It has been more than a month since the last earnings report for Vulcan Materials Company (NYSE:VMC) . Shares have lost about 2.8% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Second Quarter 2017 Results

Vulcan Materials’ second-quarter 2017 adjusted earnings of $0.90 per share missed the Zacks Consensus Estimate of $1.22 by 26.2%. However, the bottom line was flat on a year-over-year basis.

Total revenue of $1.03 billion also missed the Zacks Consensus Estimate of $1.08 billion by 4.5%. Sales however increased 8% from the prior-year quarter.

Segment Details

Aggregates

Revenues increased 3% year over year to $818 million. Freight-adjusted revenues also inched up 3% year over year to $631 million.

Aggregates shipments (volumes) decreased 2% due to severe wet weather conditions and flooding in May and June, leading to a slowdown in construction activity. Aggregates segment gross profit was $253 million, down $1 million year over year.

Non-Aggregates

Revenues at the Asphalt Mix segment were $175.8 million, up 23.7% owing to a 16% increase in volumes. Asphalt segment gross profit was $29 million, down by $2 million year over year.

Total revenue at the Concrete segment was $105.2 million, up 29.6% year over year. Concrete segment gross profit was $9 million in the quarter, down by $3 million from the prior-year quarter. Shipments increased 21% from the prior-year quarter driven by increased volumes in most of the company's concrete markets.

Total revenue at the Calcium segment was $1.9 million, reflecting a decrease of 20.8% from the prior-year quarter. The segment reported gross profit of $0.6 million, down by $0.5 million from the prior-year quarter.

Operating Highlights

Adjusted gross margin of 32.6% fell 330 basis points (bps) in the second quarter. Adjusted EBITDA increased 2.9% year over year to $287.7 million.

Selling, Administrative and General expenses were $83 million, flat year over year.

Financials

As of Mar 31, 2017, cash and cash equivalents were $1.12 billion, up from $259 million at the end of 2016. During the second quarter, the company returned $44 million to shareholders through dividends and share repurchases. Total debt at the end of the second quarter was $3.4 billion.

2017 Guidance Updated

Adjusted EBITDA is projected in the range of $1.05 billion to $1.13 billion, lower than $1.125–$1.225 billion expected earlier.

Aggregates shipments are now expected between 182 and 187 million tons.

Asphalt, Concrete and Calcium gross profit growth is still anticipated at around 15%.

Core capital spending is still estimated at $300 million to support increased level of shipments and bring down production costs and boost operating efficiencies.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

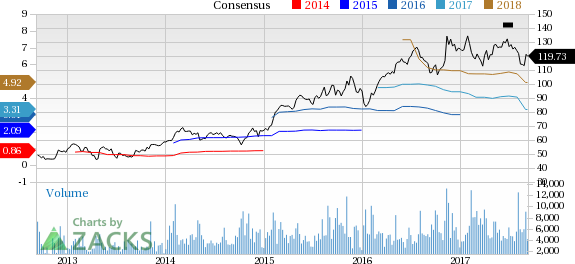

Vulcan Materials Company Price and Consensus

VGM Scores

At this time, Vulcan Materials' stock has a subpar Growth Score of D, though it is doing a lot better on the momentum front with an A. The stock was allocated a grade of F on the value side, putting it in the fifth quintile for this investment strategy.

Overall, the stock has an aggregate VGM score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is suitable solely for momentum investors.

Outlook

The stock has a Zacks Rank #5 (Strong Sell). We expect below average returns from the stock in the next few months.

Vulcan Materials Company (VMC): Free Stock Analysis Report

Original post

Zacks Investment Research