Vulcan Materials Company’s (NYSE:VMC) reported adjusted earnings of 74 cents per share in fourth-quarter 2017, surpassing the Zacks Consensus Estimate of 72 cents by 2.8%. Also, the bottom line increased about 7.2% on a year-over-year basis.

Total revenues of $ 977 million also outpaced the Zacks Consensus Estimate of $929 million by 5.2%. The top line increased 12% from the prior-year quarter.

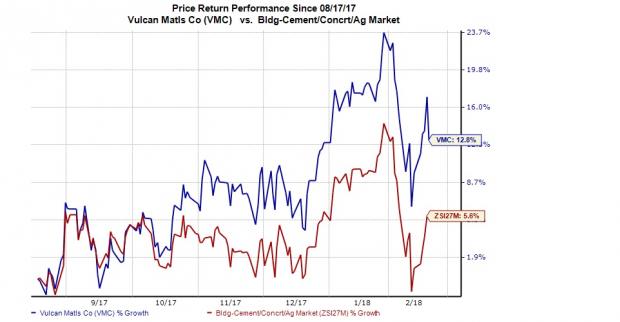

In the past six months, the company’s shares have rallied 12.8%, outperforming the industry’s gain of 5.6%.

Segments in Detail

Aggregates

Revenues increased 7.8% year over year to $769.5 million. Freight-adjusted revenues also rose 8% year over year to $596 million.

Aggregates shipments (volumes) were up 7% year over year. In the quarter under review, shipments improved significantly in California and across the Southeast, with most markets growing double-digits. Shipment rates, however, continued to lag in Houston while other storm-impacted the Gulf Coast markets.

Non-Aggregates

Revenues at the Asphalt Mix segment were $160.6 million, up 29.7%. Asphalt segment gross profit was $23 million, down by $1.3 million year over year. Shipments increased 16% from the prior-year quarter.

Total revenues at the Concrete segment were $108.3 million, up 24.1% year over year. Gross profit was $11.8 million, down by $3.6 million from the prior-year quarter. Shipments increased 13% from the prior-year quarter.

Total revenues at the Calcium segment were $1.9 million, reflecting a decline of 9.9% from the prior-year quarter. The segment reported gross profit of $0.5 million, down by $0.4 million from the prior-year quarter.

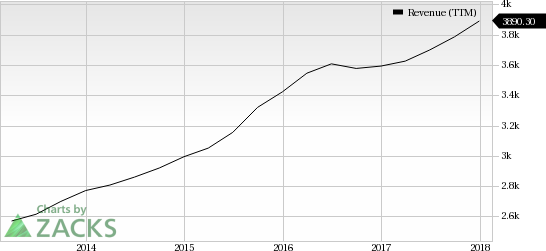

Vulcan Materials Company Revenue (TTM)

Operating Highlights

Adjusted gross margin of 28.7% fell 350 basis points (bps) in the fourth quarter. Also, adjusted EBITDA was down 2.1% year over year to $155.2 million.

Selling, Administrative and General expenses were $85.7 million, down by $6.1 million year over year.

Financials

As of Sep 30, 2017, cash and cash equivalents were $141.6 million down from $259 million at the end of 2016.

2018 Guidance

The company expects earnings from continuing operations between $4.00 and $4.65 per diluted share. Adjusted EBITDA is envisioned in the range of $1.15 billion to $1.25 billion. Aggregates shipments from Aggregates USA operations are expected to be roughly 7 million tons.

Zacks Rank & Peer Releases

Vulcan carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Masco Corp.’s (NYSE:MAS) fourth-quarter 2017 adjusted earnings per share of 44 cents surpassed the Zacks Consensus Estimate of 43 cents by 2.3%. Adjusted earnings also increased 33% year over year.

Rayonier Inc. (NYSE:RYN) reported fourth-quarter 2017 pro forma net income per share of 20 cents, comfortably beating the Zacks Consensus Estimate of 9 cents. Further, the bottom line came in significantly above the prior-year quarter figure of 5 cents.

PulteGroup’s (NYSE:PHM) fourth-quarter 2017 adjusted earnings per share of 85 cents outpaced the Zacks Consensus Estimate of 84 cents by 1.2%. Also, the bottom line reflects a 27% jump from 67 cents in the year-ago quarter.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Masco Corporation (MAS): Free Stock Analysis Report

Rayonier Inc. (RYN): Free Stock Analysis Report

Vulcan Materials Company (VMC): Free Stock Analysis Report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

Original post

Zacks Investment Research