Virtually every corner of the closed-end fund (CEF) marketplace has been on an unrelenting grind higher over the last 18-months. Very few pullbacks have meant that you either had to be in these vehicles to capture the capital appreciation from the get-go or grind your teeth and jump in at some random point along the way.

More recently, we are starting to see signs of a shakeup across many sectors of the CEF universe. With stocks starting to take on a wobbly posture and high yield credit spreads compressed to multi-year lows, there is an atmosphere of uncertainty in the air. That can ultimately spell opportunity for those who have been waiting patiently on the sidelines for new dislocations to present themselves.

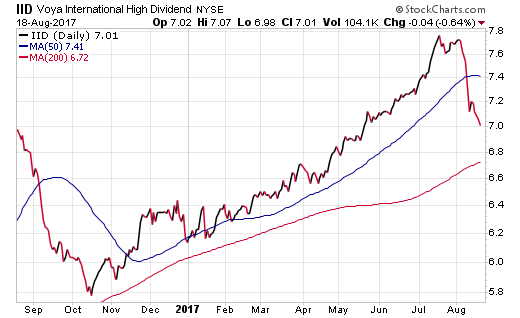

Take for example the Voya International High Dividend Fund (NYSE:IID), which a hawk-eyed client pointed out last week. This small $60 million fund is primarily made up of global large-cap dividend stocks and recently peaked at an exorbitant +12% premium to its underlying net asset value (NAV).

The recent dip shown on the chart above has quickly reset the price to a more palatable -0.85% discount to NAV as of Friday’s close. This type of sharp drop is common throughout the CEF landscape when certain funds get too far over their ski’s. It’s also typical to see an immediate re-pricing in closed-end funds due to a drastic portfolio change, dividend reduction, or management shakeup.

Such are the risks of owning an asset whose price is driven heavily through sentiment as opposed to the actual underlying performance of its stock or bond portfolio. This point is crucial for CEF investors to understand as price trends often overextend (in both directions) for far longer than most think is possible. It’s a much different risk dynamic than buying an open-ended mutual fund or ETF that trades at or very near its daily NAV.

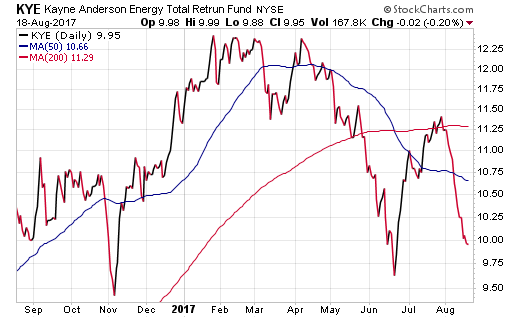

Another closed-end fund asset class that has been under fire in recent weeks are master limited partnerships. A chart of the Kayne Anderson Energy Total Return Fund (NYSE:KYE) tells the story for much of this group. The compression of energy stocks and volatility in commodity prices has created an unpredictable trading environment for these funds.

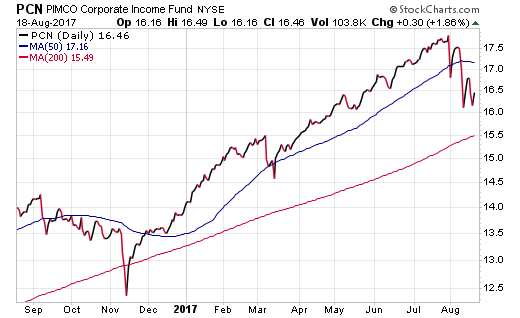

This recent bout of volatility isn’t strictly relegated to stock or equity-like assets either. Even historically more conservative bond CEFs have experienced some very swift reversals in recent weeks. The PIMCO Corporate Income Fund (NYSE:PCN) has fallen more than 10% from high to low and is attempting to stabilize above its 200-day moving average.

PCN was another fund that became extremely frothy at a peak premium of +17% versus its underlying net asset value. It’s now dropped to a modestly rich premium of +8% through Friday’s closing price.

The question that many CEF investors will soon be mulling is whether this is a good time to buy or should they hold out in anticipation of further downside?

Most investors I speak with are under the impression that the hard part of trading is knowing when to sell. In my experience, it’s far harder to pick an appropriate time to be a buyer as you continually weigh the benefits and risks of establishing new positions from the relative safety of cash.

This timing becomes even more nuanced through use of CEFs, with a fixed number of shares and a limited pool of participants to trade them. A 10%-15% sell off can easily morph into a 20-30% event if high yield spreads widen sharply or if downside in other risk assets acts as an accelerant.

My advice for those who are seeking to gain additional exposure in these funds is to strike when we see these intermittent periods of volatility emerge. A watch list of favored holdings can help narrow down the field of CEFs you want to own and you can always leg into them with multiple trades if needed to round out an appropriate position size.

At our firm, we have been making incremental shifts since early 2017 to pare down our exposure to CEFs showing rich premiums or narrow discounts relative to historical norms. Now we are starting to become interested again in seeking out areas of value and potentially add tactical positions that have become oversold in the short-term.

There is never a perfect way to know where the top or bottom will be in any market. Nevertheless, a counter-intuitive mindset can help mitigate the natural greed and fear cycles that heavily influence the price behavior of these funds.