- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Volatility And The Falling Euro

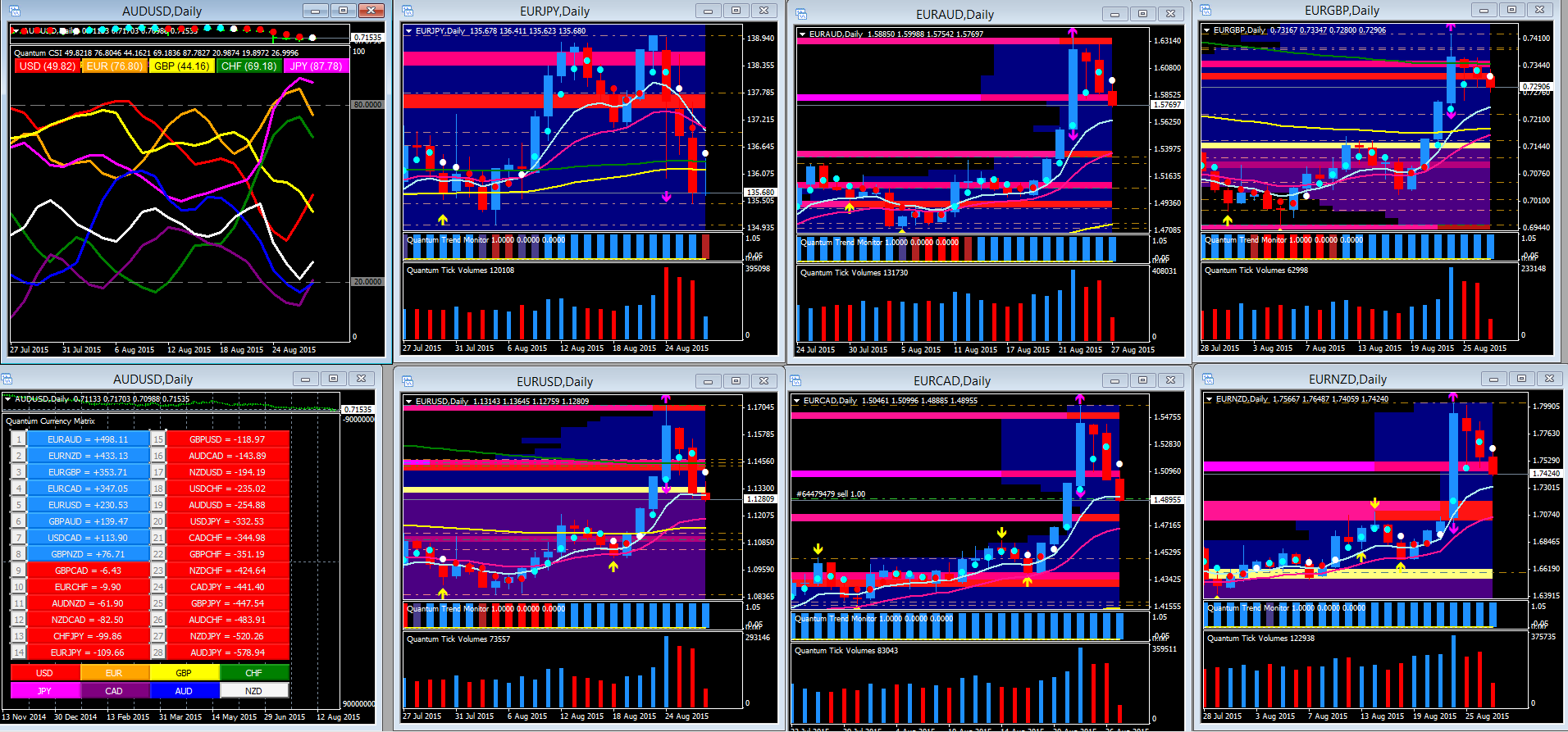

So far in today's forex trading session it’s been a case of selling the EUR/USD and buying the commodity dollars, with a strong move lower also in the EUR/JPY, although this bearish sentiment towards the euro has not been as strong in eurodollar.

What is particularly interesting in the euro pairs is the extent to which today’s moves are in the process of reversing Monday’s bullish volatility candles on the daily chart. As traders, volatility can be our greatest friend or deadliest enemy, and Monday’s extreme market reaction—which resulted in price ranges well outside the ATR for the euro pairs—is a perfect example of how we can use this event to our advantage.

Of the pairs in our euro matrix, only the EUR/AUD, EUR/GBP and EUR/NZD are still trading within the range of Monday’s candle, with the remaining three pairs, namely the EUR/JPY, EUR/CAD and EUR/USD trading at Monday’s lows. The priority for these latter pairs is to see whether Monday’s reversal can be sustained. For the pairs still trading within Monday’s volatility candle there is still some way to go and much will depend on whether the current bearish sentiment towards the euro is maintained and continues into September.

What has also been a feature in euro trading this morning has been the relatively muted move to the downside in the eurodollar, which comes as no great surprise given the presence of the VPOC on the daily chart, which of itself would help to contain any price move.

For the eurodollar, it will be the US session which will determine whether this morning’s selling will continue, particularly as we have two key items of fundamental news for the USD, namely the unemployment claims and the q/q preliminary GDP number. In addition, we have the start of the Jackson Hole Symposium which too should add its own influence to the price action.

Related Articles

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

USD/CAD lifted by Trump’s tariff push but faces resistance overhead US data missing forecasts at the fastest pace in five months Fed rate cut bets grow, pushing Treasury yields...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.