It has been about a month since the last earnings report for Vornado Realty Trust (NYSE:VNO) . Shares have lost about 6.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Vornado Realty Q2 FFO and Revenues Beat Estimates

Vornado reported second-quarter 2017 FFO per share of $1.35, beating the Zacks Consensus Estimate of $1.26. The number also increased 11.6% year over year.

However, the results reflect a fall in occupancy in the Washington DC and 555 California Street portfolio.

In the reported quarter, total revenues came in at $626 million, up 0.7% year over year. The figure also surpassed the Zacks Consensus Estimate of $610.81 million.

Behind the Headline Numbers

In the New York portfolio, Vornado leased 543,000 square feet of office space and 24,000 square feet of retail space in the reported quarter. Also, the company leased 91,000 square feet and 5,000 square feet of space in the Mart and 555 California Street, respectively. It also leased 196,000 square feet of office space in Washington DC.

At the quarter end, same-store occupancy in the New York portfolio was 96.6%, flat sequentially and up 60 basis points (bps) year over year. Further, same-store occupancy in the Washington DC portfolio was 90.4%, down 20 bps sequentially and 160 bps year over year.

Same-store earnings before interest, tax, depreciation and amortization edged down 0.5%, year over year, for the New York portfolio. For the Washington D.C. portfolio, the figure descended 2.7%.

As of Jun 30, 2017, Vornado had $1.4 billion of cash and cash equivalents, down from $1.5 billion as of Dec 31, 2016.

Other Important Developments

On Jul 17, the company completed the spin-off of JBG SMITH properties from its New York-based business and merged the same with the operating company and specific Washington, D.C. metropolitan area assets of The JBG Companies (JBG). This move led to the formation of an independent public company — JBG SMITH Properties (JBGS) — which started trading on the NYSE on Jul 18.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been two revisions higher for the current quarter compared to one lower.

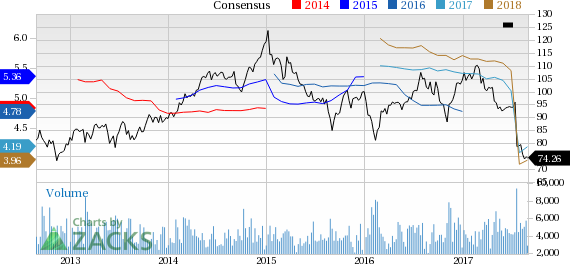

Vornado Realty Trust Price and Consensus

VGM Scores

At this time, Vornado Realty's stock has a poor Growth Score of F. However, its Momentum is doing a lot better with a B. The stock was allocated a grade of F on the value side, putting it in the bottom 20% for this investment strategy.

Overall, the stock has an aggregste VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum investors based on our style scores.

Outlook

While estimates have been moving upward, the magnitude of the revision is net zero. The stock has a Zacks Rank #5 (Strong Sell). We expect below average returns from the stock in the next few months.

Vornado Realty Trust (VNO): Free Stock Analysis Report

Original post

Zacks Investment Research