. To provide a constant maturity Barclays executes a daily roll of first and second month contracts, gradually reducing the number of first month contracts until they are all sold right before they expire. Barclays describes this process as providing a “constant weighted average maturity of one month.”

This is really misleading.

The VIX index tracks “the market’s expectation of 30-day volatility.” It computes this using a weighted mix of options that are at least 7 days from expiration plus longer dated options.

When the near month VIX futures contract expires it closely matches the VIX index value—the 30 day estimate. But on that day VXX has 100% rolled over to the successor VIX futures contracts that have another 30 calendar days before they expire—so VXX is really providing a weighted maturity volatility expectation of 60 days, not 30.

A longer effective maturity would at least partially explain VXX’s tendency to move about 50% of the VIX index daily moves on average. Longer term volatility expectations are less volatile.

To verify this analysis I created a spreadsheet that computes average maturity for VIX futures using linear interpolation/extrapolation of the futures prices. Since this does not require modeling the buying / selling of VIX futures contracts there are no distortions due to contract rolls.

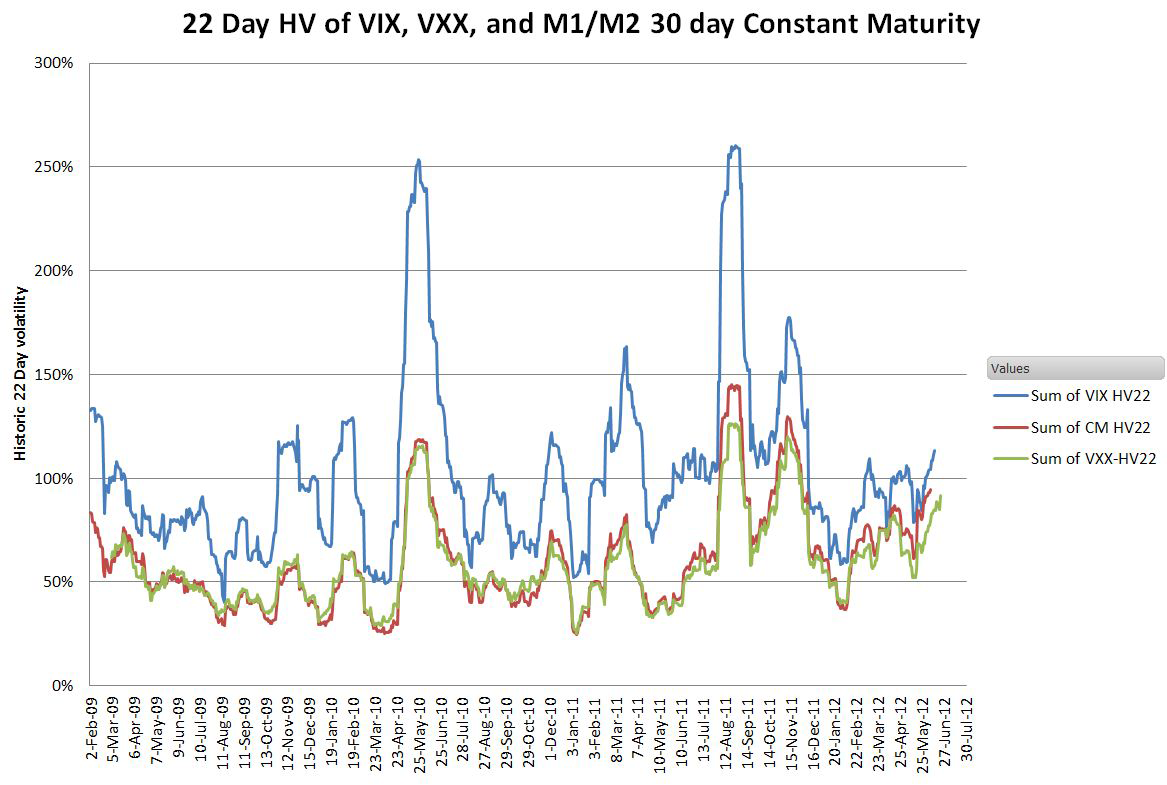

The chart below shows the historical volatility (22 trading days) of the VIX index compared to the historical volatility of VXX and my 30 day synthesized mix of first and second month (M1/M2) VIX futures.

My synthesized values match up well with VXX’s actuals. It is interesting that VXX’s huge yield roll costs don’t show up in this chart. The average of VXX’s historical volatility since January 2009 has been 58%—compared to 102% for VIX.

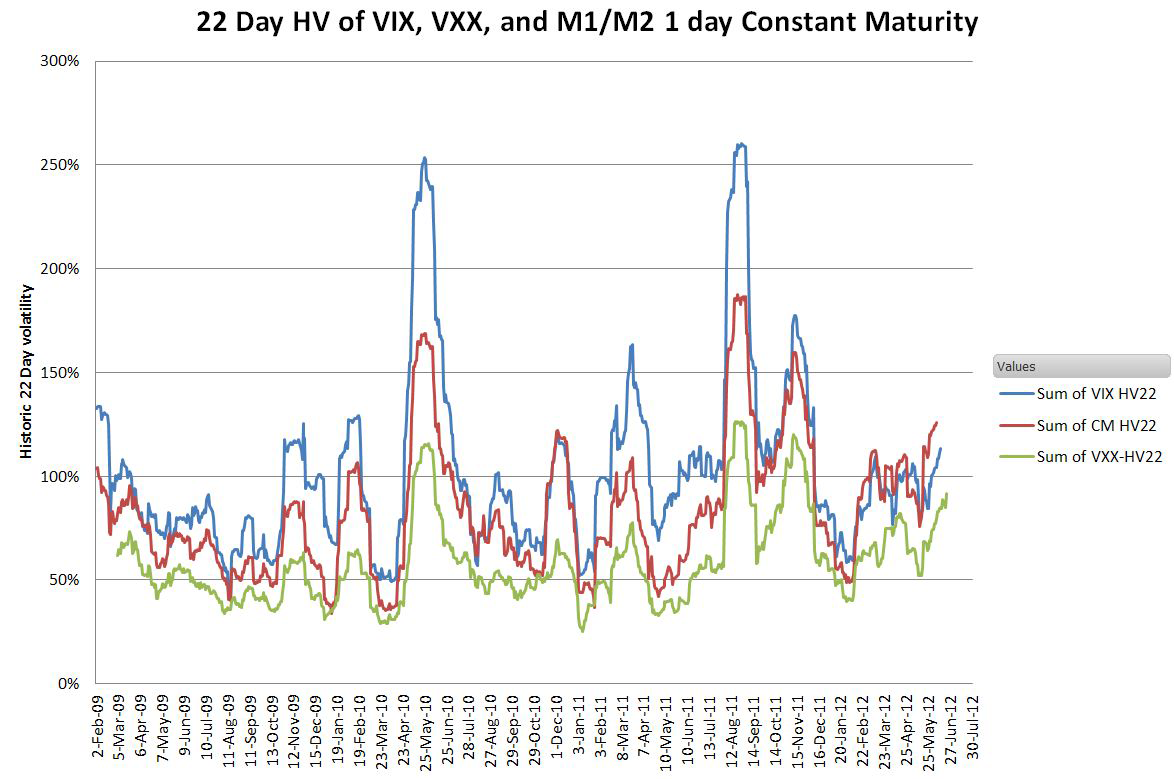

Next I shifted my synthesized mix of M1/M2 futures to closely match the true 30 day expectation of VIX.

My simulation uses a linear extrapolation of the VIX term structure, rather than an exponential match, so I expected extreme volatility events to be understated. But in quiet times the match between the VIX index and my true 30 day maturity mix of VIX futures is often quite good.

I think Barclays’ stated “constant weighted average maturity of one month” is a month shy of reality, and I’d like to see that changed in their literature. This product is confusing enough without misstating the duration of its volatility expectation by a factor of two.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

VXX ETF: Not As Short Term As You Think

Published 06/25/2012, 02:26 AM

Updated 07/09/2023, 06:31 AM

VXX ETF: Not As Short Term As You Think

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.