U.S. markets moved sharply lower overnight as both the Dow Jones and the S&P 500 ended their four day long rallies. That impasse over the debt ceiling continues in the U.S. Congress. The deadline is October 17 at midnight.

Just after the markets closed last night on Wall Street, Fitch Ratings placed the United States Government’s precious AAA credit rating on the negative rating watch. If the U.S. defaults they will downgrade its rating.

Senator Dick Durbin stated that any and all fiscal negotiations are now suspended until the Congressional Republicans formulate a plan to overcome the stalemate with the debt limit and the budget. We need for both sides to reach an agreement and raise that debt ceiling today OR we will see a default. We have gone from no chance for a default, last week, to it is likely as of today.

STOCKS

The DJIA lost 133 points to close at 15,168.01. We are just above a key support at 15,100. When that break we go below 15,000 towards 14,700 and maybe even lower. The S&P 500 lost 12 points to 1,698.06 and he Nasdaq 100 lost early gains to finish at 3,794.01. It had hit a new 13 year high at one point. To date, the Nasdaq Composite is up 22 percent for the year.

Investor nerves are plaguing Asian markets. The Shanghai Composite has lost over one percent and has now hit a new one week low. Other markets were higher but very choppy. The South Korean Kospi and the S&P/ASX, in Australia, were higher. The Nikkei was up again today. It has gained for six straight days and is riding the coattails of a weakening yen. The yen has now hit a two week low versus the Dollar.

CURRENCIES

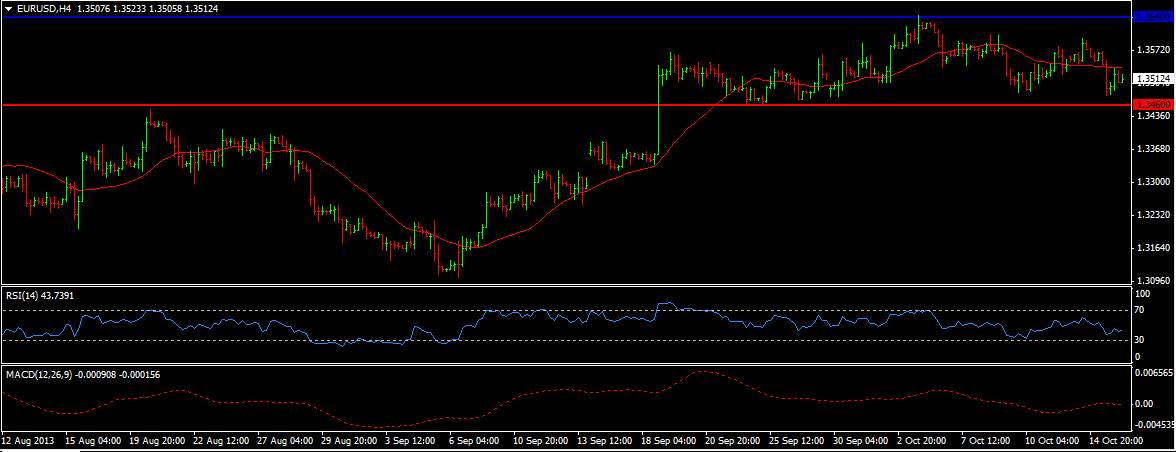

The Dollar lost some gains against the European majors. We saw a rally at first then lost ground. The EUR/USD (1.35122) remains above its support at 1.3460 and is now trading above 1.35. While we still appear to be in a sideways pattern, we are treading higher. See below chart.

The GBP/USD (1.5968) is finding support at 1.3460 but we are consolidating here as well. The USD/CHF (0.9146) is inching a bit higher and sees resistance at 0.9149. The Swiss franc is being forced lower against the Sterling and euro today. The USD/JPY (98.508) is up a bit but in a long term sideways pattern from a high at 100.60 to a low near 96.840.

COMMODITIES

Gold (1279.70) is trading on DC fears. We saw a drop to a three month low which enticed buyers to enter the market. However, the yellow metal remains under pressure as investors watch the ongoing U.S. debt talks. We saw a low at 1251.66, just above the support at 1250 which held. We are now above 1275 and can target 1300.

WTI Crude (101.17) rose on comments out of DC. This recovery could be shout lived as we have strong resistance at 101.90. We could be ranged between 100 and 102 for a bit.

TODAY’S OUTLOOK

The debt negotiations continue today. No need to state the obvious at to what is at stake here. The U.S. will release a plethora of data today. Mortgage applications, the CPI, housing data and the Beige Book.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Volatile Red Day On Wall Street

Published 10/16/2013, 06:08 AM

Updated 05/14/2017, 06:45 AM

Volatile Red Day On Wall Street

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.