Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) is reportedly planning to add new versions of its two crossover models, namely Atlas and Tiguan. The new editions will include two-row, five-seat version in the Atlas model, while the Tiguan will feature two-row, long-wheelbase version.

The latest editions will enable Volkswagen to offer compact crossovers at lower costs.

Earlier in the year, the company rolled out crossovers with a focus on three-row vehicles, including the seven-seating Atlas.

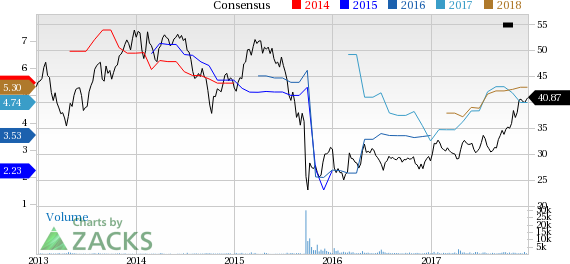

Volkswagen AG Price and Consensus

Timing for the above changes in Atlas and Tiguan has not been announced yet. However, the company is scheduled to launch another model of Atlas in 2020.

Of late, demand for crossovers has been up significantly, primarily driven by the good fuel efficiency, interior spacing and impressive exterior features. Per IHS Makrit, global sales for same type of vehicles increased to 12.83 million units in 2016 in comparison to 3.31 million units in 2007. This has led to declining sales in traditional hatchbacks and sedans.

Furthermore, consumers' interests in these models have encouraged auto makers to flood the market with new model line-ups, enabling the customers to choose vehicles as per their required specifications.

Per management, escalating its crossover offerings will help the company strengthen its financials.

Price Performance

Shares of Volkswagen have soared 42.5% year to date, outperforming the 12.9% gain of the industry it belongs to.

Zacks Rank & Key Picks

Volkswagen carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are Denso Corporation (OTC:DNZOY) , Tower International, Inc. (NYSE:TOWR) and Honda Motor Company (NYSE:HMC) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Denso has an expected long-term growth rate of 10.1%. In the last three months, shares of the company have rallied 18.7%.

Tower International has an expected long-term growth rate of 10%. Shares of the company have gained 15.1% over the last three months.

Honda has an expected long-term growth rate of 3.8%. Year to date, shares of the company have risen 17.9%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Honda Motor Company, Ltd. (HMC): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Denso Corp. (DNZOY): Free Stock Analysis Report

Tower International, Inc. (TOWR): Free Stock Analysis Report

Original post

Zacks Investment Research