Key Points:

- USD/JPY Facing interest rate decision from the Fed and BOJ in the coming week.

- Possibility that the Federal Reserve could alter their current policy position.

- Watch for sharp volatility due to the level of current uncertainty around a rate hike.

The USD/JPY rose throughout most of last week as the pair reacted initially to a rise in U.S factory orders and a weak Japanese Account Balance result of 66.0B. Subsequently, the pair ending up finishing the week around 75 pips higher. However, there are some significant risk events looming on the horizon as the Bank of Japan and the U.S. Federal Reserve get ready to set announce their interest rate policies in the week ahead. Subsequently, let’s review the pair’s major events in the past week and take a look at the possible outcomes for the pending events.

The USD/JPY rose steadily throughout most of last week as the pair benefitted from a range of stronger U.S economic data. In particular, a surprise rise in factory orders to 1.2% m/m buoyed the pair, as did the ADP NFP figure of 298k. In addition, the JPY Account Balance figures proved disappointing at 66.0B which further exacerbated the greenback’s rise. However, the official NFP result of 235k, released late Friday, saw a surprising trend reversal as the market had been prepared for a much larger figure following the ADP beat. Subsequently, the pair gave back some of its gains but still closed the week out around 75 pips higher at 114.79.

The week ahead will be a busy one for the USDJPY with some sharp volatility likely to be present in the wake of multiple central bank interest rate decisions. In particular, the unpredictable U.S. Federal Reserve is set to meet to determine their near term rate outlook. Although most estimates have the central bank remaining on hold it is still a live meeting where anything could occur. In addition, the Bank of Japan is also set to meet but the chance of a further rate decline, from the present -0.10% rate, is relatively small. However, the statements following both events are likely to bring with them plenty of volatility and some sharp moves for the pair.

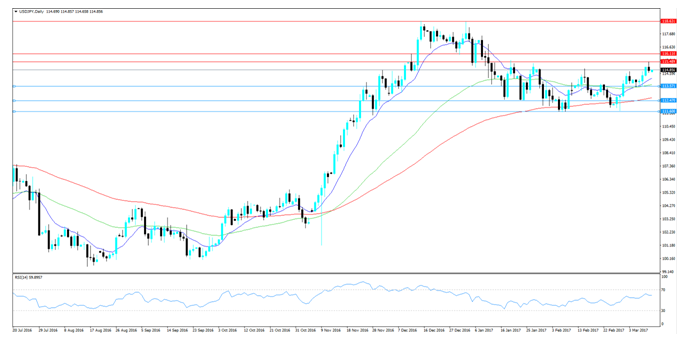

From a technical perspective, price action appears to have formed a temporary top around the 115.49 mark before retreating back to its current level. In addition, the RSI Oscillator remains predisposed to the upside, but it should be noted that the indicator is nearing overbought levels. Subsequently, our initial bias for the week ahead is neutral as the current phase could turn consolidative. Support is currently in place for the pair at 113.57, 112.47, and 111.60. Resistance exists on the upside at 115.48, 116.11, and 118.63.

Ultimately, it’s likely to be the U.S. Federal Reserve’s decision on rates that drives the pair in the coming week. This is especially the case considering that a policy reversal from the central bank is a real possibility given some of the delivered speeches of late. Subsequently, watch the FOMC vote closely as I expect to see plenty of price volatility as the market ultimately moves to digest the decision.