European manufacturing faces significant challenges, while the sanctions that the EU may extend to key Russian metals such as aluminum will likely lead to an unintended impact on the competitiveness of EU-based companies.

As a result, firms like Volkswagen (ETR:VOWG_p) (VOGW) and BMW (ETR:BMWG) – the objects of my today’s research - are experiencing declining margins, exacerbated by rising competition from Chinese brands, which are becoming more affordable in Europe and worldwide.

That’s why I believe that the low stock multiples for VW and BMW that we see today may not necessarily present a buying opportunity for value investors – the risk of getting into a classic “value trap” seems too high to me right now. I recommend waiting for more information and some sort of a confirmation that the cost-cutting measures taken by these firms actually bring value.

All That Glitters Is Not Gold

As it’s generally said among analysts, auto manufacturers are no-moat companies that always face challenging competition, high capital intensity, and cyclical demand - BMW and Volkswagen are no exception to this commonality, and especially so in recent quarters.

For example, Volkswagen's gross profit declined by more than 5% in the first half of 2024, despite a slight increase in sales. This decline in profitability is attributed to lower selling prices – the firm offers huge discounts to revive the growth in China amid the ongoing price war there. Compared to BMW, VW seems to be in a shakier position here, as China has been one of the most important sales regions for many years.

BMW also saw a gradual decline in pricing momentum since the peak in Q1 2023, while again, the most troubles came from China, where BMW faced a downward trend in transaction prices during Q2 2024.

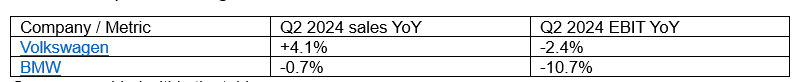

Sources provided within the table

Interestingly, both companies face ongoing financial challenges as they navigate the loss of cheap raw materials from Russia, which are now being redirected to China, further benefiting Chinese competitors. I just want to make sure the context is clear here: in the event of official sanctions on the auto industry in Europe on Russian aluminum would likely lead to increased production costs and supply chain disruptions.

This is especially true for the automotive industry considering the increasing use of aluminum parts in vehicles in recent yearsRussian aluminum, if sanctioned, can’t be quickly replaced (and at the same cost and with the same environmental standards). So that’s why I think BMW and VW, two of Europe's automotive giants, are particularly vulnerable due to their significant use of aluminum in vehicle production.

If someone loses, there should also be a winner. The Chinese automotive industry, which has seen production nearly triple since 2008, is aggressively expanding its global market share, offering competitive pricing and advanced technology. Now this expansion should be further facilitated by China's access to low-cost, low-carbon Russian aluminum, which enhances its competitive edge in the global market. According to Macro Advisory, China will import ~2.675 million tons of aluminum in 2023, almost half of which will come from Russia, so the strategic shift in supply chains is already taking place before our eyes.

Alcoa (NYSE:AA), a major US-based player in the aluminum industry, also stands to gain from the current geopolitical dynamics, because in my view, as European manufacturers grapple with supply chain challenges and rising costs, Alcoa's strategic positioning allows it to meet the increasing demand for aluminum, particularly in the growing EV sector. Since there are no alternatives, European manufacturers will be forced to overpay for American aluminum (and not only).

So effectively, Alcoa now has more influence in the market due to the departure of its major Russian competitor - it's likely to dominate the end market, as I wrote in one of my previous articles.

So again: VW and BMW are now having to deal with the rise in costs of raw materials, supply chain expenses, and heightened level of competition from Chinese car manufacturers hampering their profit margins. It is already evident that Volkswagen has embarked on its first serious measures to contain the further shrinkage of the company’s margins. As FT reports German car manufacturer has started implementing its plans and will be trying to close some of its factories in Germany at last, something the company has never done before in its history.

Source: FT

The main reason cited is weak demand for the company's electric vehicles. However, I believe the situation is straightforward: it is increasingly difficult for VW and BMW to compete with cheaper, yet equally high-quality alternatives from Asia, where both labor and materials are less expensive.

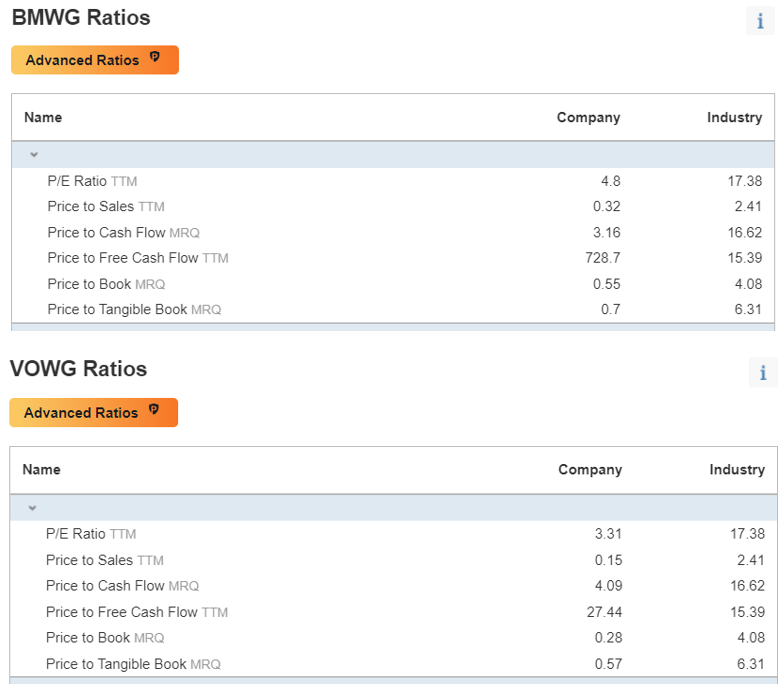

Now is the time to discuss the valuation multiples at which the shares of the two companies, the subjects of my research today, are traded. The low stock multiples of VW and BMW might seem attractive at first glance, but they reflect the underlying risks and uncertainties facing these companies. For example, these low multiples could actually grow significantly and oftentimes unexpectedly if earnings continue to fall.

Investors often refer to such companies as 'value traps.' These stocks appear very cheap and attract value investors, who unfortunately often end up holding shares that continue to decline in value despite their low multiples. It's crucial to understand that the companies we're discussing today are cyclical players. Before becoming truly attractive to investors, cyclical companies typically need to hit rock bottom in terms of profitability, becoming unprofitable at the low point of their economic cycle. This is usually when a turnaround begins, but we have not yet observed this in the shares of Volkswagen or BMW.

Source: Investing.com

The European automotive market is undergoing a significant transformation today, driven by the shift towards sustainable and electric vehicles, and while VW and BMW are investing heavily in this transition, the competition from Chinese manufacturers, who are rapidly advancing in EV technology, poses a significant threat. The European Union's recent tariffs aimed at protecting local automakers may provide some relief, but this measure is unlikely to stop Chinese brands from competition trying to compete in Europe – it will still be beneficial to them in most cases to pay the tariff and earn just a bit less.

However, I do not rule out the possibility of BMW and VW shares bouncing off their current lows for technical reasons. If you pay attention to the recent price action of these stocks, you will see that they have both approached their important past lows, from which buyers could begin to be active again.

Source: Investing.com

Conclusion

In short, I should say that the current geopolitical landscape presents a challenging environment for all EU manufacturers, particularly in the automotive sector. The sanctions on Russian energy and metals have really inadvertently strengthened China's economic position lately, allowing it to compete more aggressively with European companies - in the auto sector especially.

Even if we set aside the discussion of sanctions and their potential impact, the rapid development of Chinese companies in recent years, particularly in the automotive sector, is striking to me. It raises questions about how precarious the market positions of even well-established brands like Volkswagen and BMW can become.

I truly believe that for retail investors, the cheap multiples of VW and BMW stock may not necessarily indicate a buying opportunity, given the significant risks and uncertainties both of these companies face right away. It's better to look for some better candidates, preferably in other industries.