Long before pundits began to notice, traders have been pointing out the strange trading environment we’ve faced in 2014, following the exciting but still unexplained rally of 2013. The CBOE Volatility Index (VIX), aka the Fear Index, is at record lows and sitting in a narrow range.

Volume in the S&P 500 futures has been as low on some ordinary trading days as it used to be only on holidays. And prices in the major stock indices have often spent the day inside ranges of less than 20 points. Hard to make big money from small moves.

This lethargy is starting to worry big players. Goldman Sachs (NYSE:GS) President Gary Cohn said the narrow ranges and low volatility mean less commission for his firm and less profitable trading for clients. He told an investor conference, “What drives activity in our business is volatility. If markets never move or don’t move, our clients really don’t need to transact.”

Citigroup (NYSE:C) and J P Morgan Chase & Co. (NYSE:JPM) are looking at second-quarter drops in revenue of 20-25% versus a year ago, for the same reason. Cohn added, “We don’t have clear vision of economic growth or lack of growth.”

Really? 44 straight months of private sector job creation, 6.3% unemployment (the lowest since October 2008), the SPDR ETF (ARCA:SPY) more than doubled since 2009 — and you can’t see growth? But let’s leave Cohn’s vision problems aside for now.

A more visible problem is that while stock indices are making new highs, the number of individual stocks making new one-year highs has gone down dramatically.

A year ago, ⅕ of stocks would make new highs when the index did. Now it is just 1 in 19 stocks. In other words, a few booming stocks are pushing the indices higher, but the rest aren’t going up anymore.

We noticed a similar phenomenon in the MiM (MrTopStep imbalance Meter) yesterday. The MiM gave a strong sell signal, which many of us in the Trading Room used to get short and make some profits before the close. However, breaking down the buy and sell orders, we saw that 50% of the sell orders were for just two stocks, out of over a hundred, in our proprietary basket.

In short, it’s no longer accurate to talk about what “the market” is doing. As a whole, it is doing a whole lot of nothing. But a few stocks and a small number of traders (some human, some algo) are able to move it around because they don’t have much volume standing in their way. The tail is wagging the dog. And that’s scary.

So if it’s scary, the “fear index,” the VIX should be high, right? No, it’s a lagging indicator. It doesn’t say, “Warning: Danger Ahead.” It says, “Uh oh, now you’re in trouble.”

The VIX won’t be of use in predicting the correction. In fact, right now it’s saying this is the least worrisome time since 2006. And we all remember what happened next.

So there’s a trifecta of sorts to worry about: funds losing money because no one is trading, the markets being driven by an increasingly small number of stocks, and a fear index that seems stuck in Pollyanna mode. None of which seems to have much connection to the reality of most people’s lives.

The Asian markets closed modestly lower and in Europe 7 out of 12 markets are down. Today economic and earnings schedule starts out with the GDP numbers, Jobless Claims, and Incoming Cleveland Federal Reserve Bank President Loretta Mester’s speech in Cleveland to a conference on inflation and monetary policy. Outgoing Cleveland Federal Reserve Bank President Sandra Pianalto will open the conference.

Expected reports include Corporate Profits, Pending Home Sales, EIA Natural Gas Report, 7 Yr -Note Auction, Fed Balance Sheet, Monday Supply, Kansas City Federal Reserve Bank President Esther George’s speech in Stanford, California and earnings from Costco (NASDAQ:COST), Abercrombie & Fitch (NYSE:ANF), Dollar General (NYSE:DG) and Sanderson Farms (NASDAQ:SAFM).

Our View

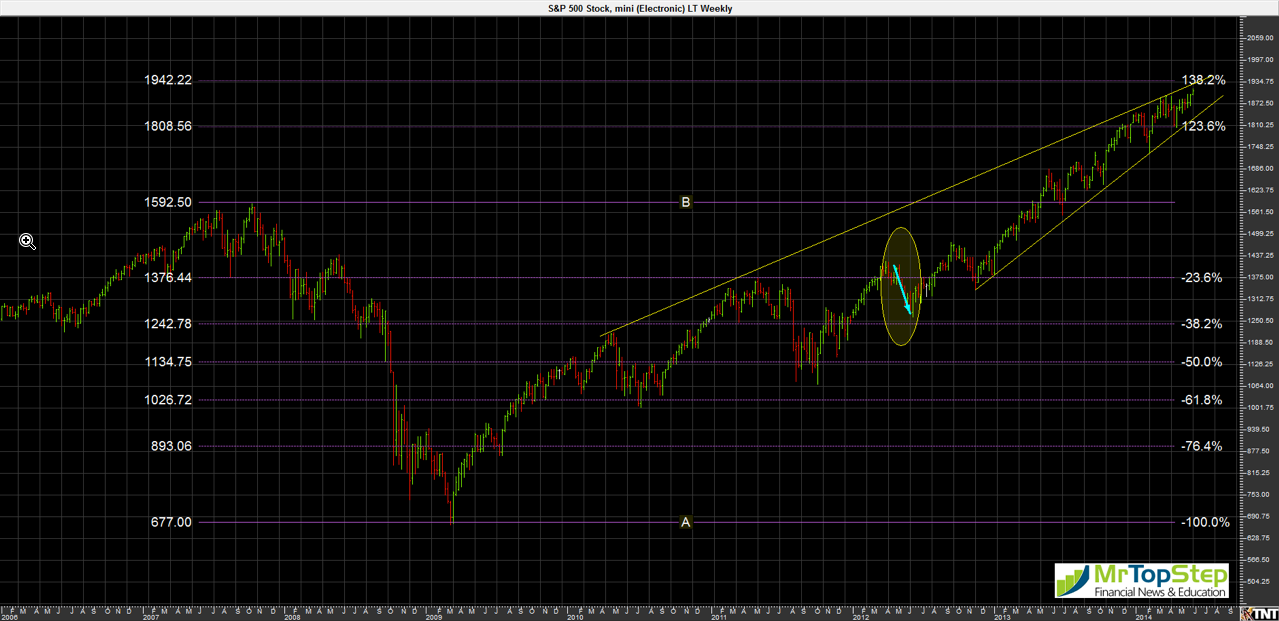

Wow, where has everyone gone? We knew it was a rough winter and we suspected it would be slow this week but we are seeing record low volumes. Of the 20 trading days so far in May, 13 have been up and 7 down. The S&P has been up 5 of the last 6 with yesterday closing down -0.10 handles.

Our view is the S&P is stalling and with so many stops being run on the upside over the last two weeks we really lean to lower prices as we go into the end of the week. That does not mean the S&P can’t take out yesterday’s high or even higher but we want to sell into it.

As always please keep an eye on the 10-handle rule and please use stops when trading futures and options.

- In Asia, 6 of 11 markets closed lower : Shanghai Comp. -0.47% , Hang Seng -0.30%, Nikkei +0.07%.

- In Europe, 7 of 12 markets are trading lower : DAX -0.08%, FTSE +0.21%

- Morning headline: “Bonds up, Dollar down Ahead of US GDP ”

- Fair Value: S&P -2.17 , Nasdaq -1.29 , Dow -13.80

- Total volume: 1mil ESM and 4.8k SPM traded

- Economic calendar: GDP numbers, Jobless Claims, Incoming Cleveland Federal Reserve Bank President Loretta Mester speaks, Outgoing Cleveland Federal Reserve Bank President Sandra Pianalto speaks, Corporate Profits, Pending Home Sales, EIA Natural Gas Report, 7 Yr -Note Auction, Fed Balance Sheet, Monday Supply, Kansas City Federal Reserve Bank President Esther George speech in Stanford, California and earnings from Costco (NASDAQ: COST), Abercrombie & Fitch (NYSE: ANF), Dollar General (NYSE: DG), and Sanderson Farms (NASDAQ: SAFM).

- E-mini S&P 500 1911.00+2.00 - +0.10%

- Crude 102.15+0.02 - +0.02%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23010.141-69.889 - -0.30%

- Nikkei 225 14681.72+10.77 - +0.07%

- DAX 9932.76-6.41 - -0.06%

- FTSE 100 6873.34+22.12 - +0.32%

- Euro 1.3612