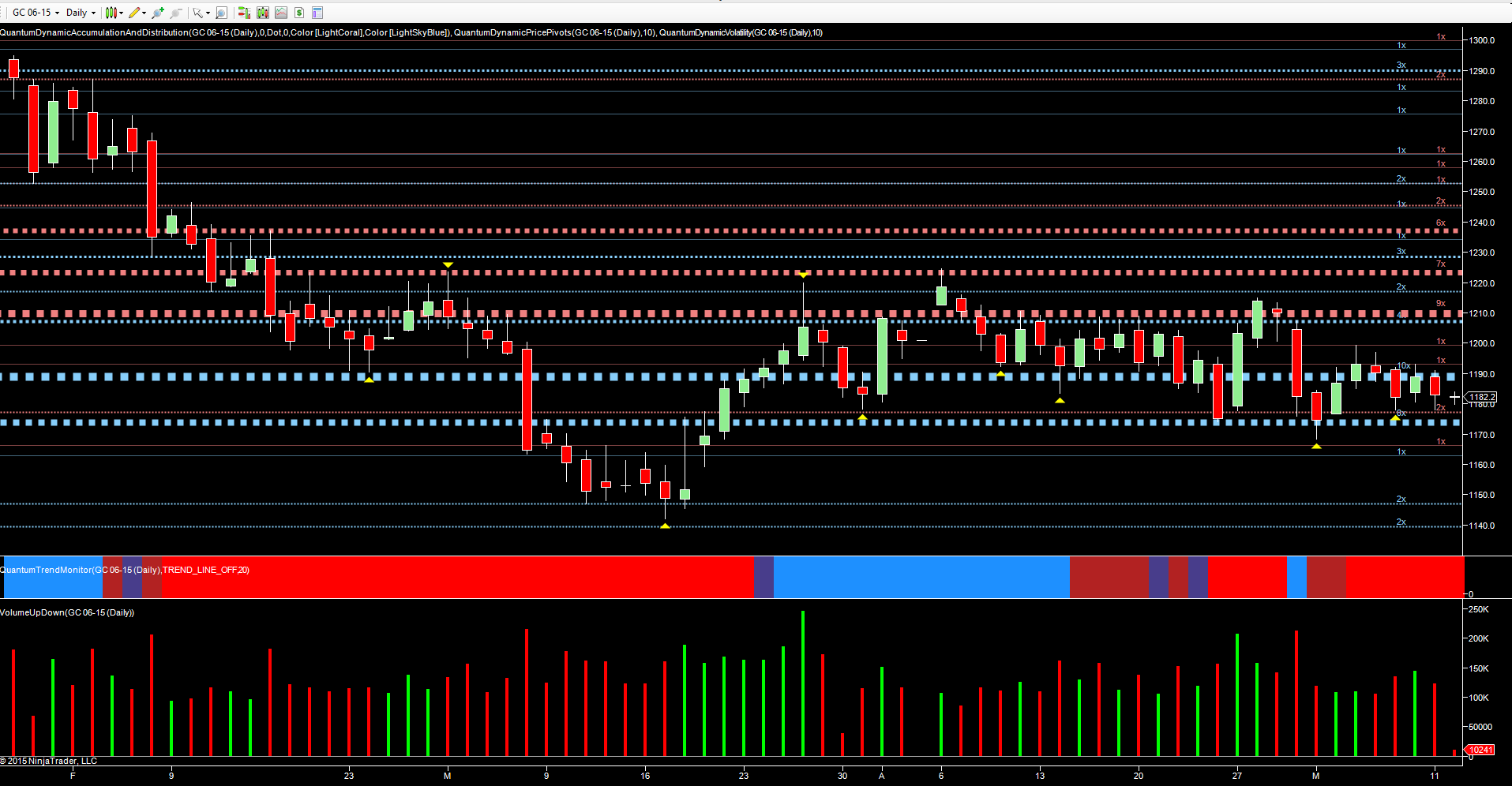

With the US dollar currently in a consolidative phase, gold is also pondering its next move as it continues to trade within a tight range. Volatility has certainly drained away since last week which saw the GVZ index trading around the 18 region. In early trading today the index has fallen sharply to currently trade at 15.85 at time of writing.

As traders, whenever we sense a falling away, or lack of momentum, a quick look at the volatility indices at the CBOE can provide an insight into likely future volatility. In the last two months, we have seen volatility rise steadily from 14.50 to last week’s peak at 18, before declining sharply. Of course, it is always important to remember that volatility on the GVZ is not an indicator for direction, but merely an indication of increasing or decreasing future volatility.

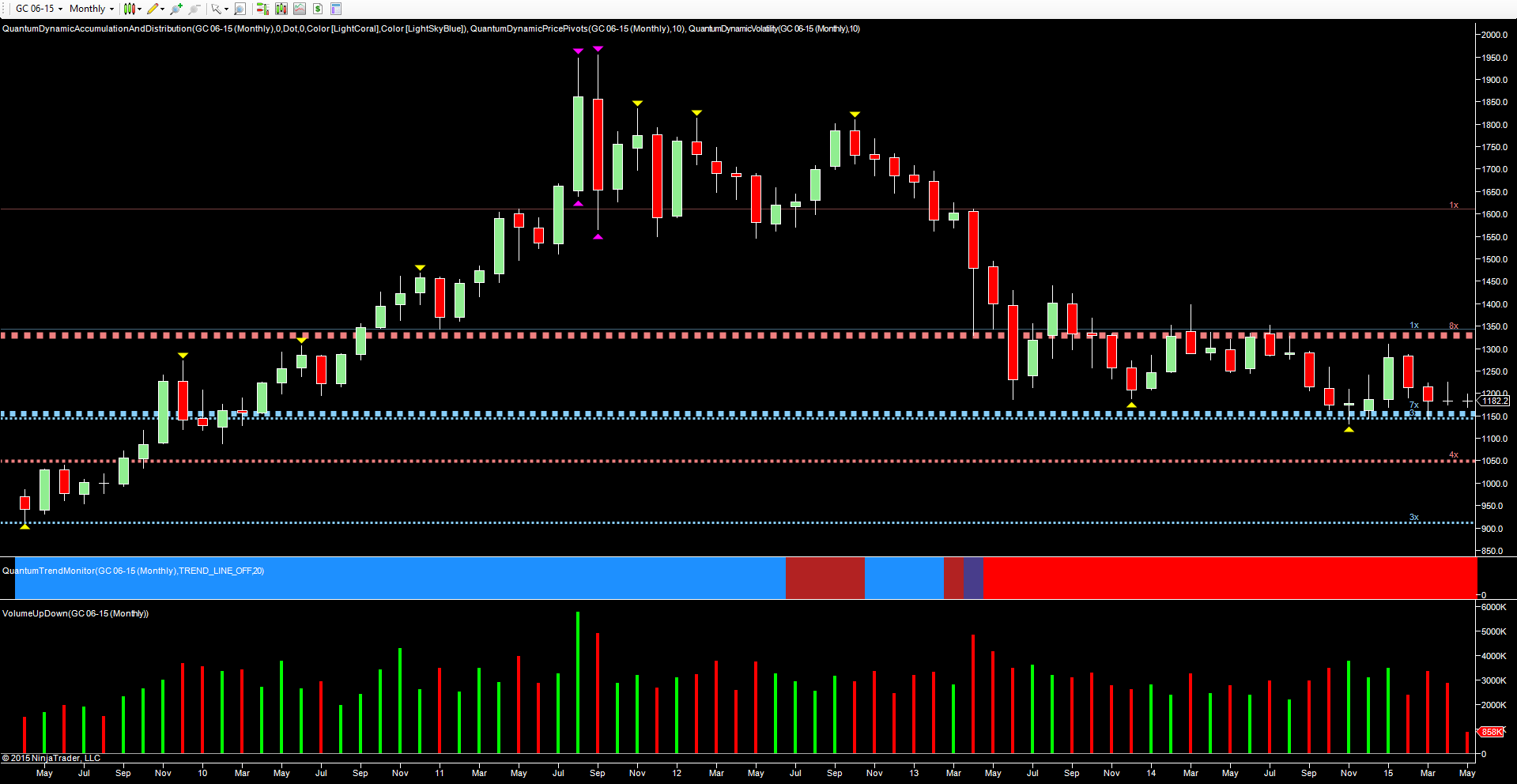

Moving to the monthly chart for gold, the present somewhat moribund price action is clearly in evidence, along with the defined parameters for a sustained move. If gold is to recover, then it has to pierce the ceiling of resistance in place at $1330 per ounce, as denoted by the red dotted line, a strong level of price distribution.

Below, the platform of support continues to hold in a price band which centers around the $1150 per ounce area, as denoted by the two blue lines. This is a key platform in this time frame, and any move through here will then open the way to a test of the next region at $1050 per ounce – the long drop for gold. For gold investors there is little sign of a buying climax in this, or indeed in any other time frame, and with the prospects for inflation becoming increasingly remote, the longer term outlook as an investor looks worrying to say the least. However, this platform of support is holding firm for the time being and may do so again, but the monthly chart really does encapsulate the longer term picture for the precious metal. Any move beyond these two levels will define the longer term trend once more.