Per Reuters, Volkswagen (DE:VOWG_p) AG’s (OTC:VLKAY) independent company, MOIA, announced plans to introduce an all-electric minibus for ride-pooling services in 2018. The company aims to target customers who favor paying for transportation services rather than owning a vehicle. With this minibus launch, the company’s goal is to eliminate one million cars from the cities of Europe and the United States by 2025.

Launched in December 2016, MOIA aims to develop and offer a portfolio of on-demand mobility services for its urban passengers.

Next year, MOIA will be introducing 200 six-seater buses in Hamburg, Germany with added features that include internet access and USB ports to charge electronic devices.

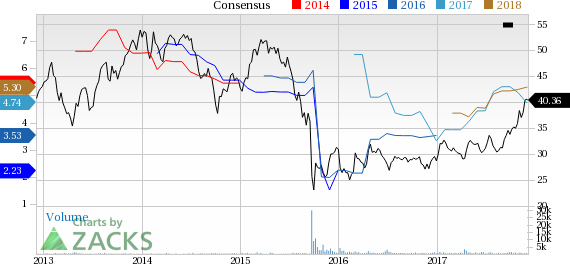

Volkswagen AG Price and Consensus

Further, within the next three years, it will be mounting its electric-minibus fleet service in Hamburg to 1,000 units. By 2019, MOIA targets to expand in other cities too.

Per management, introducing this ride-sharing service will help curb traffic congestion at lower rates than cab rides.

In order to build the all-electric minibuses, MOIA will be using Volkswagen’s modular platforms. The buses are expected to travel 186 miles on a single charge. Further, it will take 30 minutes to recharge 80% of the battery.

Price Performance

In the last three months, shares of Volkswagen have outperformed the industry it belongs to. The stock has rallied 25% compared with the industry’s 10.2% gain during the period.

Zacks Rank & Key Picks

Volkswagen carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the auto space are BMW AG BAMXF, BorgWarner Inc. (NYSE:BWA) and Cummins Inc. (NYSE:CMI) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

BMW has an expected long-term growth rate of 4.2%. Over the past year, shares of the company have been up 12.7%.

BorgWarner has an expected long-term growth rate of 9%. In the last three months, shares of the company have been up 16.9%.

Cummins has an expected long-term growth rate of 12.2%. Year to date, its shares have been up 20.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Volkswagen AG (VLKAY): Free Stock Analysis Report

Bayerische Motoren Werke AG (BAMXF): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post